What Are ASX Iron Ore Shares?

Why Invest in Iron Ore Stocks?

Iron ore price

Iron ore is holding around US$105/tonne as of early November 2025, defying forecasts of a drop below US$90. Seasonal stockpiling and modest Chinese stimulus are keeping demand steady, supporting strong margins for ASX miners.

Market Cap

The top ASX iron ore stocks, BHP, Rio Tinto, and Fortescue, have market caps of roughly A$230B, A$170B, and A$70B, respectively. All three have outperformed the ASX 200 recently, driven by resilient prices and solid earnings.

Supply chain

Australia’s iron ore supply chain is world-class, anchored by Pilbara production and efficient export infrastructure. While China remains the key buyer, demand from India and Southeast Asia is growing, and ESG goals are reshaping long-term logistics.

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today and make informed investment decisions.

What Might the Future Hold for Australia's Iron Ore Industry?

Australia’s iron ore industry faces a complex outlook in 2025, with short-term resilience but long-term uncertainty. Prices remain firm around US$105/tonne, supported by China’s modest stimulus and seasonal stockpiling, yet a structural decline in China’s property sector, once the backbone of global steel demand, is weighing on future prospects. China’s share of global steel demand fell below 50% in 2024, and new home construction remains weak. Meanwhile, supply is set to expand with the Simandou project in Guinea is scheduled to begin production as early as late 2025, though delays remain possible.

Analysts forecast average prices of US$80–95/tonne through 2025, with downside risk if new supply ramps up quickly. For Australia, the path forward will depend on diversifying demand, adapting to ESG pressures, and maintaining competitiveness in a shifting global landscape.

3 Best ASX Iron Ore Stocks to Buy Now in 2025

BHP Group (ASX: BHP)

BHP Group remains the safest way to play the iron ore sector while maintaining diversification. BHP operates massive iron ore assets in the Pilbara alongside significant copper, nickel, and coal operations. This diversification provides a buffer if iron ore prices soften more than expected....

Rio Tinto (ASX: RIO)

Rio Tinto (ASX: RIO) provides pure-play exposure to iron ore and aluminium while maintaining financial strength. Rio's Pilbara operations produce some of the world's highest-grade iron ore, giving it a cost advantage over competitors. The company generated record iron ore shipments....

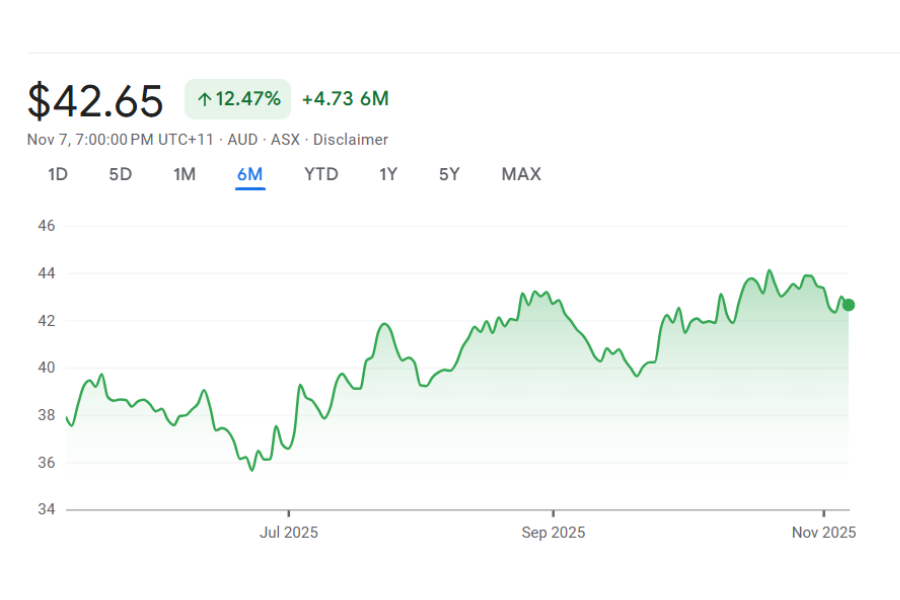

Fortescue (ASX: FMG)

Fortescue (ASX: FMG) offers the most leveraged exposure to iron ore prices among the major producers. Operating exclusively in the Pilbara, Fortescue produces approximately 190 million tonnes annually, making it the world's fourth-largest iron ore producer. The company's low production costs.....

