What Are ASX Cybersecurity Stocks?

ASX cybersecurity stocks are companies listed on the Australian Securities Exchange that offer solutions and services to defend digital infrastructures from cyber threats. These institutions play significant roles in the cybersecurity industry, which is growing in importance as businesses and government operations become more digitally integrated.

The Australian cybersecurity market is estimated by Modor Intelligence to be US$7.1bn (A$10.8bn) in 2024 and reach US$16.5bn (A$25.1bn) in 5 years, representing a CAGR of 18.4%. Globally, it is even larger - McKinsey estimates that it could be up to US$2tn. This rise is driven by increased demand for cybersecurity solutions in multiple areas, including cloud security, data protection, and endpoint security. The market includes organizations that provide comprehensive cyber recovery solutions to reduce the effect of cyber attacks and safeguard data environments.

Notably, ASX cybersecurity stocks are few of the many companies, offering niche products and services ranging from cloud technology solutions to restricting cyber bullying. Investing in cybersecurity space is a sensible decision for stakeholders looking to capitalize on the threats that the industry face.

Why Invest in Cyber Security Companies in Australia?

Investing in cybersecurity companies in Australia is a lucrative prospect due to the sector's rapid growth and rising cyber threats. Cybersecurity spending is expected to grow substantially at home and abroad, making it an appealing business opportunity. Financial investment is crucial for cybersecurity enterprises to build advanced solutions and services.

Australian enterprises, known for their ingenuity in cloud computing and cybersecurity solutions, will gain considerably. For instance, Palo Alto Networks, a leader in cybersecurity services, demonstrates the sector's potential through its cutting-edge security platform products.

The 2023–2030 Australian Cyber Security Strategy, which identifies national cybersecurity as a priority and promises government actions to enhance the sector, is an example of the proactive approach used by the Australian government. Because of this government backing, ASX cybersecurity stocks are a desirable option for investors looking to diversify their holdings within the tech sector, as well as for those who recognize the growing importance of data protection in the face of growing cybersecurity risks.

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today!

Future Outlook of the ASX Cybersecurity Sector

Because cyber dangers are always evolving and cybersecurity solutions are always needed, the future of the ASX cybersecurity sector is very bright. The cybersecurity industry is predicted to increase significantly because investment in this area is trending upward.

The COVID-19 pandemic's drive for remote work has highlighted the continuous digital revolution, increasing reliance on cloud services and, consequently, cloud security protocols. Australian cybersecurity businesses are well-positioned to benefit from these trends thanks to their security software and cyber recovery solutions.

ASX cybersecurity companies appear to have a bright future because of strategic investments in cybersecurity, which are supported by government efforts and growing worldwide web marketplaces for cybersecurity. As a result, players in the cybersecurity industry may expect more development, innovation, and financial gains, solidifying the industry's position as a pillar of Australia's digital economy and national security.

3 Best ASX Cybersecurity Stocks to Buy Now

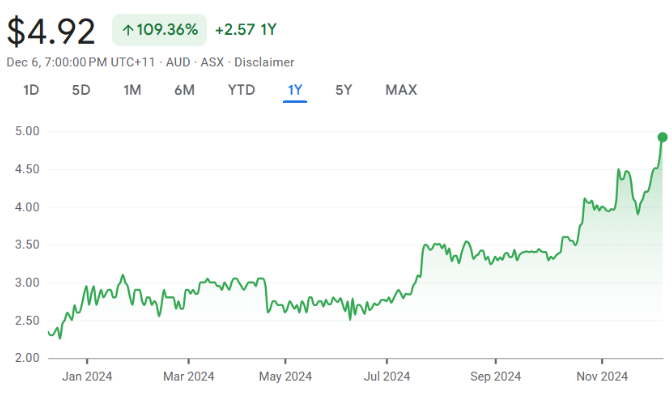

Dropsuite (ASX: DSE)

Dropsuite is an emerging player in the cybersecurity and cloud backup space, offering services that are becoming essential for businesses of all sizes. The company specialises in cloud-based backup, archiving, and recovery solutions that protect critical business data such as emails, websites, databases, and more....

Firstwave Cloud Technology (ASX: FCT)

Firstwave is a cybersecurity company that focuses on delivering powerful and accessible protection to businesses through its innovative cloud-based platform. Headquartered in Australia, Firstwave has developed a unique CyberCision platform, combining email, web, and firewall security into one streamlined solution...

