What Are Lithium Stocks?

Why Invest in Lithium Stocks?

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today and make informed investment decisions.

3 Best ASX Lithium Shares to Buy Now in 2025

Pilbara Minerals (ASX: PLS)

Pilbara Minerals is Australia's largest lithium producer, operating the flagship Pilgangoora operation in Western Australia's Pilbara region. The company produced 754,000 tonnes of spodumene concentrate in FY25 and maintains a market capitalisation exceeding $12 billion.....

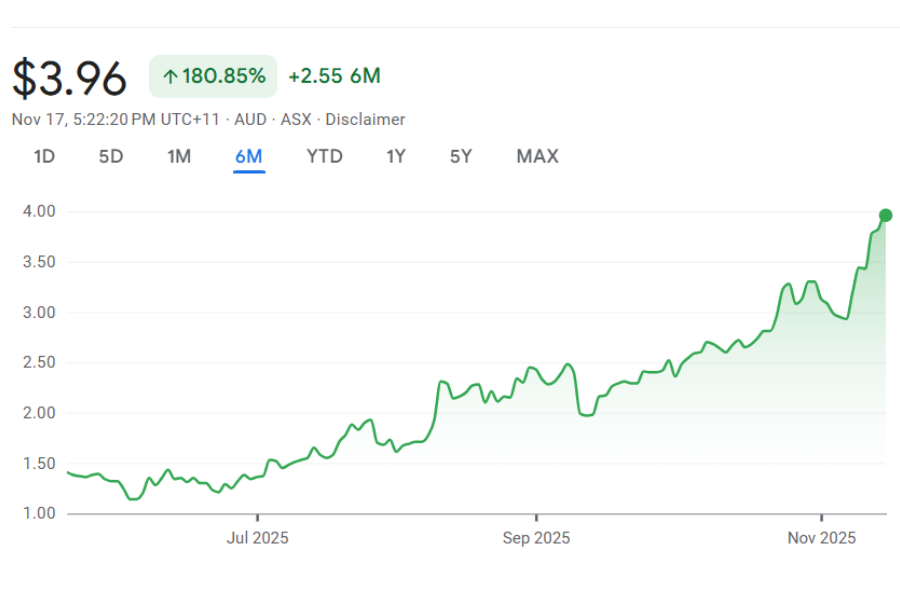

Liontown Resources (ASX: LTR)

Liontown Resources has delivered a 75% gain year-to-date, reflecting investor confidence in its Kathleen Valley lithium mine in Western Australia. The company successfully ramped up production through 2025 and is positioning to become one of Australia's major lithium producers. Kathleen....

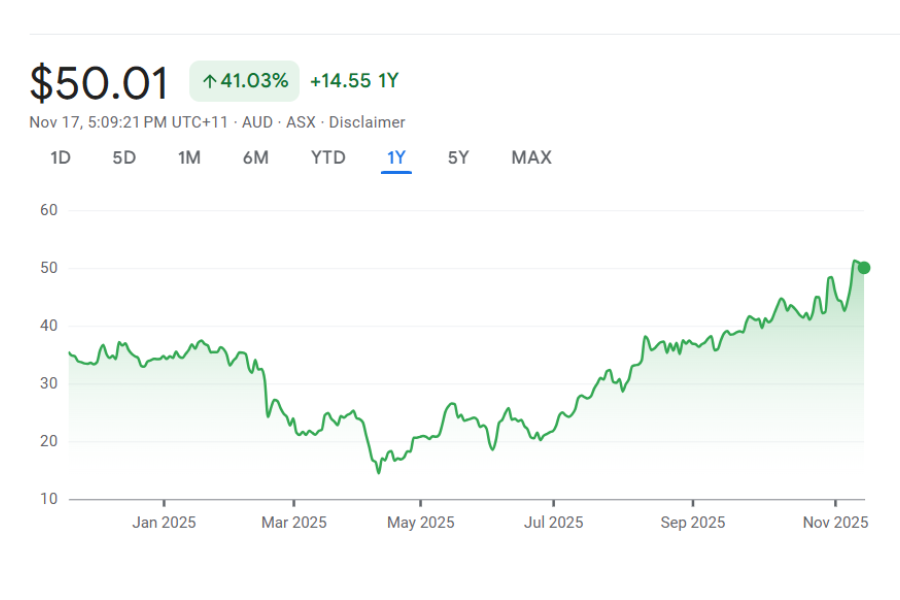

Mineral Resources (ASX: MIN)

