Is it time to look at Revasum (ASX:RVS) again after its 2023 revenue guidance?

Chip equipment company Revasum (ASX:RVS) has been a perennial battler since its 2018 listing, but things may have taken a turn for the better last month when it raised its revenue guidance.

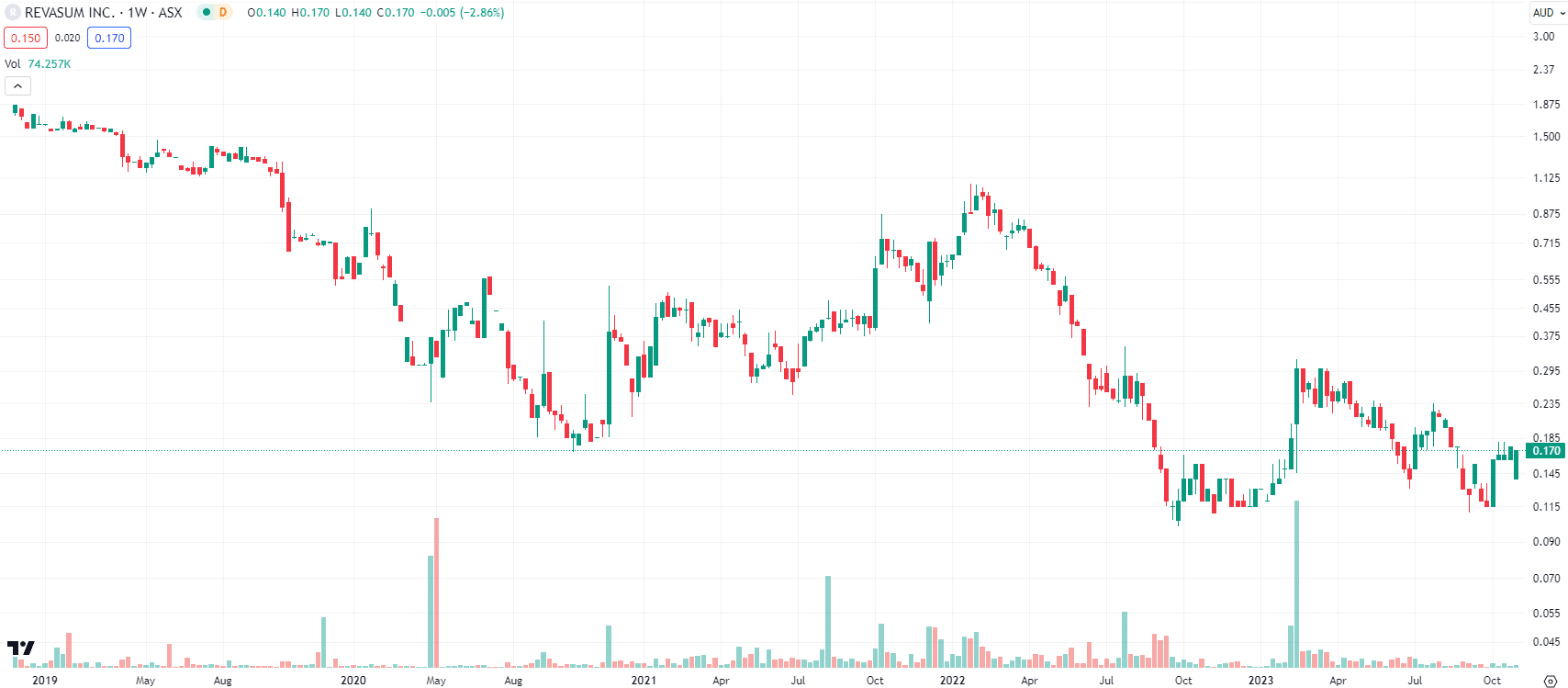

Revasum (ASX:RVS) share price chart, log scale (Source: TradingView)

Recap of RVS

Revasum is a semiconductor stock that listed on the ASX in 2018, specialising in the manufacturing of polishing, grinding and chemical mechanical planerisation (CMP) equipment. The main products of its growth story are the 7AF-HMG grinding tool and the 6EZ polisher.

