Pacific Smiles Group (ASX:PSQ): After a cataclysmic COVID period, dentistry is a good industry to be in

Let’s take a closer look at dental stock Pacific Smiles Group (ASX:PSQ). Pacific Smiles operates 131 dental care centres across Australia and generates over $200m in sales annually. We think this is both a company that has potential to defy inflation in the next 12-24 months and is a good growth story too.

Do you need solid trading & investment ideas on the ASX? Stocks Down Under Concierge can help!

Concierge is a service that gives you timely BUY and SELL alerts on ASX-listed stocks – with price targets, buy ranges, stop loss levels and Sell alerts too. We only send out alerts on very high conviction stocks following substantial due diligence and our stop loss recommendations limit downside risks to individual stocks and maximise total returns.

Concierge is outperforming the market by a significant margin!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Meet Pacific Smiles Group

Pacific Smiles is the ASX’s only remaining dental practice operator. Smiles Inclusive gave up the ghost, 1300 Smiles was acquired and while SDI is listed, it is an equipment manufacturer. Pacific Smiles owns and operates the Pacific Smiles Dental Care Centres as well as the nib Dental Care Centres in the ACT, NSW, Victoria and Queensland.

It was founded in 2003 and operates 131 clinics today under a franchise model with ~600 registered dentists. The individual franchise operators do the hands-on work, while the head office takes care of everything else. The revenue is split 60-40 between Pacific Smiles and the individual dental practice.

The company’s co-founders are Alison Hughes and Alex Abrahams who own just over 10% each – although the latter retired from a full-time capacity in 2020. Between 2012 and 2021, TDM Growth Partners had the largest shareholding (just under 25%) before offloading the bulk of its stake throughout 2021. HBF Health was one of the buyers, which took a 10% stake just before Christmas last year.

Why is it unique?

The company doesn’t have the largest market share in the industry by any means, at just 2.5%, but the story goes deeper than that. You see, the company is selective about where it sets up shop, doing so in areas lacking an established dentist and typically setting them up in shopping centres, capitalising on foot traffic and how convenient it would be to consumer.

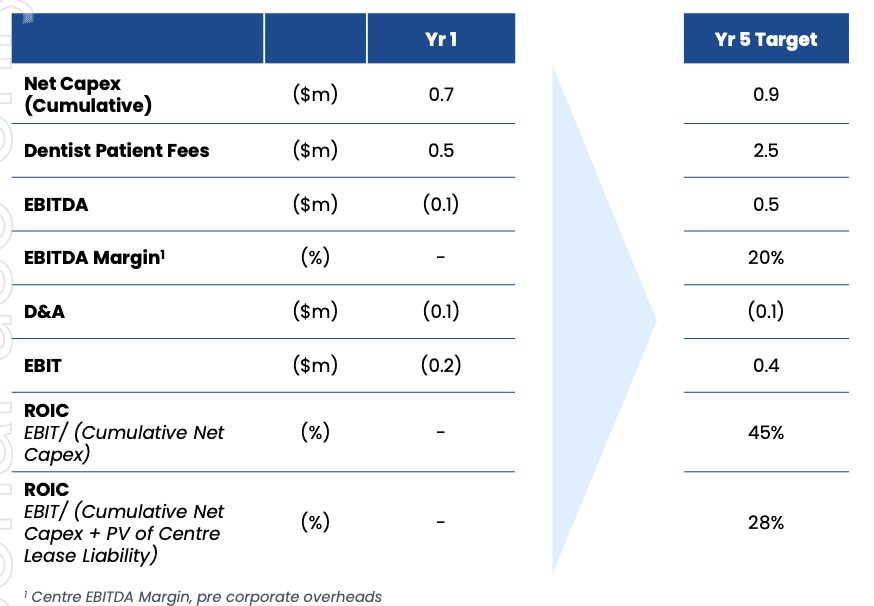

It takes 9 weeks to build a centre and it aims to sign up at least 500 permanent patients before it opens as well as for the shop to be profitable in 9-12 months and generate a 28% ROIC (accounting for capex and lease liabilities).

Pacific Smiles’ operating model for opening individual stores (Source: Company presentation for May 31, 2023 investor day)

A small proportion of its centres are NIB facilities, owned by Pacific Smiles under a licensing deal to serve their members mostly (although others can use them too). At each and every individual store, the company’s aim is to ensure that dentists can not just do their jobs, but do the jobs they are good at. Yes, they take care of the administrative burdens that dentists would have to deal with if they ran independently such as accounting and dealing with broken machinery. But they allow individual dentists to pick and choose the work they’re good at.

It also allows for flexible hours, enabling them to work on weekends if that is better for business, as well as to take sick leave without impacting the business (by passing the work to others). So, if they prefer to do root canals rather than wisdom teeth, they can pick up root canal jobs, even at other practices. Conversely, those good at wisdom teeth can go to other practices and take those jobs.

