Understanding Silver as a Commodity

Silver is both an industrial and investment metal. About half of the demand comes from uses like solar panels, EVs, electronics, and medical gear, while the other half comes from investors treating it as “poor man’s gold.” This dual role makes silver more volatile than gold but also gives it a strong upside in bull markets when both industries and investors compete for supply. With renewable energy driving consumption higher, solar panels alone could add 30 million ounces annually by 2030, and mining output staying flat, silver’s supply-demand imbalance is becoming more pronounced. This mix of rising demand and limited supply positions silver as a unique growth commodity.

What are ASX Silver Stocks?

ASX silver stocks are Australian-listed companies engaged in the exploration, development, or production of silver and silver-rich polymetallic deposits. Only a limited number of pure silver producers exist on the ASX, as many miners operate across multiple commodities. These stocks provide investors with exposure to global silver prices while benefiting from Australia’s stable regulatory environment and investor familiarity with resource-sector equities. Leading examples include Adriatic Metals (now part of Dundee Precious Metals, ASX: DPM), Silver Mines Limited (ASX: SVL), and Sun Silver (ASX: SS1), all of which offer varying levels of production, development progress, and exploration upside. Investing in such companies provides greater leverage to rising silver prices but introduces additional operational and jurisdictional risks compared with holding physical silver or ETFs.

Why Invest in Silver Shares

Silver shares present a compelling opportunity in November 2025, with the gold-silver ratio elevated at 80–86:1, well above its historical average, signalling potential outperformance as it reverts toward normal levels. Structural industrial demand from electric vehicles, solar panels, and 5G networks continues to underpin silver’s role beyond its traditional monetary use, while global mining output has stagnated and reserves have declined by 25% over the past decade, creating persistent supply constraints. At around $50 per ounce compared to gold at $4,000, silver also remains far more accessible to retail investors, a dynamic that often drives additional momentum during precious metals bull markets.

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter for exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today and make informed investment decisions.Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today and make informed investment decisions.

How to Choose the Right ASX Silver Stocks

Selecting the right ASX silver stocks requires more than tracking silver prices; investors should assess a company’s silver exposure, cost structure, resource quality, development stage, and financial strength. Pure-play miners with a high percentage of revenue from silver provide stronger leverage to price movements than diversified producers, while low all-in sustaining costs (AISC) under $20 per ounce ensure healthy margins compared to higher-cost projects. High-grade deposits in stable jurisdictions like Australia reduce operational risk, and the stage of development, whether producer, developer, or explorer, shapes the balance between risk and reward. Finally, companies with strong cash reserves and solid balance sheets are better positioned to fund growth without excessive shareholder dilution, making these factors critical for aligning silver investments with individual risk tolerance.

3 Best ASX Silver Shares To Buy Now In 2025

Silver Mines Limited (ASX: SVL)

Silver Mines is the closest thing to a pure silver play on the ASX, with 86% of projected revenue tied directly to silver. Its flagship Bowdens Silver Project in New South Wales is Australia’s largest undeveloped silver deposit, holding 71.7 million ounces in reserves. Recent drill results in November 2025 were the strongest in the project’s 36-year history, confirming consistent high-grade mineralisation and suggesting potential resource extensions.

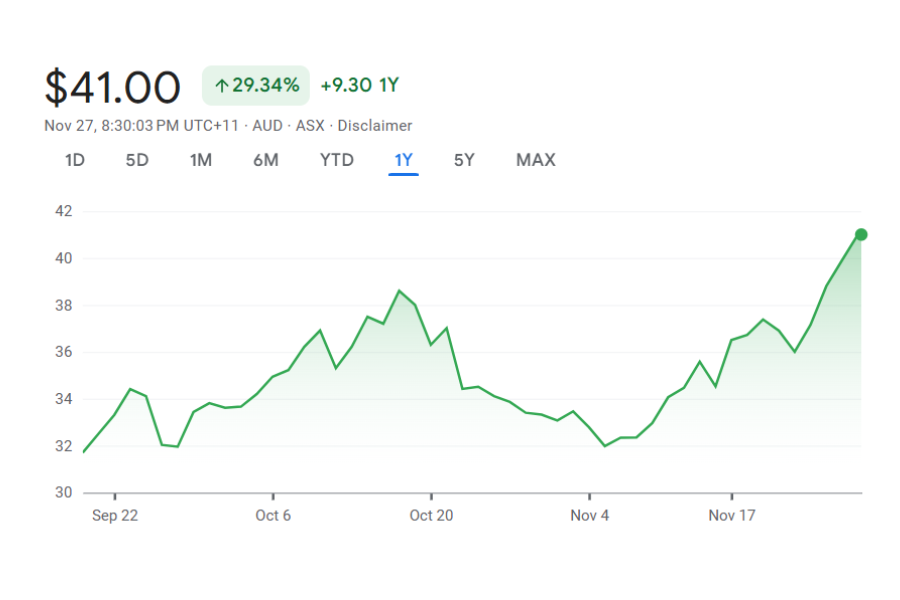

DPM (ASX: DPM)

DPM, formerly Adriatic Metals, has transformed into a significant silver producer through its Vares project in Bosnia and Herzegovina. Commercial production began in July 2025, and DPM reported strong Q3 2025 silver output following the Vareš project’s July start of commercial production, highlighting the scale of operations.

