What Are Penny Stocks?

Penny stocks are typically low-priced shares of smaller companies, often trading for under $5 per share. These stocks are linked to smaller market capitalisation (market cap) companies and typically have lower liquidity, which means there are fewer buyers and sellers in the market. Despite their low price, penny stocks often present opportunities for significant price movements, which can yield high returns in a short period.

Unlike larger companies, often referred to as blue-chip stocks, penny stocks tend to be more volatile and are considered highly speculative. This volatility is due to several factors, including market sentiment, the company’s stage of development, and its financial situation. Many penny stocks are issued by young companies or those in financial difficulty, but some have potential for substantial growth, particularly if they are involved in high-demand sectors such as mining or technology.

ASX penny stocks offer retail investors an affordable entry point to the market, making them an attractive investment choice for those with a high-risk tolerance. However, this high-risk investment class is not suitable for everyone, as the price of these stocks can fluctuate significantly based on news releases, company performance, and broader market trends.

Top 6 Reasons Why You Should Invest in ASX Penny Stocks

Investing in penny stocks comes with its risks, but for the right investor, there are clear benefits. Here are the top six reasons why you should consider ASX penny stocks for your investment portfolio in 2025:

Many of the top penny stocks on the ASX are from young companies in emerging sectors. These stocks often experience rapid share price growth when their products or services gain traction in the market. Companies involved in high-growth sectors, such as mining projects or renewable energy, can see significant appreciation in their share price, making them an appealing choice for investors seeking substantial returns.

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today and make informed investment decisions.

What to Look for When Buying Micro-cap Shares

When buying micro-cap stocks, which are often referred to as penny shares due to their low price per share, it's important to perform your research to sift through high-risk investments and identify potential gems.

Look for micro-cap stocks with a solid balance sheet and promising revenue growth. This is a good indicator that the company is managing its resources well, even if it's one of the smaller companies. Financial stability in young companies can be a green flag, showing their potential to graduate from being most penny stocks to more established stocks.

Investigate whether these penny shares are in a unique position within their market. Young companies often innovate or enter underserved niches. For instance, Castle Minerals Limited, operating in Western Australia, focuses on development projects in mining, which could set it apart from more established companies in similar sectors.

Many micro-cap stocks are also thinly traded, meaning they have relatively few sellers and buyers. This can lead to volatility, which could be risky if you need to sell shares quickly. Adequate liquidity is essential to ensure that you can enter and exit positions without causing significant price movements.

ASX small-cap stocks, like all ASX stocks, must adhere to specific regulatory requirements. Check their filings for any red flags or inconsistencies. Transparency is important and a lack of it is a significant concern as ASX penny stocks tend to be less transparent than larger companies.

3 Best Penny Stocks ASX to Buy Now in 2025

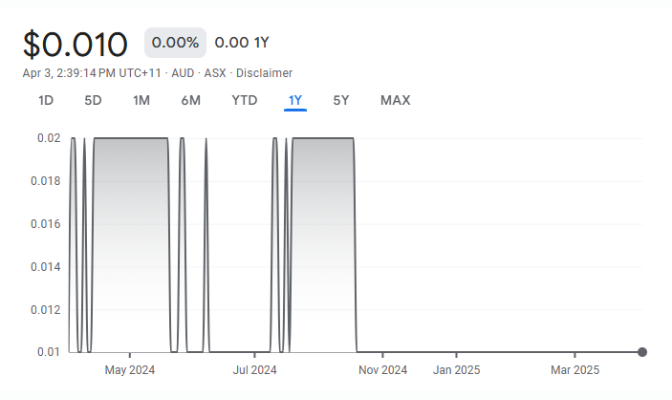

The Calmer Co International Ltd (ASX: CCO)

The Calmer Co International Ltd (ASX: CCO) is a company focused on wellness and sustainability, offering products such as nutraceuticals and eco-friendly goods. With consumer demand for health-conscious and environmentally friendly products on the rise, CCO is capitalising on this growing market..

