What are Safe Stocks?

Focusing on reputable businesses with a history of stability and resilience may be a wise move for safe stocks in the US in 2024. Safe stocks are shares in companies that exhibit a high degree of stability and resilience, typically characterized by steady earnings, reliable dividends, and strong financial health. These stocks are often found in defensive sectors such as utilities, consumer staples, and healthcare, where demand remains consistent regardless of economic fluctuations.

Investing in such companies, often blue-chip firms with established market positions and low debt levels, can provide a buffer against market volatility and offer a more predictable return on investment. While they are considered lower-risk compared to more speculative stocks, it is important to remember that no investment is entirely risk-free, and even safe stocks can be influenced by broader economic conditions and market changes.

Why invest in Safe Stocks?

Purchasing safe stocks has a lot of benefits, especially for people looking to reduce risk and maintain consistency in their investments. These equities, which are usually issued by reputable businesses with sound financial standing, provide investors with a more stable investing environment with less volatility and steady returns. Because they originate from industries like consumer staples, utilities, and healthcare, which have consistent demand despite market volatility, they are particularly important during economic downturns. For investors who are primarily concerned with their income, safe stocks frequently provide a consistent flow of income in the form of dividend payments.

Investing money in safe stocks offers a more reliable option than more volatile common stocks. these preferred stocks are completely safe because they are low-risk investments and are typically sourced from reputable organizations with sound financial standing. They are less likely to suffer large losses because of their steady earnings and strong balance sheets, which help them withstand market and economic downturns.

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today!

Improve Your Cash Flow with Safe Stocks

Safe stocks can help you improve your cash flow by balancing risk and return with a systematic investment approach. To begin customizing your investments, determine your level of risk tolerance and cash flow requirements. Pay attention to dividend-paying stocks, especially those that have a track record of reliably rising dividends. One example of such a company is Dividend Aristocrats, which has increased dividends for at least 25 years in a row.

Furthermore, take into account blue-chip stocks, which are well-established, stable businesses with solid market positions, steady growth and profitability, and minimal volatility. Because they are necessities, defensive stocks in industries like utilities, consumer staples, and healthcare can also offer stability. Invest in a variety of industries and geographical areas to spread your risk and guarantee a consistent income. For diversified exposure to safe equities, think about income-focused mutual funds or exchange-traded funds (ETFs). You can also investigate other techniques like dividend reinvestment plans (DRIPs), which allow you to reinvest dividends for possible future gains.

Best Safe Stocks to Buy Right Now in 2025

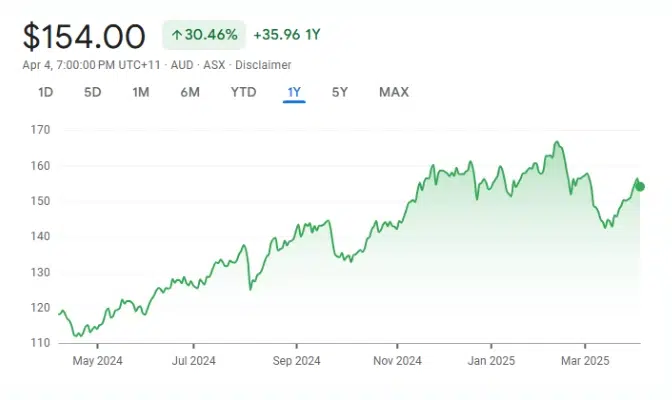

Commonwealth Bank of Australia (CBA)

The Commonwealth Bank of Australia (CBA) is one of the largest financial institutions in the country, providing retail, business, and institutional banking services. CBA’s stock is considered a safe investment due to its size, strong profitability, and consistent dividend payouts.

BHP Group Ltd (BHP)

BHP Group Ltd (ASX: BHP) is a global leader in the mining sector, with a strong presence in the extraction of iron ore, copper, and other essential minerals. BHP is widely regarded as a safe stock due to its market dominance, diversified portfolio

CSL Limited (CSL)

CSL Limited (ASX: CSL) is one of the largest biotechnology companies in the world, focusing on the development of innovative treatments for rare and serious diseases. The company’s stability comes from its robust product portfolio, which includes therapies in immunology, haematology, and respiratory care.

Best Safe Stocks to Buy Right Now in 2025

How to Choose Safe Stocks to Invest

Choosing a safe stock to buy or invest in involves a thorough analysis of various factors to ensure stability and minimize risk. Start by assessing your investment goals and time horizon to determine your risk tolerance. Evaluate the financial health of potential stocks by looking for companies with strong balance sheets, consistent earnings, and reliable cash flow. Focus on dividend-paying stocks, particularly those with a history of regular and growing dividends, such as Dividend Aristocrats, which reflect financial stability and offer a steady income stream.

Examine the market position of companies, favouring those with a competitive advantage or strong market leadership. Review valuation metrics like the price-to-earnings (P/E) and price-to-book (P/B) ratios to ensure stocks are fairly priced. Analyze historical performance to identify stocks with lower volatility and consistent performance. Diversify your investments across different sectors and geographic regions to mitigate risks, and stay informed about economic conditions, interest rates, and industry trends that might affect stock performance.

Lastly, consider consulting with a financial advisor to tailor your investment strategy to your specific goals and risk tolerance. By carefully evaluating these factors, you can select the safest stocks around that offer a higher degree of safety and stability.

Red flags that a stock is unsafe

It's critical to recognize warning signs that suggest a top stock market can be dangerous if you want to safeguard your investments. Poor financial health, such as rising interest rates, high debt levels rising, higher interest rates, and a continuous negative cash flow, are important warning indicators of possible financial instability.

Inconsistent earnings or on the decline, with notable variations or a track record of losses, could point to deeper issues with the business's operations. Red flags can also include poor management and governance, which is indicated by erratic behavior or frequent leadership changes.

Furthermore, overvaluation—which is typified by abnormally high price-to-book or price-to-earnings ratios—may suggest that a stock is expensive and vulnerable to a decline. Risks may also be highlighted by a weak market position, such as a diminishing market share or a lack of competitive advantage.

FAQs on Investing in Safe Stocks

Investments in businesses regarded as low-risk and likely to yield consistent profits and dividend cuts over time are referred to as "safe stocks.".

Our Analysis on ASX Safe Stocks

The 50% CGT discount on shares: Here’s how it works, and if it is under threat

The 50% CGT discount on shares is one of the key mechanisms that helps investors keep as much of their…

5 Beaten-Down ASX Stocks That Could Bounce Back with a Vengeance in February 2026!

ASX Stocks That Could Bounce in February The start of 2026 has been brutal for several quality ASX names. While…

ASX Stocks Set to Win or Lose From Trump’s Venezuela Operation

ASX Stocks to Watch After Venezuela Military Strike The US military operation that captured Venezuelan President Nicolás Maduro has sent…

Stocks Down Under’s Top 10 Hottest ASX Stocks to Look At in 2026!

Today, on the first trading day of 2026, Stocks Down Under publishes its its 10 Hottest ASX Stocks to Look…

Our 5 ASX Predictions for 2026!

This article outlines 5 ASX Predictions for 2026 that Stocks Down Under puts its neck on the line to assert…

Here are 6 stocks that got promoted in the ASX quarterly rebalance, and 6 that got demoted

On Monday December 22, the ASX quarterly rebalance will be effective. Stocks will be promoted into new indices, while others…