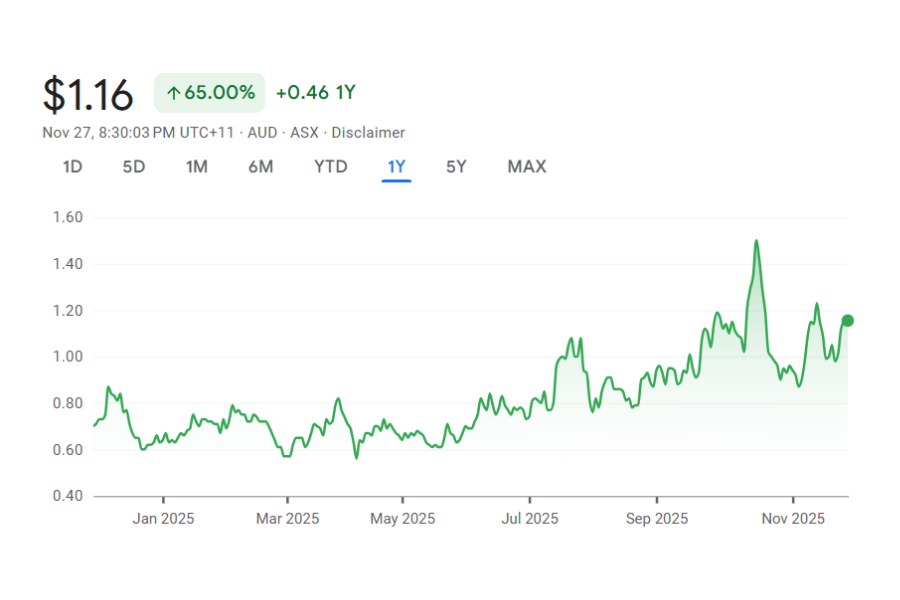

Sun Silver (ASX: SS1)

Sun Silver offers the most speculative but potentially rewarding play, with its Maverick Springs project in Nevada hosting 480 million ounces of silver equivalent, the largest resource base among ASX-listed silver companies. The grades, averaging 68 g/t AgEq, compare favorably with many global deposits. The company launched its 2025 drilling program in November to expand resources and conduct metallurgical testing to demonstrate economic ....

3 Best ASX Silver Shares To Buy Now In 2025

Silver Price and the Impact on Silver Stocks and silver production

Silver has surged in 2025, rising from $29 to around $50 per ounce, a gain of over 70% and briefly topping $54 in October, its highest since 2011. This strength boosts silver stocks: for example, Silver Mines’ Bowdens project value jumped nearly 50% as prices rose. Producers benefit from wider margins, developers see stronger project economics, and explorers attract more investor interest. Still, silver remains more volatile than gold, with pullbacks tied to Fed policy shifts. Importantly, even after recent profit-taking, silver has held firm above $49–50, showing resilience and strong investor appetite.

Gold-Silver Ratio: A Crucial Indicator for Investors

The ratio sits at 80–86:1, above the historical 50–70:1 average, suggesting silver is undervalued relative to gold. After peaking above 100:1 earlier in 2025, the ratio has fallen, showing silver’s recent outperformance. If it continues compressing toward historical levels, silver could deliver stronger returns than gold over the next 12–24 months. For investors, this ratio acts as a key signal: when elevated and trending lower, it has historically marked the start of powerful silver bull runs, making current conditions especially favourable for silver exposure.

Thе Impact of Silvеr Supply and Dеmand on Silvеr Stocks

Global silver demand hit a record 1.2 billion ounces in 2024, driven by industrial uses like solar panels, which alone could add 30 million ounces annually by 2030. Supply, however, has stagnated since the mid-2010s, with reserves down 25% and few new projects in the pipeline. Industry reports project persistent supply deficits through the late 2020s, potentially totalling hundreds of millions of ounces. For ASX silver stocks, this is especially favourable. Australia’s large resource base means projects reaching production in the next few years could benefit from tight supply and strong demand.

Investing in Physical Silver vs. Silver Stocks

Investors have two primary ways to gain silver exposure: physical metal or silver stocks.

Physical Silver

Physical silver gives direct exposure to price movements without company-specific risks. Investors can buy bullion bars, coins like Australian Silver Kangaroos, or ETFs such as Global X Physical Silver (ASX: ETPMAG). The main advantages are simplicity and security: if silver rises 10%, your investment rises about the same, and physical silver never goes to zero. However, it comes with storage and insurance costs, wider buy/sell spreads, and no cash flow or leverage; returns move 1:1 with silver prices.

