De Grey Mining (ASX:DEG): How it recorded astounding growth from a $50m explorer to a $2bn gold developer

De Grey Mining (ASX:DEG) is one of the best resources success stories in the last decade in the ASX resources sector. It has never looked back since the discovery of the Hemi deposit in WA that has over 10Moz and is set to be a top five Australian gold mine.

It is not the only success story during the last half-decade and has to some extent been in the shadows of battery metal discoveries like Chalice’s (ASX:CHN) Julimar deposit or Liontown’s (ASX:LTR) Kathleen Valley. But while both those projects now look less appealing amidst battery metals volatility, De Grey has taken few steps back – if any.

Introduction to De Grey Mining (ASX:DEG) and its project

De Grey Mining has the Hemi Gold Project in WA, that is 85km by road from Port Headland. It was discovered less than four years ago and has still had limited exploration considering it is part of a 150km-long provincial scale tenement package, but it has delivered for shareholders.

Since successful drilling in early 2020, the company has never looked back, constantly growing its resource and delivering study after study showing this could be a fairdinkum gold mine. In fact, one of Australia’s to p5 based on production. The Ore Reserve is 6.0Moz @ 1.5g/t gold and could produce 5.7Moz over 12 years, equating to over 500,000 ounces per annum.

It would deliver $4.5bn in free cash flow after tax, a payback of less than 2 years despite a capital cost of nearly $1.3bn. And it is set to begin production in the second half of CY26. Chalice will have barely made an Final Investment Decision (FID) by then.

The DFS showed an NPV of $2.9bn post-tax, representing an IRR of 36% at an AISC of $1,295/oz over the first 10 years. The total evaluation period economic contribution is a staggering $10.8bn. Construction has not yet begun, although all necessary approvals are expected in time to start full construction in the second half of this year.

Good to be in gold

Gold is a good commodity to prospect for. It is the pre-eminent symbol of wealth and prosperity throughout history and (usually) an inflation-hedge. Although it has not grown as solidly as battery metals, the lack of volatility has meant gold has fared better in 2023 than many battery metals and stocks that mine or prospect for them.

