Perpetual (ASX:PPT) rose over 10% despite rejecting a $3bn takeover offer

Perpetual (ASX:PPT) rose off the back of a takeover offer from a company sometimes considered Australia’s Berkshire Hathaway even though it was rejected. Washington H. Soul Pattinson (ASX:SOL) offered $3bn for Perpetual but this was dismissed as ‘materially undervaluing’ the company’s various businesses. Does the target company just want a better offer or is there more to it?

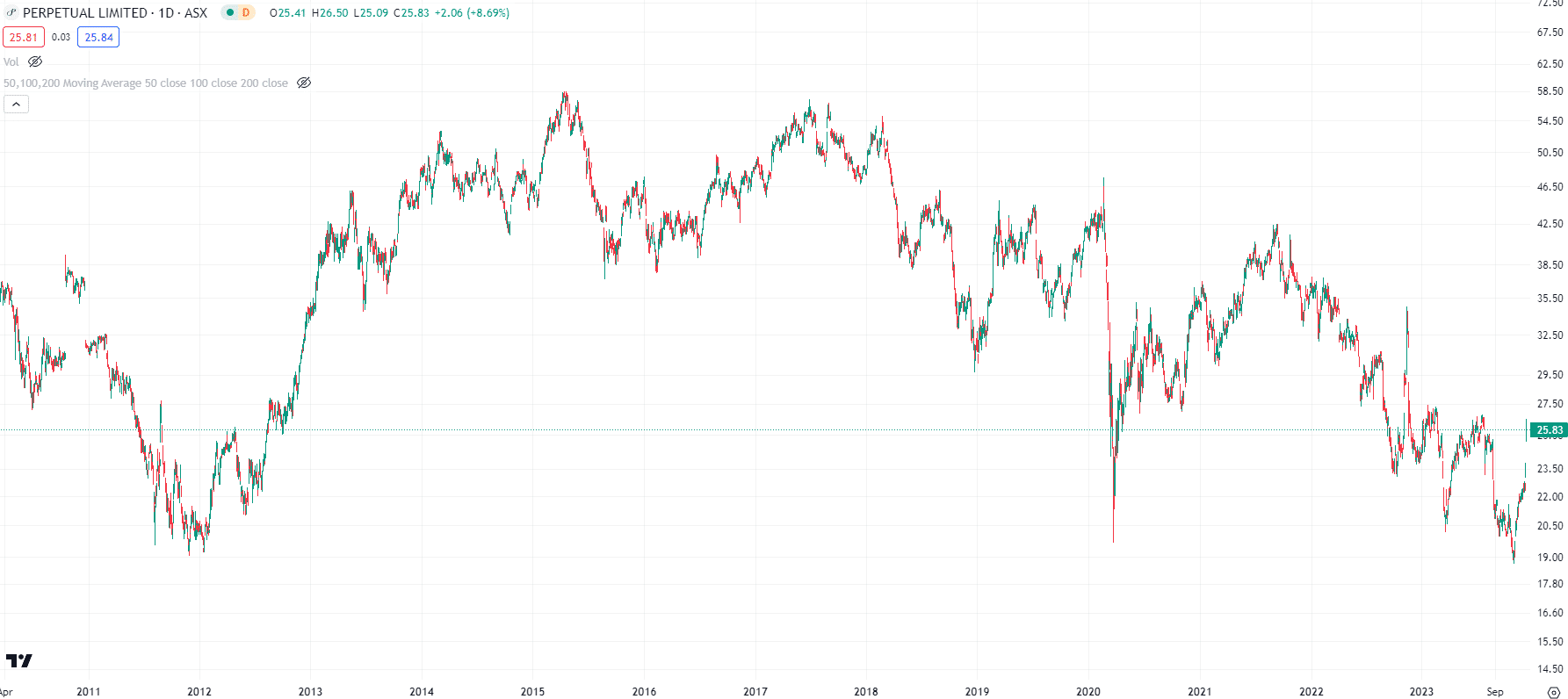

Perpetual (ASX:PPT) share price chart, log scale (Source: TradingView)

Putting the Perpetual bid into context

Perpetual shares are up 6% in the last year, but are down over 20% in 5 years. It has been a difficult time to be a money manager given the performance of various asset classes in the past couple of years. PPT has the added scrutiny of buying out rival Pendal for $2bn and not to see the return on investment, either from a share price or financial perspective.

Only hours before WSP’s takeover bid, the company told investors that it was exploring a demerger of its asset management unit from its wealth and corporate trust business.

The bid is rejected

WSP is a 9.9% investor in Perpetual and made a bid. The bid represented a 28.6% premium to the closing share price. In a letter to PPT’s investors, WSP said it understood the company as a long-term investor and that the bid would provide further diversification to its portfolio, not to mention provide value.

‘The Indicative Proposal demonstrates WSP’s ability to unlock value through a creative, flexible and long-term approach,’ it said.

Only a couple of hours later, the target company released its own statement rejected the bid. ‘Perpetual has three high-quality, unique businesses that have attracted market interest from time to time,’ it said. ‘As announced this morning, Perpetual believes there is merit to exploring the separation of Perpetual businesses as part of a strategic review. The Board remains focused on exploring options to maximise shareholder value’.

What now for shareholders?

If past precedent is any guide, it is anyone’s guess what happens from here.

WSP may come back with a higher bid, there may be a new bidder, or just the status quo. Who needs to pay for Netflix when you can just watch boardroom battles? However, we cannot help but spare a thought for those shareholders who would’ve accepted some sweet cash to get out of it all.

What are the Best ASX Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Electro Optic Systems (ASX:EOS) US$42m Slinger Order Lands as Defence Demand Heats Up

New Highs, New Contract, But Valuation Is Now the Debate Electro Optic Systems has pushed to new highs on the…

Immutep’s Phase 3 trial for Efti has gotten the chop and shares plunge >90%! What now for investors?

After nearly a week in suspense, Immutep (ASX:IMM) confirmed news about Efti that its investors did not want to hear,…