Introduction to ASX Mining Shares

ASX mining shares are stocks of Australian companies listed on the Australian Securities Exchange that focus on exploring, extracting, and selling minerals. These companies are central to global supply chains, providing essential raw materials for industries like construction, energy, electronics, and clean technology. Investors can choose from large, established producers such as BHP and Rio Tinto, or smaller exploration firms aiming to discover new deposits. Popular commodities include gold, lithium, copper, iron ore, and rare earths, each playing a key role in the transition to renewable energy and infrastructure development. ASX mining shares offer a way to invest in the resource economy and benefit from rising commodity demand.

Why invest in mining stocks?

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today and make informed investment decisions.

How to choose the right ASX mining stocks?

First, consider the commodity exposure itself: Does the company mine commodities with strong structural demand drivers, or is it reliant on cyclical construction materials? Gold offers safe-haven appeal during uncertainty, copper benefits from electrification trends, and lithium serves the EV revolution. Each commodity carries a different risk-reward profile.

Second, evaluate operational quality. Low-cost producers with strong balance sheets can weather price volatility far better than marginal operations. Companies maintaining cash flow generation and reducing carbon emissions are attracting institutional capital even when commodity prices soften. This shift in investor priorities means environmental and operational efficiency increasingly drive valuations alongside commodity price exposure.

Third, assess the development stage and execution risk. Established producers with operating mines offer immediate commodity price leverage but potentially limited growth. Development-stage companies promise higher returns if projects reach production, but carry significantly more execution risk. The right choice depends on individual risk tolerance and portfolio objectives.

3 Best ASX Mining Stocks to Buy Now in 2025

BHP Group (ASX: BHP)

BHP is Australia’s largest mining company and one of the most diversified resource producers globally. It offers exposure to iron ore, copper, coal, and nickel, commodities that are critical to infrastructure, energy, and industrial growth. Recently, BHP has ramped up its copper operations, becoming the world’s largest ...

Pilbara Minerals (ASX: PLS)

Pilbara Minerals is a leading lithium producer, operating the high-grade Pilgangoora project in Western Australia. As the global push for electrification intensifies, lithium demand is surging, especially for EV batteries and energy storage systems. Pilbara’s low-cost operations and strategic offtake agreements position it well to benefit from this trend....

Northern Star Resources (ASX: NST)

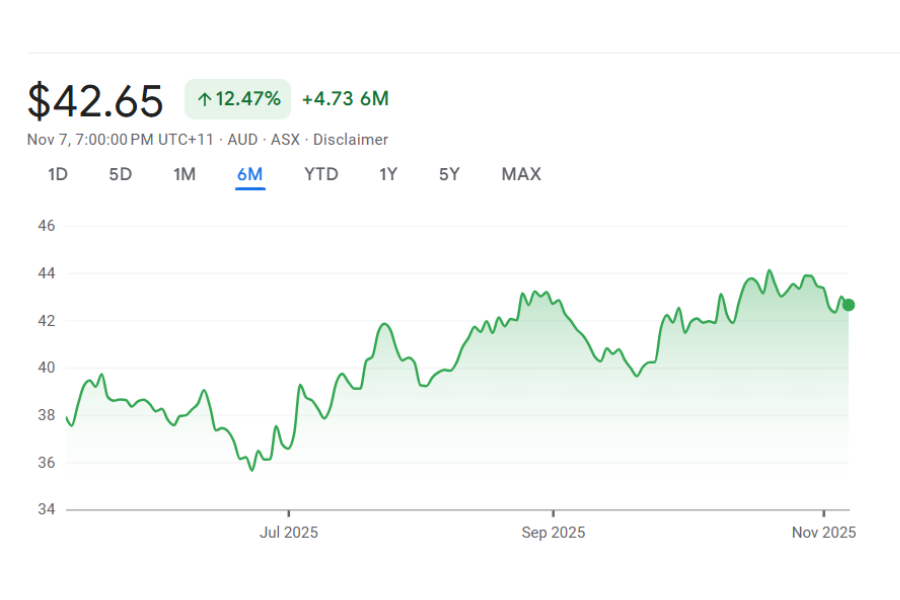

Northern Star is one of Australia’s top gold producers, with a portfolio of high-quality assets in Western Australia and Alaska. The company has delivered strong performance this year, with its share price up over 50% despite a recent pullback during gold’s correction. Gold remains a key hedge against...

3 Best ASX Mining Stocks to Buy Now in 2025

What is the Future Outlook for the ASX Mining Sector?

The outlook for ASX mining stocks largely depends on China’s economic recovery and global infrastructure spending. Iron ore prices have stayed stronger than expected, hinting at steady Chinese demand. If Beijing’s stimulus efforts take hold, demand for resources could rise further into 2026.

However, investors should stay realistic. Commodity markets are still cyclical, and much of the optimism around battery metals and copper is already priced in. For mining stocks that have surged this year, further gains may depend on stronger commodity prices or standout company performance.

The pros and cons of investing in ASX Mining Stocks

Pros: Exposure to global growth and energy transition themes, potential inflation hedging through hard assets, strong Australian mining expertise and infrastructure, and improving cash generation as costs moderate while prices remain elevated.

Cons: Commodity price volatility can create significant share price swings, operational risks including cost overruns and production issues, China economic dependency creates geopolitical risk, and environmental and social license challenges increasingly impact project development timelines and costs.

Are ASX Mining shares a good investment?

Mining stocks can be a smart choice for investors who understand the risks. Not all miners are equal. diversified companies with strong finances and exposure to multiple commodities are better placed than those relying on just one. With money shifting from financials to resources, there’s a clear interest in the sector. But instead of chasing price spikes, investors should focus on well-run companies with solid value and the ability to weather market swings. Smart selection and realistic expectations are key.

FAQs on Investing in Mining Stocks

After commodity prices stabilise from a downturn, before the broader market catches on. But rather than timing cycles, focus on strong, well-managed companies.

Our Analysis on ASX Mining Stocks

Monadelphous Group (ASX:MND) A Clean Beat, Revenue Up 45%, Profit Up 52%

Monadelphous Group Earnings Quality Improves as Construction Surges Monadelphous Group had a strong re rate on its half year result,…

Imdex (ASX:IMD) Hits Record Revenue but Profit Misses: Buy or Wait?

Imdex (ASX: IMD) rose 8.2% on Monday after delivering its strongest-ever first half. Revenue jumped 16% to A$246.6 million, and…

Rio Tinto (ASX:RIO) Drops 3% Despite Record Copper Output: Is This a Buying Opportunity for Income Investors?

Rio Tinto’s FY2025 Result: What Income Investors Should Know Rio Tinto (ASX: RIO) dropped 3.1% to A$163.30 on Friday after…

Fortescue Future Industries: Are the iron giant’s bold green ambitions on track?

In 2020, Fortescue Future Industries was born to realise the then-Twiggy Forrest operated iron ore miner’s green ambitions, including in…

Chariot Resources (ASX:CC9) Surges 17% on CATL Supplier Deal: Speculative Buy or Too Early?

Chariot Resources Surges on CATL Supplier Deal Chariot Resources (ASX: CC9) surged 17% to A$0.17 after securing a binding A$1.425…

Regis Resources (ASX:RRL) Posts Record Profit- Is It Still a Buy After a 164% Rally?

Regis Resources: Record Profit After a Big Rally Regis Resources (ASX: RRL) delivered the best half-year result in its history,…