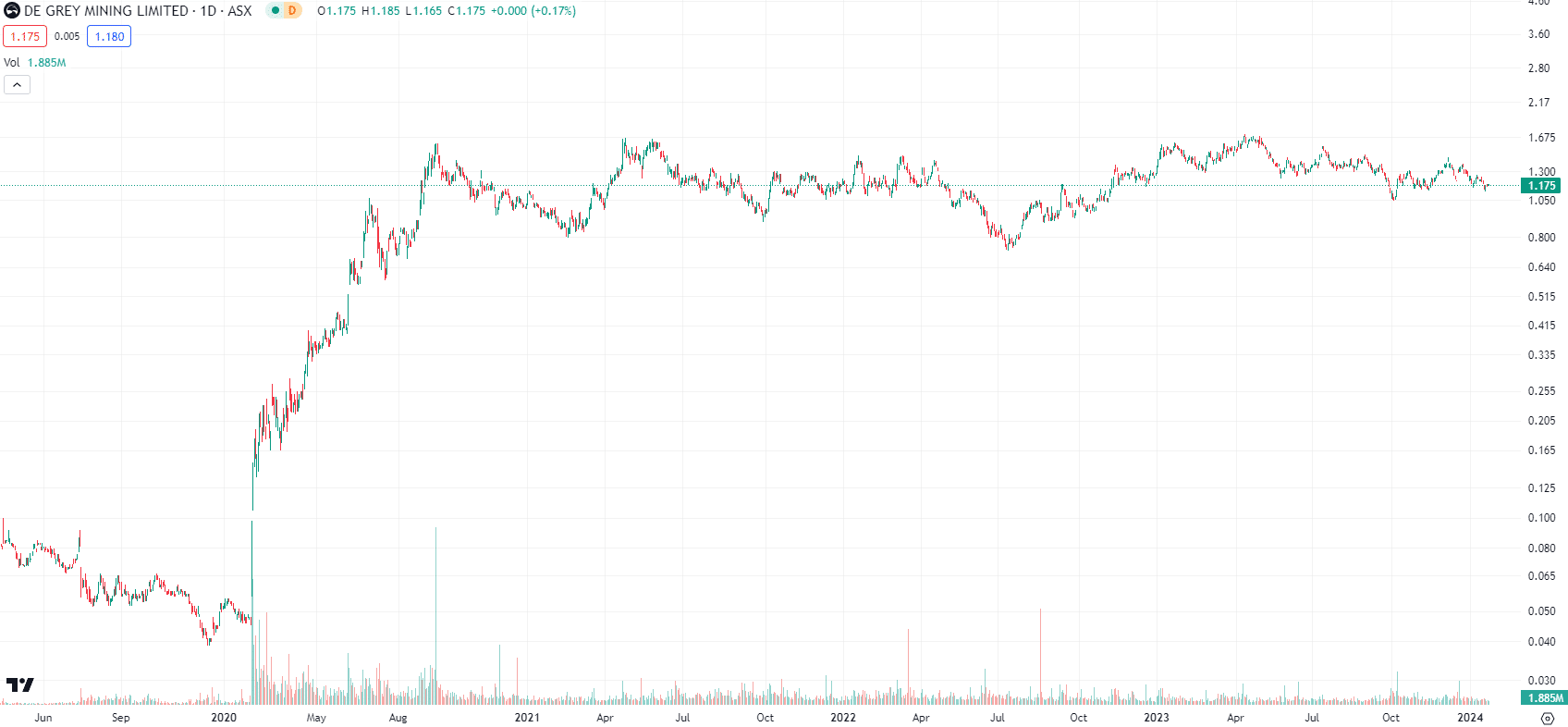

Things have gotten so bad that Liontown had a promised funding package withdrawn for that reason alone and has to scale down its project to ensure it can meet the production deadline it set itself with its current cash reserves. De Grey has had none of these problems. Given all of the above, it has re-rated from a market cap of ~$50m five years ago to over $2bn now. The share price doesn’t suggest the same growth, although this is due to the capital raisings the company has undertaken in this time. Although of course, it could’ve been a lot worse.

De Grey Mining (ASX:DEG) share price chart, log scale (Source: TradingView)

So what’s next?

Obviously, the big step is becoming a fully-fledged gold producer, and this is expected in the second half of CY26. Consensus estimates suggest gold sales of over $1bn in the first year, drawn from 9 analysts. The mean target price is $1.72, suggesting further upside of over 40%. It is trading at just 7.2x P/E for FY27 – a very low multiple in and of itself, although it is not as if it is the multiple for the current year.

De Grey does have a chance of capturing upside sooner. It is continuing exploration work at Hemi as it has all along. Since the maiden resource in 2019, it has grown by 1.5Moz at a cost of less than $10/oz. Ongoing drilling work has continued to uncover more gold at the project.

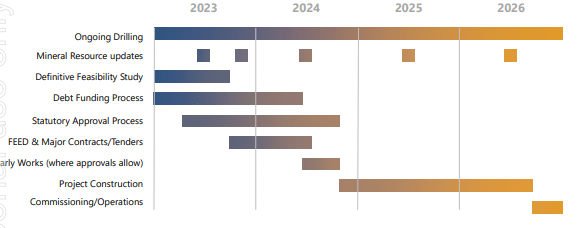

Behind the scenes, hard work is being done to ensure that the project remains on track including securing financing (which it intends to take on $800m of debt), ordering long lead items, advancing major project tenders and conducting detailed engineering and design to a high confidence level before project approvals and the FID (expected during CY24).

Source: Company

Our view

We think there is further room to re-rate as the company edges closer to production and gold proves popular. We think it could be worth over $6bn based on our own models. At the current number of shares on issue, this would be $4.35 per share, although we think it will be closer to $3 per share post-dilution (assuming it raises the balance between the $800m it will secure in debt financing and the $1.35bn or so it needs for construction capex and raises at a share price similar to the current price). We followed all the DFS assumptions, including the same discount rate, production assumptions, gold prices, forex rates and company margins. This suggests there is further value to be created.

There are some risks with this one including the risks that:

- Gold prices fall like battery metal prices have,

- Securing project financing proves more difficult than anticipated,

- The company runs into project delays for whatever reason (whether engineering, supply chain issues or something else)

Ultimately, when you look at this company, there’s little not to like and investors have a great opportunity before them.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

AML3D (ASX:AL3): Order Book at $16.5m, The Growth Runway Stays Intact

A $150m to $200m Navy Opportunity, But Execution Comes First AML3D has reported its interim half-year results, and while revenue…

Capital Allocation in a Fragmented World, Where Smart Money Is Quietly Moving

Global markets in 2026 feel more fragmented than ever. Inflation has moderated in some regions yet remains sticky in others.…

Nvidia (NASDAQ:NVDA) New Rubin Chip Is Here, A 25% Higher Price, A 10x Better Outcome

Rubin Is Here, The Real Story Is Cost per Token Nvidia has now unveiled its new Vera Rubin chips, and…