Whitehawk (ASX: WHK)

Whitehawk is a unique player in the cybersecurity space, offering an online Cybersecurity Exchange platform that empowers businesses, especially small to medium enterprises (SMEs), to easily identify, manage, and mitigate cyber risks Unlike traditional cybersecurity firms that often sell products...

How to Choose the Right Cyber Security Stock ASX?

Choosing the right ASX cybersecurity stocks involves a thorough evaluation of each cybersecurity company’s market position, financial health, and innovation capability. Investors should look for companies with strong free cash flow, a solid track record of managing cybersecurity threats, and a portfolio of cybersecurity products that address current and emerging security challenges.

Additionally, firms that have established partnerships with government organizations or are involved in security orchestration for critical infrastructure can be considered more stable investments due to the essential nature of their services.

How to Invest in Cybersecurity Stocks in Australia?

Investing in cybersecurity stocks in Australia can be approached through direct investment in individual ASX cybersecurity shares or through cybersecurity ETFs like the Global X Cybersecurity ETF. Direct investment allows investors to target specific companies they believe have the best growth potential or advantage in cybersecurity solutions.

On the other hand, ETFs provide diversified exposure to the sector, reducing the risk associated with individual stocks but also diluting potential high returns from standout performers. Investors should conduct thorough research or consult financial advisors to identify the top cybersecurity stocks that align with their investment strategy and risk tolerance.

Are ASX Cybersecurity Shares a Good Investment?

ASX cybersecurity shares represent a compelling investment opportunity, given the sector's significant growth potential driven by increasing digital world demands and evolving cyber threats. The importance of cybersecurity for protecting computer networks, data, and digital operations across industries underscores the long-term demand for cybersecurity services.

However, potential investors must be mindful of the inherent volatility in the tech industry and the ongoing innovation and regulatory changes that could impact companies’ performance. With careful selection and a focus on companies that lead in zero trust security, artificial intelligence, and network management, investors can potentially reap financial benefits from the growing reliance on cybersecurity solutions in Australia and globally.

Our Analysis on ASX Cybersecurity Stocks

The 50% CGT discount on shares: Here’s how it works, and if it is under threat

The 50% CGT discount on shares is one of the key mechanisms that helps investors keep as much of their…

Stocks Down Under’s Top 10 Hottest ASX Stocks to Look At in 2026!

Today, on the first trading day of 2026, Stocks Down Under publishes its its 10 Hottest ASX Stocks to Look…

Our 5 ASX Predictions for 2026!

This article outlines 5 ASX Predictions for 2026 that Stocks Down Under puts its neck on the line to assert…

Activist investors: Here’s what you need to know about them and 4 famous Australian activists to watch out for

Hear the term ‘Activist investors’ and you might think of GetUp, the progressive activist group that forced Woolworths to hold…

As ASX Reporting Season for FY25 Looms: Here’s An Investors Ultimate Guide

ASX Reporting Season is almost upon us once again. It is the most important time of the year for investors,…

Here are Our 11 Top ASX Stocks to Buy in FY26: 1 From Each Sector!

It is a New Financial Year, so it’s time to outline 11 Top ASX Stocks to Buy in FY26. Why…

FAQs on Investing in Cybersecurity Stocks

ASX-listed cybersecurity firms use a variety of defences against cyberattacks, such as cloud-based software technologies, cyber recovery services, and advice on cybersecurity procedures and technology. They concentrate on thwarting cyberattacks, identifying weak points, and instructing their clientele on how to keep their cyber defences up to date.

3 Best ASX Cybersecurity Stocks to Buy Now

Pros and Cons of Investing in Cybersecurity Shares

The volatile nature of the cyber security industry presents both significant opportunities and concerns when investing. Positively, the need for cybersecurity solutions is growing due to the constant rise in cyberthreats and the significance of digital activities in the modern economy.

Businesses that specialise in zero trust security frameworks or provide cyber recovery solutions are well-positioned for expansion. Growing internet penetration and the financial benefits of strong cyber defences highlight this need, which fuels the expansion of the cybersecurity product market. The capabilities of cybersecurity companies are being significantly enhanced by artificial intelligence solutions, which provide investors a growth path as these technologies develop.

However, there are cons to consider. The cybersecurity sector is highly competitive, with major cloud computing firms and established tech industry players entering the space which can potentially dilute market share for smaller ASX cybersecurity stocks. Additionally, the sector is subject to volatility, with market cap fluctuations influenced by data breaches and cyber attacks. The evolving nature of security challenges means that companies must continuously innovate, adding a layer of risk for investors if a company fails to keep pace with new security challenges or government regulations.

Get in touch

contact@stocksdownunder.com