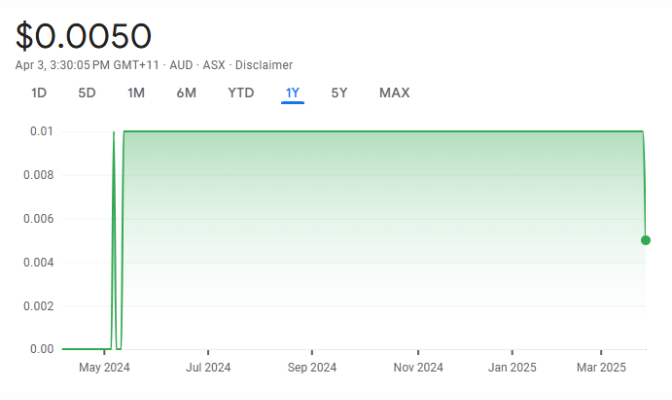

Legacy Iron Ore Ltd (ASX: LCY)

Legacy Iron Ore Ltd (ASX: LCY) is an exploration company focused on iron ore, particularly its Mount Bevan project in Western Australia. This region is well-known for its abundant iron ore resources, and LCY is working to develop its mining operations in the area. Iron ore remains a critical commodity..

Australian Vanadium Ltd (ASX: AVL)

Australian Vanadium Ltd (ASX: AVL) is focused on the exploration and development of vanadium, a critical material used in the production of high-performance batteries for large-scale energy storage. As the global shift towards renewable energy accelerates, demand for vanadium is expected to surge..

3 Best Penny Stocks ASX to Buy Now in 2025

How to Trade and Invest in Penny Stocks

Trading and investing in penny stocks can be both exhilarating and risky, making it a perfect fit for those who classify themselves as highly speculative investment enthusiasts.

So to start, develop a bullish outlook based on research and trends. Many successful penny stock traders focus on sectors with upcoming positive shifts due to new regulations, technology changes, or economic factors that favour smaller companies over larger companies.

Given that penny stocks are highly speculative investments, using limit orders can protect you from buying at a higher price or selling at a lower price than expected.

While penny shares can offer substantial gains, they are at higher risk. Balancing your portfolio with international stocks, established stocks, and other stocks on the ASX can protect you from the volatility associated with most penny stocks.

The sentiment and movements in major markets can often influence investor behaviour worldwide, even among ASX small-cap stocks.

Finally, continually reassess your investments in penny stocks. The market conditions and company fundamentals can change rapidly, making it crucial to stay informed and react accordingly. Always conduct your research periodically, even after buying shares, to ensure your investment reasons still hold.

The Risk of Investing in Penny Stocks

Penny stocks offer tremendous upside potential, but they also come with considerable risk. Here’s a deeper look into some of the risks associated with ASX penny stocks:

Penny stocks generally have low trading volumes, meaning there are relatively few sellers. If you want to sell a large quantity of shares quickly, you might struggle to find buyers. Penny stocks often have low liquidity, which can lead to significant price fluctuations based on relatively small buy or sell orders. This can make stock trading in penny stocks more difficult and riskier than trading with larger companies.

Are ASX Penny Shares a Good Investment?

So, are ASX penny shares a good investment? If you're someone who enjoys research, has a knack for spotting trends, and can afford to take on high-risk investments, penny shares might be an exciting addition to your portfolio. However, they should likely not represent the entirety of your investment strategy due to their risky nature.

For conservative investors focused on steady growth and preserving capital, these stocks might not be suitable due to their unpredictable nature and potential for significant losses. It’s often recommended to approach penny shares as just one part of a diversified investment strategy, rather than a standalone plan.

FAQs on Investing in Penny Stocks

Penny stocks typically exhibit high volatility and increased risk during bear markets, often underperforming due to their low market capitalizations and liquidity constraints.

Our Analysis on ASX Penny Stocks

Blackstone Minerals (ASX:BSX): Straw hats in winter

Blackstone Minerals (ASX:BSX): Summer is coming Back in early 2022, Blackstone Minerals was riding high. The Perth-based resource junior, at…

Invion (ASX:IVX): Using Photodynamic Therapy to fight cancer

Unless you’re a professional dermatologist, you may not have ever heard of Photodynamic Therapy, let alone thought of it as…

Bio Gene Technology (ASX:BGT): Commercialising a new class of insecticides

Bio Gene Technology (ASX:BGT) ASX-listed AgTech company developing two compounds – Flavocide™ and Qcide™ – as insecticides. Investors may hear…

Prescient Therapeutics (ASX:PTX): About to take the plunge into a Phase 2 trial against T-Cell Lymphoma

There’s plenty of ASX oncology biotechs conducting clinical trials, but Prescient Therapeutics (ASX:PTX) is one of the closest to commercialisation.…

Here are 4 economic indicators that impact stocks and investors must pay attention to

There are several economic indicators that impact stocks, both on the ASX and internationally. Whenever data is released, it can…

As lower interest rates loom, here are 6 ASX stocks that will benefit from forthcoming rate cuts

Here 6 ASX stocks that will benefit from lower interest rates! AGL Energy (ASX:AGL) You might think AGL is…