The company looks after them well, employing dental assistants currently studying with the intention that they will gradually work their way up to becoming fully qualified dentists and also providing the ongoing education necessary (including providing specific study training to help trainees pass mandatory exams). Of course, they don’t just take on everyone – having said no to 7 applicants in the past month due to a lack of experience.

Hit by disruptions

The opportunity in this company is that you’re buying it as a turnaround story. It was nearly $3 during late 2021 but has nearly halved since. Obviously, COVID was a disruption to the business as people avoided seeing the dentist due to COVID-19. But we see three further issues that have impacted investor sentiment.

- First, its bottom line swinging from a $14m profit to a $3.2m loss from FY21 to FY22. This was due to falling demand, but also due to strategic investments in its IT systems that will benefit in the long-term.

- The second was board turmoil. In late 2022, following several months of rift between board members, Dr Abrahams called for a boardroom spill that was ultimately rejected, but it was a close margin. Although the board remained, they agreed to moderate expansion.

- Third, the company missing out on the private equity swoop of the dental sector. During the pandemic, 1300 Smiles and Abano Healthcare were acquired by private equity. Shareholders arguably hoped that Pacific Smiles could have been bought too.

Pacific Smiles Group (ASX:PSQ) share price chart, log scale (Source: TradingView)

Why Pacific Smiles can re-bound

We’re not going to say people are going to be headed back to the dentist for the first time since COVID and that will boost the company. We think, just as with the travel industry, that ship has sailed. OK, there may be a few practices where this may be the case. The company noted that Sydney CBD was one practice that was down from pre-COVID levels given the decline in foot traffic to the city. But we think this is a long-term growth story. We think dentistry is not something that can be put off due to price hikes – at least procedures that involve correcting pain are.

You also have to keep in mind the growing use of Private Health Insurance (which covers 80% of PSQ visits) and the company’s broad spectrum of Preferred Provider Agreements (PPA) where an insurer may refer a client to PSQ by default. We would also point out the Child Dental Benefits Scheme (CDBS) – the company has told investors this was a big driver in demand in April 2023.

Long term potential as well

In the medium term, the company is targeting a 5% market share, 250 centres (up from 129), 800 individual chairs (up from 539 now) and a 15% EBITDA margin (up from 6.8% now). For the first 10 months of FY23, Pacific Smiles has generated $216.5m in patient fees (up 20.5% from 12 months ago). It has guided to $270m in patient fees for the full year (which would be 19.4% higher than the full FY22 total) and underlying EBITDA of $24m (112% higher than FY22).

Consensus estimates for the years ahead look good too. In FY24, Pacific Smiles is expected to achieve $197m in statutory revenue (up 16% from FY23 consensus) and $33.9m in EBITDA (up 43%). For FY25, $222.6m in revenue (up 13% from FY24) and $40m in EBITDA (up 18%).

You can obtain this for just 9.9x EV/EBITDA and 19.4x P/E. When you consider it is just 0.2x EV/EBITDA-to-EBITDA growth and 0.14x PEG, the company looks even more compelling.

We think PSQ is undervalued

So, just what is this company worth? Using an EV/EBITDA multiple of 13.5x for FY24 (being the multiple that peer 1300 Smiles was acquired at), we think Pacific Smiles’ Enterprise Value should be $457.7m. With a projected net debt position of $92.5m, this derives an equity value of ~$365m and a consequential share price of $2.29 per share.

You could even argue it deserves a higher multiple considering 1300 Smiles had barely over 30 practices at the time it was acquired. But even being conservative, you can see it is undervalued. If the company achieves its guidance we expect it to re-rate.

What are the risks with this one? Well above all other risks, investors should be aware that the bar has been set high and the stock could be punished if it underperforms. We see three potential headwinds: First, industry competition. Second, inflation remaining persistently high. And the third is personnel risk.

But we think the company has mitigated these risks through its strategy of only setting up shops where there are no established business and also because private health insurance provides a big help to patients in covering costs. We also think how the company looks after their employees reduces the risk of turnover.

In fact, the company told investors at its investor day that there are some practitioners who leave, but come back within months because they didn’t realise how good they had it!

Keep your eye on Pacific Smiles

Pacific Smiles hasn’t had the most stable performance in the three years, but we think it has turned a corner and is destined for a better future. You may remember Silk Laser (ASX:SLA), which we wrote about in early March and since re-rated due to a takeover offer. We think it is a similar story here. We are not saying this company will be acquired, but we see a parallel in that there was such a wide gap between investor perceptions about what was happening to the company and reality. We believe this company will re-rate when investors see that gap.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target and stop loss level in order to maximise total returns. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…