Underlying v Statutory results? There’s a big difference between the 2 – here’s how to tell

When companies report results every reporting season, you’ll hear underlying and statutory results. What is the difference between the two and how big does the gap tend to be?

The difference between underlying and statutory results (in theory)

Underlying results refer to performance measures that strip out one-off charges or non-recurring events, providing a better representation of underlying financial performance without the impact of any unusual or extraordinary items.

Statutory results are the official and legally reported numbers as determined by Generally Accepted Accounting Principles (GAAP). These reflect all activities of the business including one-off items, non-recurring events and other regulatory elements.

The difference in practice

But is this the case in practice? Yes, it is.

This is because, as noted above, underlying results strip out non-recurring events and one-off charges, such as restructuring costs, asset impairments, legal settlements, and extraordinary gains or losses. These are all items that are not part of a company’s typical operations and may have a large impact on the financial performance of the company. By removing these items from the reported financial results, it provides truer insight into the overall performance and health of the business.

On the other hand, statutory results include all activities of the business including one-off items, non-recurring events and other regulatory elements. This means that a company’s statutory results may appear to be more profitable if there are one-off gains or extraordinary events included in its reported figures, however it may not be an accurate reflection of its core underlying operations performance. It may even be as extreme as a company being profitable on an underlying basis but not profitable on a statutory basis.

A real life case study

Let’s look at the FY20 results of Qantas (ASX:QAN). We know it is a while ago now, but this set of results is a better example to use in order demonstrate our point – more than any result in FY24. Obviously the result for any airline in this period was always going to be a harsh result given the onset of the pandemic that wiped out demand for air travel overnight.

Regardless, the company was profitable on an underlying basis recording $124m, albeit 91% lower than in FY19. But the company recorded a statutory loss of $2.7bn, the majority of which was aircraft write downs – given they were not being used but would require some expenditure while in storage to ensure they could be used again.

The write down was not a literal cash outflow but it represented an ongoing cost to the company so it was not reflected in underlying results but it was reflected in statutory results.

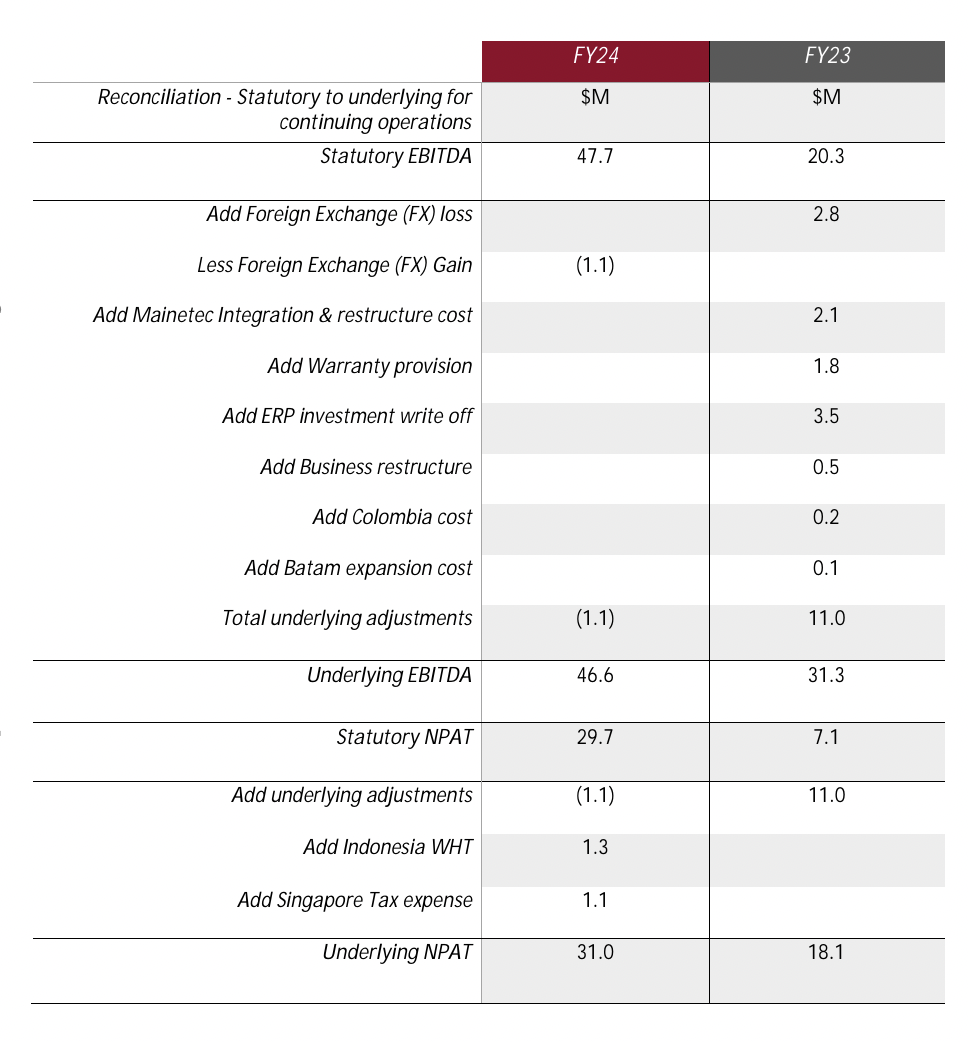

Let’s look at a more recent result, Austin Engineering’s (ASX:ANG) result for FY24, as well as for FY23. Note that we are using FY24 rather than the current FY25 because companies’ results in August are technically only preliminary – they’ll only be final in the company’s set of accounts due a month later.

Anyway, you can see the underlying and statutory results in respect of ANG all differ because of what is added or taken away. In FY24, the company’s forex result made it gain money after losing money in the year before. Companies like Austin need to do business in multiple currencies and can end up gaining or losing money in converting the currency. Seemingly in FY24, it gained more than it lost and had to be included in the statutory profit, but was not part of the underlying operations so was excluded from the underlying result. In the year prior, the company lost more than it gained.

Source: Company

Sometimes, statutory results can be better than underlying results. One example was AMP (ASX:AMP) in its FY22 results. Its underlying NPAT was $184m but its statutory NPAT was $387m. This was inflated by the gain on the sale of its infrastructure debt platform in FY22, but partly offset by impairments.

Understand both underlying and statutory results

It is important to understand both underlying and statutory results when assessing companies’ financial performance in order to make informed decisions about investing in them.

Furthermore, when underlying and statutory results differ substantially, it is important to understand just why that is the case.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Capstone Copper (ASX:CSC) Hits Record Production Despite Chile Strike: Is This Copper Giant a Buy?

Capstone Copper Achieves Record Production Despite Strike Capstone Copper (ASX: CSC) jumped 7% to AU$15.63 on Friday after the company…

1414 Degrees (ASX:14D) Surges 20% on AEMO Approval: Is This $9M Energy Stock a Buy?

1414 Degrees wins AEMO approval for Aurora battery link 1414 Degrees (ASX:14D) jumped 20% to A$0.030 on Friday after getting…