How much will lithium demand skyrocket during the rest of the 2020s?

Lithium demand is only going in one direction – up. And if you hadn’t realised this, you’ve probably been living on Planet Mars. But what investors may be forgiven for not knowing is just how much demand will increase in the rest of this decade and beyond?

Why is lithium demand expected to increase so much?

Lithium demand is expected to surge over the next decade, mainly due to its role in renewable energy storage. Lithium-ion batteries are increasingly being used in electric vehicles, home energy storage systems and stationary industrial energy storage applications. Additionally, lithium is also an essential component in grid-scale energy storage solutions, such as large-scale batteries. With governments around the world promoting clean energy sources, demand for lithium is likely to increase significantly as renewable energy sources become more prominent.

Other contributing factors to the exponential growth in lithium demand include the decreasing cost of lithium ion batteries and growing consumer demand for portable electronic devices like cell phones and laptop computers.

As these markets continue to expand, manufacturers are turning to lithium-ion batteries as a reliable power source that can store substantial amounts of power while taking up minimal space. This has led to a steadily increasing demand for lithium over recent years. The outlook for continued growth in the near future is positive given that technological advances are making lithium even more attractive for use in a variety of applications. Moreover, the development of new production processes and efficient recycling technologies could further boost demand for this metal over the coming decade.

But how much?

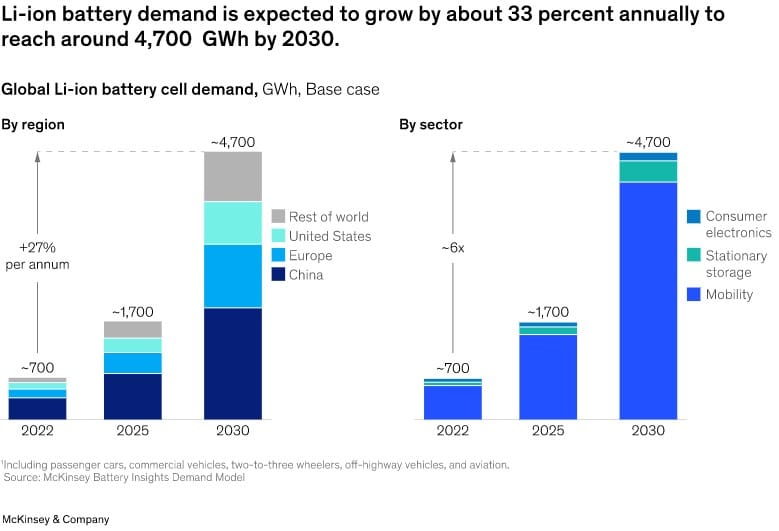

There are varying estimates, but one of the more reliable in our view is from management consulting agency McKinsley. Analysis from McKinsley last year estimated that the entire lithium-ion battery chain (from mining through to recycling) could grow over 30% annually every year up to 2030, by which point it would reach US$400bn and a market size of 4.7TWh.

Source: McKinsley

Another recent estimate came from industry player Albemarle (it is a part owner of the Greenbushes and Wodgina mines in Australia). It predicts global revenues would rise from US$4.7bn in 2022 to as much as US$15.7bn in 2027. It also anticipated the world would consumer 1.8Mt of lithium carbonate equivalent in 2025 and 3.7Mt in 2030. It also estimated that electric vehicle production would grow from 11.2m in 2022 to 46.9m in 2030.

We’ll show one final estimate for future lithium demand. Public-private alliance Li-Bridge expects demand for batteries to increase more than five-fold by 2030. You can clearly see that there are various estimates but they all point to the same direction – namely onwards and upwards by a very long way.

So what this growth in lithium demand mean for investors?

With this growth in lithium demand comes potential opportunities for investors. In particular, there are opportunities in the form on companies that produce or supply lithium-based products, such as battery manufacturers or raw material suppliers. Furthermore, companies that prospect or produce lithium might be ones to consider.

Investors should pay close attention to the growing global lithium demand and evaluate ways they can benefit from its increasing use in various industries.

Why then are prices low and will they recover?

Some investors may scoff at this because of the bear market over the past couple of years. When even the world’s lowest-cost lithium mine (Greenbushes) is not paying dividends to conserve cash, you know there’s trouble.

The 2022 bull run in lithium prices led to companies ramping up production too fast. With a glut of supply, prices are falling as demand remains slow at current pricing levels.

But it does appear lithium prices found a bottom with many companies withdrawing the sector. The Australian Government’s Department of Industry, Resources and Sciences’ predicts a ‘modest recovery’ across 2025. Goldman Sachs expects 2025 to be a stagnant year but for a ful run in 2026 and 2027. Still, it is important to note not all lithium is created equal. Higher grade products will attract higher prices. So investors need to specifically consider any lithium company’s product, as well as its portfolio of mines and downstream processing assets.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…