Silver Stocks

Silver stocks provide leveraged exposure because profits expand faster than silver prices. For example, a miner with costs of $25/oz earns $25 at $50 silver but $50 at $75 silver, profit doubles while silver rose only 50%. Stocks can also generate dividends and add value through exploration or resource growth. The downside is company-specific risks such as management execution, permitting delays, cost overruns, or dilution from capital raises. Strong silver prices don’t always guarantee strong stock performance if operations falter.

The Role of Silver in a Diversified Investment Portfolio

Advisors often suggest 5–15% of a portfolio in precious metals, with silver playing a unique role. It acts as an inflation hedge, though more volatile than gold, and provides diversification since it has low long-term correlation with equities. Silver also benefits from dual demand: investors drive prices during uncertainty, while industrial uses support prices during growth. For Australians, ASX silver stocks add exposure to tier-one mining projects and potential re-rating opportunities compared to global peers.

Silver in a Future Driven by Technology

Silver’s industrial importance makes it central to future growth trends. Solar panels require about 20 grams each, with installations projected to add 25–40 million ounces of demand annually by 2030. Electric vehicles use roughly twice as much silver as traditional cars, while 5G and upcoming 6G networks need silver for circuits and connections. These uses are structural, not cyclical, and no cheaper substitute has emerged despite decades of research. This ensures industrial demand will keep rising, providing strong long-term support for silver prices alongside investment demand.

Pros and Cons of Investing in ASX Silver Stocks

Pros of ASX Silver Stocks

Silver stocks offer strong leverage to rising silver prices, with profits often multiplying faster than the metal itself. Exploration success and resource growth can add value beyond price moves, while Australia’s stable mining jurisdiction reduces political and regulatory risks. Once in production, companies may pay dividends, giving investors both income and capital appreciation, along with diversification benefits by combining precious metals exposure with Australian equities.

Cons of ASX Silver Stocks

The risks include poor management, cost overruns, or operational issues that can hurt performance even in a rising silver market. Development projects face uncertain timelines due to permitting or financing delays, and capital raises can dilute shareholders. Silver stocks are also more volatile than physical silver, amplifying both gains and losses, while regulatory approvals and community opposition in Australia can still pose challenges.

Future Outlook of ASX Silver Stocks

Heading into 2026, silver and ASX silver stocks look well-positioned. Analysts project silver could average around $56–65 per ounce, with some forecasts as high as $80–90 by year-end due to structural supply deficits. New projects take years to develop, so the current shortfall is likely to persist, while industrial demand from solar, EVs, and electrification remains policy-driven and secular. The gold-silver ratio at 80–86:1 also suggests silver is undervalued relative to gold, with historical patterns pointing to potential outperformance as the ratio compresses. For ASX stocks, catalysts include Silver Mines securing development consent for Bowdens, new producers reaching commercial output, and rising investor attention as silver equities remain underfollowed compared to gold.

Are ASX Silver Shares a Good Investment?

ASX silver shares can make sense depending on your risk tolerance and investment horizon. Bullish investors benefit from leveraged exposure to silver’s fundamentals, with profits multiplying faster than price gains for low-cost producers and developers. Current prices around $49–50, down from October highs, may offer an attractive entry point. However, silver stocks are volatile and carry company-specific risks. Producers like DPM provide immediate cash flow with lower risk, developers like Silver Mines offer strong leverage but face permitting challenges, and explorers like Sun Silver carry the highest upside and risk. For growth-oriented investors with a 2–3 year horizon, quality developers in tier-one jurisdictions look compelling, while conservative investors may prefer a mix of physical silver or ETFs with producing stocks. Matching your choices to your risk profile is key, as silver’s dual role as both monetary and industrial metal underpins a strong long-term case.

FAQs on Investing in Silver Stocks

Advisors usually suggest 5–15% in precious metals overall. Aggressive investors might put 5–10% directly into silver stocks, while conservative investors may prefer 2–5%. The key is balancing silver’s upside with its higher volatility compared to gold or equities.

Our Analysis on ASX Silver Stocks

Our 5 ASX Predictions for 2026!

This article outlines 5 ASX Predictions for 2026 that Stocks Down Under puts its neck on the line to assert…

Silver Mines (ASX:SVL) Crashes 22% on Permitting Setback: Buy the Dip or Avoid?

Silver Mines: Buy the dip or avoid? Silver Mines (ASX: SVL) dropped 22% to 18 cents yesterday after announcing it…

Black Bear Minerals (ASX: BKB) Surges 20%: Is This Silver Stock Worth Buying?

Black Bear Minerals (ASX: BKB) surged 20% after successfully launching on the US OTCQX market under ticker BKBMF on December…

Here are 6 ASX mining services stocks to look at (other than Mineral Resources)

There are plenty of ASX mining services stocks doing well right now due to the booming gold and iron ore…