Here’s why Zip shares had a 10% dead cat bounce on Tuesday

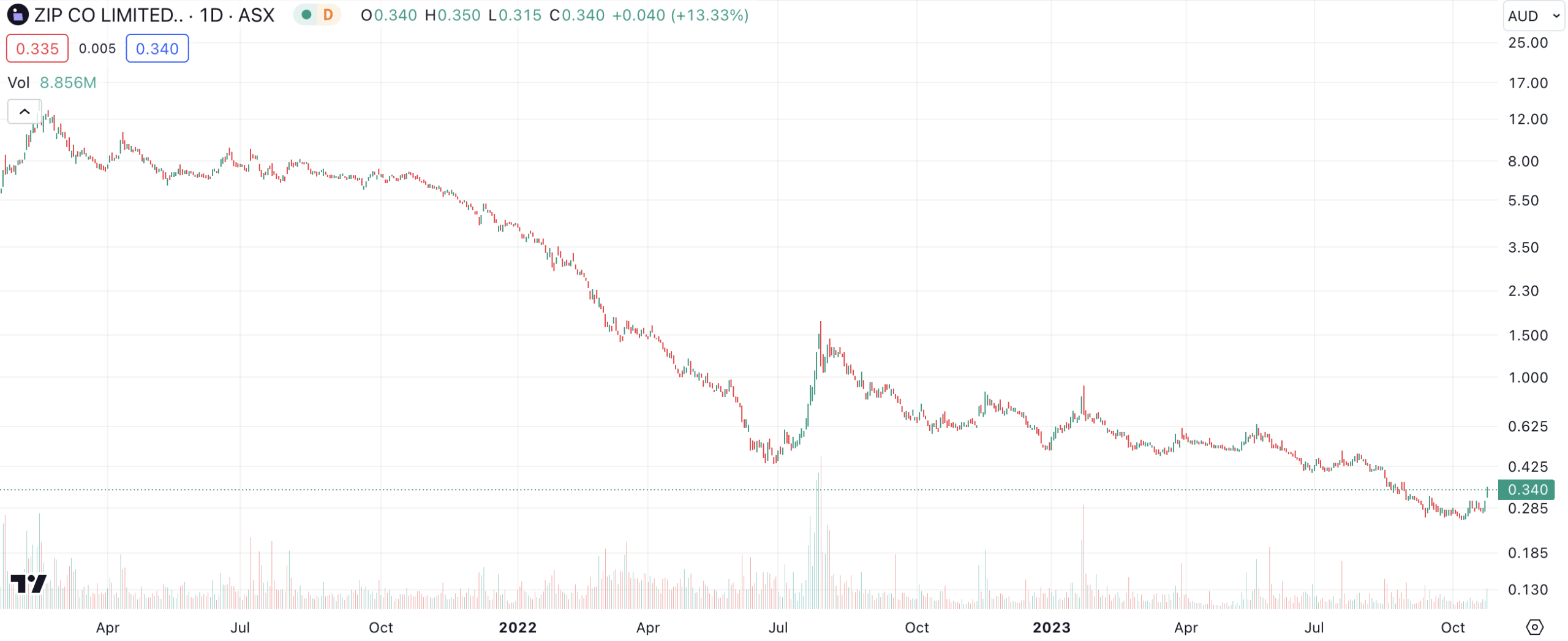

Zip shares had a 10% dead cat bounce on Tuesday. For those who are unaware, a dead cat bounce is a small, brief recovery in the price of a declining stock. Despite the gain today, they are down nearly half in the last year and down 97% from all time highs.

Zip (ASX:ZIP) share price chart, log scale (Source: TradingView)

Why Zip shares had a dead cat bounce

Zip released its results for the September quarter (1Q24) this morning and some investors seemed to like it. The company boasted that it recorded positive cash EBITDA for the period. It recorded 32% revenue growth to $204.4m, 11% transaction volume growth to $2.3bn and it boasted 6.1m active customers.

The company told investors US bad debts were below its target range and that it had signed several key merchants during the quarter including Amaysim, and R.M. Williams. And finally, it claimed to have a health balance sheet with the face value of its Convertible Notes reducing to $110.1m.

So back to $12 per share?

We wouldn’t think so. Afterpay was, and still is, a great company. But too many investors have sought to find another one like it and bought several other companies that have done very little in comparison to Afterpay (if anything).

There were some negative signs such as a decline in transactions and transaction volume in the ANZ market – 6.1% quarter-on-quarter and 9.6% year-on-year – as well as a fall in Active Customers across the globe. And even though bad debts are lower than a year ago, they rose from 1.84% to 1.99% in the past quarter. And this is not the first dead cat bounce we have seen out of this company either. Investors betting that it will return to 2021 highs (or perhaps even 2022 highs) should expect to be disappointed.

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

CSL CEO Paul McKenzie has departed, now what for the fallen biotech giant?

In a bombshell 4pm announcement, investors learned that CSL CEO Paul McKenzie was departing the company effective that very afternoon…

This company just made an IND submission to the US FDA, here’s why its a big step!

Imagion Biosystems (ASX:IBX) just made a IND submission. This is a big deal for the company, and we thought it…

Amplitude Energy (ASX:AEL) Down 20% After Elanora 1 Misses, Isabella Is the Next Shot

Amplitude Energy The Market Was Positioned for Gas, It Got Water Amplitude Energy (ASX:AEL) saw a sharp sell-off, down around…