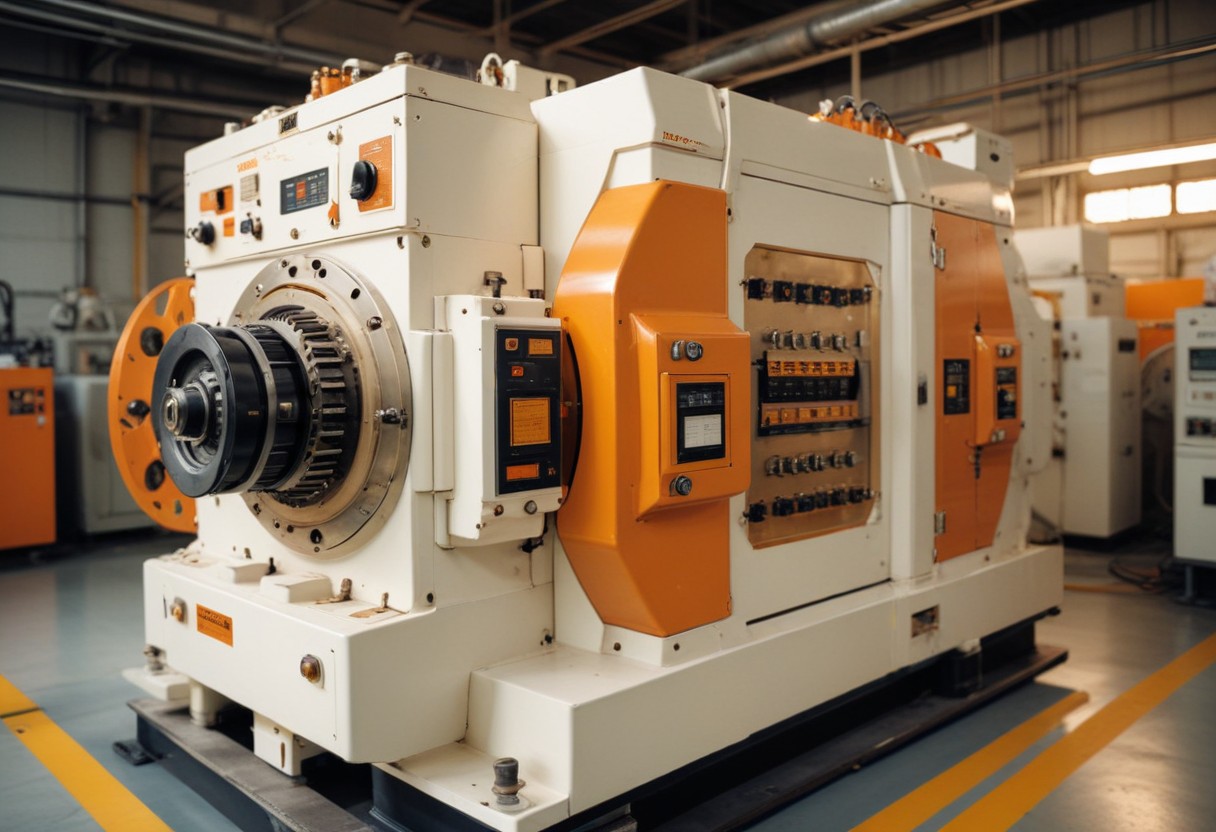

The former processes materials for use later in the production process. The latter of these tools essentially removes a thin layer of material from the surface of a wafer to achieve a high degree of flatness and smoothness so the reliability and performance of the final product is maximised – take a look at it!

Source: Company

The company’s tools are specialised for Silicon carbide (SiC) semiconductors, a relatively new technology that is becoming more attractive. Silicon Carbide is a compound substrate material with unique electrical and thermal properties for use in applications such as hybrid and electric vehicles, power management and communications devices.

The company’s tools are designed specifically to solve the particular problems of silicon carbide (SiC) processing. Their SiC-specific design offers significant advantages such as high material removal rates and material removal homogeneity. Revasum is now at the forefront of SiC processing technology thanks to this crucial product offering.

No, it is not the case that its tools are sold directly to the big device makers like Apple and Samsung. Instead, the big semiconductor fabs use these tools in their own manufacturing technologies and processes.

As a smaller company, however, it was reliant on a handful of large individual sales to drive share price momentum and it struggled to make a profit. On top of all this, the semiconductor industry is highly volatile and not well understood by local investors. Hence, its struggles for all these years it has been listed…until now?

RVS raises its revenue guidance

The company raised its revenue forecast for Fiscal Year 2023 (FY23), citing a strong year-to-date performance and an encouraging Q4 order pipeline. Revenue is expected to climb between $17.0 million to $20.0 million, a significant increase from $14.7 million the previous year.

Revasum’s anticipated revenue growth is supported by a stable foundation. The company’s year-to-date performance highlights its resilience and ability to efficiently manage the volatile semiconductor market. The company saw a 43% jump in Q3 revenue, a 9% decline in operating expenses and a 5.7% point increase in Gross Margins compared to the same quarter the previous year. This success suggests that the company is well-positioned to capitalize on the rising demand for semiconductor production equipment.

Collaboration with SGSS

The latest partnership between Revasum and Saint-Gobain Surface Solutions (SGSS) has the potential to revolutionize SiC wafer manufacture. This collaboration intends to set new standards in accuracy, efficiency, and surface quality for SiC wafer fabrication by combining Revasum’s experience in semiconductor manufacturing equipment with SGSS’s cutting-edge abrasive materials. This partnership not only broadens Revasum’s technical capabilities but also creates new opportunities for development in the semiconductor sector.

The revenue projection for FY23, along with the company’s strategic product offerings and significant collaborations, positions the firm for long-term success. The niche concentration on SiC processing technology and partnership with SGSS demonstrate the company’s dedication to innovation and quality.

Revasum exhibits a balanced approach to capitalizing on the rising demand in the semiconductor sector by retaining financial prudence even in the face of expansion. This revenue projection not only speaks favourably for RVS but also for the semiconductor manufacturing industry as a whole.

What are the Best ASX Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…