Race Oncology (ASX:RAC) has good interim Phase II clinical trial results

Race Oncology (ASX:RAC) is one of the few companies to be moving significantly this morning, but all for a good reason. The company revealed interim Phase II trial results of its bisantrene drug in relapsed or refractory Acute Myeloid Leukaemia (AML) patients.

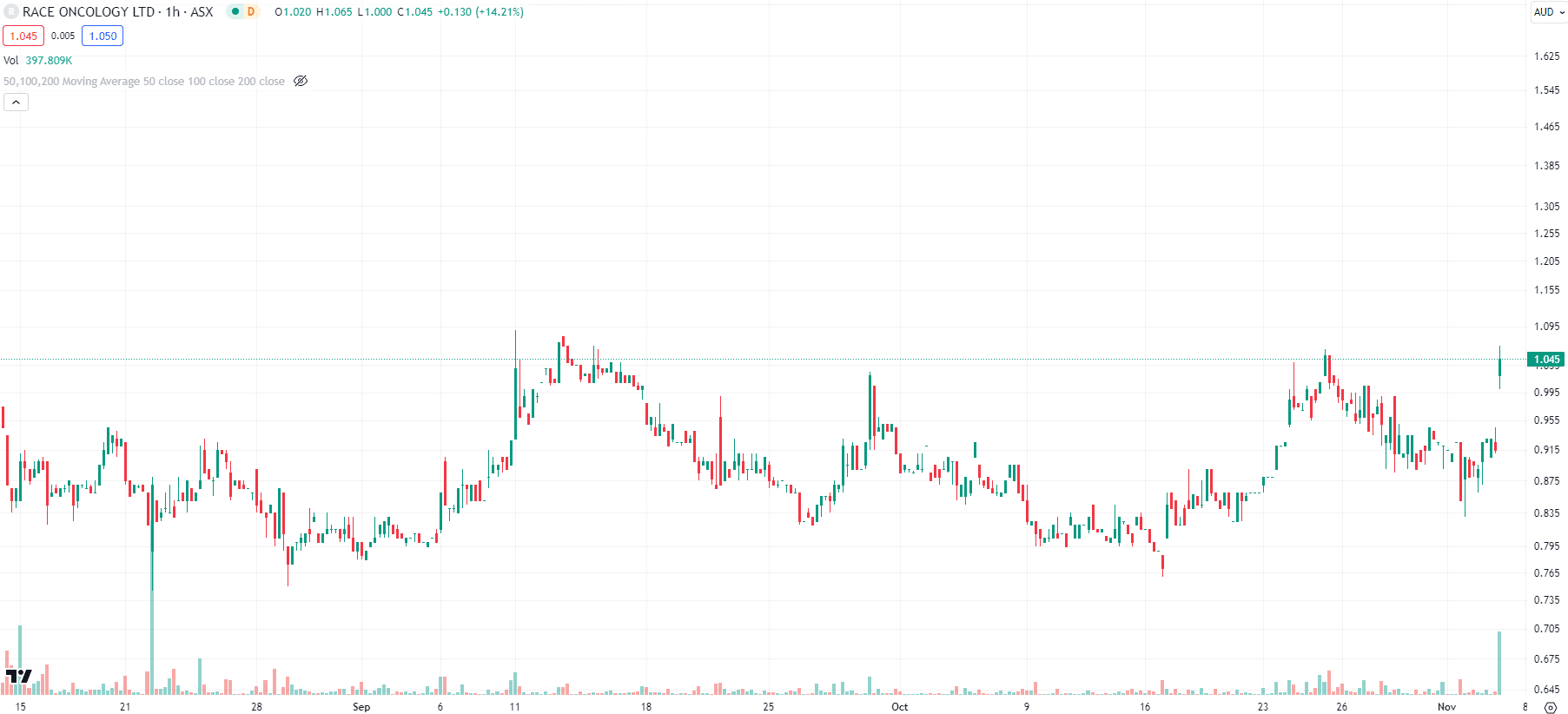

Race Oncology (ASX:RAC) share price chart, log scale (Source: TradingView)

Recap of Race Oncology (ASX:RAC)

This company is advancing an oncology drug called bisantrene through the clinic. Bisantrene is a was originally developed by American Cyanamid (Lederle Laboratories) in the 1970s & 1980s with the goal of creating a less cardiotoxic/toxic anthracycline-like chemotherapeutic.

Unfortunately, big pharma mergers meant it has not been developed, because the cancers it worked against were smaller markets, particularly AML. But, over the last decade, the company has picked it up and progressed it through the clinic.

This morning’s good news

A Phase 2 trial with bisantrene has been undertaken in Israel at the Sheba Medical Centre. Results were unveiled to the ASX this morning and will be presented at the prestigious American Society of Hematology Conference which will be held next month.

Bisantrene, in combination with fludarabine and clofarabine, administered over 4 days induced a cliical response in 6 of 15 evaluable patients (40%) with advanced relapsed or refractory AML, with 5 patients receiving a potentially curative stem cell transplant. Furthermore, bisantrene was found to be safe and well tolerated without clinically relevant cardiotoxicity or tumour lysis syndrome.

Keep in mind this was in patients that had very advanced cancer and had little other hope of survival. The primary endpoint was ‘any clinical response’. There were five patients that died before their response could be evaluated. Nonetheless, if bisantrene could work in patients at such an advanced stage, it could work for patients at an earlier stage.

The current trial is ongoing, although today’s news is good for shareholders.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

St George Mining (ASX:SGQ) 75% Resource Upgrade, Stock Down 15%, Why?

St George Mining Hits 70.9Mt, The Market Still Wants Confidence St George Mining announced a major resource upgrade at its…

Oil Supply Risk Rises After Iran Drone Attacks Reach Ras Tanura and UK Base in Cyprus

From Battlefield to Oil Chain, Drone Attacks Expand the Conflict Map A British military base at Akrotiri in Cyprus and…