3 Best ASX Iron Ore Stocks to Buy Now in 2025

The Role of Iron Ore in the Steel Industry and the Rise of ESG Considerations

Iron ore remains essential to global steelmaking, with around 98% of mined ore used in blast furnaces, each tonne of steel requiring roughly 1.6 tonnes of iron ore. But the industry is shifting as environmental concerns grow. Traditional steelmaking is highly carbon-intensive, prompting a move toward electric arc furnaces and direct reduced iron, which rely less on raw ore. Policies like the EU’s Carbon Border Adjustment Mechanism are accelerating this change by penalising high-emission imports and favouring cleaner production and higher-grade ore. Australian miners such as Rio Tinto, BHP, and Fortescue are responding with decarbonisation strategies, including net-zero targets and green hydrogen initiatives. These ESG efforts could unlock premium markets but also carry financial risks if execution falters.

How to Choose the Right ASX Iron Ore Stock?

Choosing the right iron ore stock depends on your goals. If you’re income-focused, look for strong dividend payers with low production costs; BHP and Rio Tinto have proven track records across cycles. For growth, consider companies with exposure to future-facing commodities like copper (BHP) or green hydrogen (Fortescue), though the latter carries higher risk.

Low-cost producers (under $20/tonne) like BHP, Rio, and Fortescue offer resilience during price downturns. Strong balance sheets also matter; less debt means more flexibility to invest and maintain dividends. Finally, assess exposure to China: over 60% of global iron ore demand comes from there, but diversification into markets like India helps buffer against policy shifts and property sector weakness.

How to Invest in Iron Ore in Australia?

Australian investors can access iron ore through several channels. The most direct is buying shares in ASX-listed producers like BHP, Rio Tinto, and Fortescue, highly liquid stocks offering dividend income and growth potential. For broader exposure, resources-focused ETFs include these majors alongside other commodities, reducing single-stock risk.

Mid-tier players like Mineral Resources (ASX: MIN) and Champion Iron (ASX: CIA) offer higher-risk, higher-reward opportunities, often reinvesting in growth rather than paying dividends. For active traders, iron ore futures and CFDs are available via select brokers, though these carry elevated risk and require close monitoring.

Are ASX Iron Ore Shares a Good Investment?

ASX iron ore stocks offer a mixed but compelling case in November 2025. On the upside, major producers are generating strong cash flows at current prices (~US$105/tonne), supporting fully franked dividend yields above 5%. Iron ore has outperformed bearish forecasts, and seasonal demand could lift prices further in December. However, structural risks remain, China’s property sector is in long-term decline, and new supply from Simandou may pressure prices, with forecasts averaging US$80–95/tonne through 2025, depending on supply and demand conditions.

For income investors, BHP, Rio Tinto, and Fortescue offer value, but dividend cuts are possible if prices fall below US$90/tonne. A gradual, dollar-cost averaging approach may suit conservative investors, helping manage timing risk. Overall, iron ore stocks can play a valuable role in a diversified portfolio, offering income and commodity exposure, but investors should brace for volatility and policy-driven swings.

FAQs on Investing in Iron Ore Stocks

Iron ore is trading around US$105 per tonne in early November 2025, up from recent lows of US$91 per tonne in September 2024 but well below the peaks above US$140 per tonne seen in early 2024.

Our Analysis on ASX Iron Ore Stocks

Fortescue Future Industries: Are the iron giant’s bold green ambitions on track?

In 2020, Fortescue Future Industries was born to realise the then-Twiggy Forrest operated iron ore miner’s green ambitions, including in…

JORC Resources: Here’s What’s Crucial For Investors to Know Before Investing

Investors will often hear of JORC Resources or a JORC Code and may think companies are alluding to a mere…

Champion Iron (ASX:CIA) Posts Record 3.9M Tonne Quarter as Green Steel Plant Enters Commissioning- Time to Buy?

Champion Iron’s Record Quarter Sets Up a Green Steel Catalyst Champion Iron (ASX: CIA) delivered record quarterly sales of 3.9…

Fortescue (ASX:FMG) Falls 5% on Cost Concerns Despite Record Shipments- Buy, Hold, or Sell?

Fortescue’s Record Shipments Face Cost Hurdles Fortescue (ASX: FMG) fell more than 5% on Thursday after releasing its December quarter…

Stocks Down Under’s Top 10 Hottest ASX Stocks to Look At in 2026!

Today, on the first trading day of 2026, Stocks Down Under publishes its its 10 Hottest ASX Stocks to Look…

Our 5 ASX Predictions for 2026!

This article outlines 5 ASX Predictions for 2026 that Stocks Down Under puts its neck on the line to assert…