Mineral Resources provides diversified exposure across both lithium and iron ore, reducing single-commodity risk. The company operates the Wodgina lithium mine and owns a 50% stake in the Mt Marion lithium operation. This diversification proved valuable during lithium's downturn, as iron ore earnings helped sustain ..

3 Best ASX Lithium Shares to Buy Now in 2025

How to Invest in Lithium in Australia?

Australian investors have several pathways to gain lithium exposure. Direct share ownership through a brokerage account allows you to select specific producers based on your risk tolerance and conviction. Alternatively, exchange-traded funds like the Global X Battery Tech & Lithium ETF (ASX: ACDC) provide diversified exposure across multiple lithium and battery technology companies.

For those seeking broader critical minerals exposure beyond just lithium, consider that many diversified miners like IGO also have significant lithium operations alongside nickel and other commodities. This approach can reduce concentration risk while still capturing the sector's upside potential.

Are ASX Lithium Shares a Good Investment?

The answer depends heavily on your investment timeframe and risk appetite. For long-term investors with a 3-5 year horizon, the structural demand growth from vehicle electrification and energy storage expansion supports a bullish case. The International Energy Agency projects lithium demand will exceed supply by 97,000 tonnes annually by 2030, widening to a 621,000 tonne deficit by 2040.

However, significant near-term risks remain. Lithium prices have stabilised but not yet recovered to levels that would incentivise major new supply projects. If Chinese production restarts aggressively or EV demand disappoints, prices could face renewed pressure. The sector's recent rally has also pushed valuations higher, reducing the margin of safety for new entrants.

We believe selective exposure to the highest-quality, lowest-cost producers makes sense for growth-oriented portfolios. Companies with strong balance sheets, tier-one assets, and operational track records are best positioned to survive future volatility and capitalise when markets tighten. Conservative investors might wait for a pullback before establishing positions, as commodity rallies rarely move in straight lines.

The Future Outlook of the ASX Lithium Sector

FAQs on Investing in Lithium Stocks

Lithium prices respond to the supply-demand balance between production capacity and battery demand, primarily from electric vehicles. Chinese production decisions, EV sales trends, and inventory levels are the three most important near-term drivers.

Our Analysis on ASX Lithium Stocks

Here are 5 ASX resources stocks working with big automakers! Are these signs to buy??

Today’s ‘list of stocks’ is of ASX resources stocks working with big automakers. If an ASX resources company (particularly at…

PLS Group (ASX:PLS) Surges to 52-Week High After 167% Lithium Rally: Buy or Wait?

PLS Group Soars as Lithium Recovery Gains Momentum PLS Group (ASX: PLS), formerly known as Pilbara Minerals, hit a fresh…

Liontown Resources (ASX:LTR): From riches to rags, now back to riches again? Here’s what 2026 holds

We’ve all heard the saying ‘rags to riches’ and when Liontown (ASX:LTR) found Kathleen Valley, it was the perfect illustration…

Patagonia Lithium (ASX:PL3) Surges 53% on Ameerex Partnership: Is This Lithium Explorer a Buy?

Patagonia Lithium Secures Key Partnerships for Growth Patagonia Lithium (ASX: PL3) surged 53% to A$0.13 on Friday, hitting its highest…

Chariot Resources (ASX:CC9) Lands Deal with CATL Supplier: Is This Micro-Cap Lithium Stock a Buy?

Chariot Resources’ Nigeria Lithium Opportunity Chariot Resources (ASX: CC9) has started 2026 with a bang. The company just signed a…