ROIC: How useful is this metric and which 3 sectors generate the highest returns?

ROIC, or Return on Invested Capital, is a financial metric used to measure a company’s efficiency in generating profits using the capital it has invested. It provides investors with an insight into how effectively a company is deploying its capital and whether it is generating high returns for its shareholders.

That’s it in a nutshell. But how is it calculated and which sectors tend to record the highest returns?

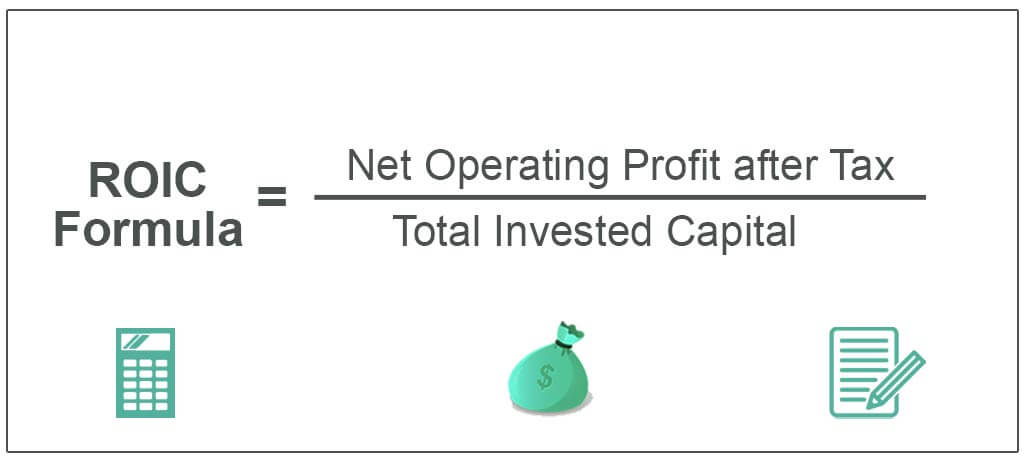

How ROIC is calculated

ROIC is calculated by dividing a company’s net operating profit after tax (NPAT) by its total invested capital. The NPAT is the profit that a company generates from its core operations after deducting the taxes paid. And total invested capital includes all the capital invested in the company, including shareholders’ equity and debt.

In general, a higher ROIC indicates that the company is generating higher profits using the capital it has invested, which is a good sign for investors. Companies that have a consistently high ROIC are often low-risk investment opportunities.

Source: WallStMojo

But returns can vary

However, it is important to note that ROIC can vary widely between companies, industries, and even time periods. To make accurate comparisons, it is important to compare a company’s return with those of its peers in the same industry. Additionally, investors should look for consistent performance over time rather than just looking at a single period.

So what sectors have the highest ROIC?

One such sector is technology as companies in this field tend to invest heavily in innovation and research and development. This investment often leads to the creation of new and innovative products, which in turn positively impacts the company’s financial performance. The ASX tech stock with the best ROIC is TechnologyOne (ASX:TNE) with 41%.

The healthcare and pharmaceutical industries are also known for having high ROICs. This can be attributed to the fact that these companies invest heavily in research and development as well, with a focus on creating new drugs and medical devices that can improve patient outcomes. Furthermore, the healthcare industry is generally less affected by economic downturns, making it a relatively stable sector to invest in. One prominent example is radiology software stock Pro Medicus (ASX:PME), which has a ROIC of over 50%.

Finally, the financial services sector can also have high ROICs, particularly in areas such as wealth management and investment banking, because these companies often generate significant revenue from fees earned on assets under management or through successful investment strategies.

Disadvantages of using the ROIC metric

There are four shortcomings.

Firstly, it does not account for differences in tax rates across companies. A company with a low tax rate may appear to have a higher ROIC compared to a company with a higher tax rate, even if the two companies have similar investments and returns.

Secondly, it fails to consider differences in accounting standards across regions. Companies based in countries with different accounting standards may report investment and return figures differently, making it difficult to compare their ROICs.

Thirdly, it does not provide insights into the efficiency of a company’s operations. It only measures the returns generated by a company’s investments, without considering the costs associated with achieving those returns.

Lastly, it does not consider the risk associated with investments. Companies with higher returns may have taken on more risk, which may not be adequately reflected in this metric.

But ROIC is a very useful metric overall

ROIC is a powerful tool for investors looking to evaluate a company’s financial health and profitability. By understanding how to calculate and analyse this metric, investors can make informed decisions about where to invest their money.

Nevertheless, it should be used in conjunction with other performance measures to provide a comprehensive picture of a company’s financial health.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Amazon (NASDAQ:AMZN) Down 9%, Is Capex Becoming the Story?

14% Sales Growth, 128B Spend, Now What? Amazon has fallen about 9%. While we are holders of the stock, when…

The proposed Rio Tinto Glencore merger failed, here’s why and what it means for the companies!

The proposed Rio Tinto Glencore merger is off. The deal would have created the world’s biggest mining company, capped at…

Tech and AI Stocks Sell Off, This Reckoning Was Always Coming

The Tech and AI Valuation Reality Check When it comes to stock prices, they usually rise when fundamentals and earnings…