Should I buy Qantas shares in 2024?

![]() Marc Kennis, March 6, 2024

Marc Kennis, March 6, 2024

In this article, we’ll look to answer the question: Should I buy Qantas shares?

Qantas (ASX:QAN) has recorded significant windfall from the post-COVID travel recovery and demand remains strong. However, it has not gone through the period unscathed, with reputational issues resulting in Alan Joyce departing after 15 years. Investors have the promise of profitable non-stop A350 flights direct from Australia to London and New York in less than 3 years, and a newly refreshed domestic fleet within a decade. But can it deliver this while maintaining profits in the short term?

Qantas has had some turbulence

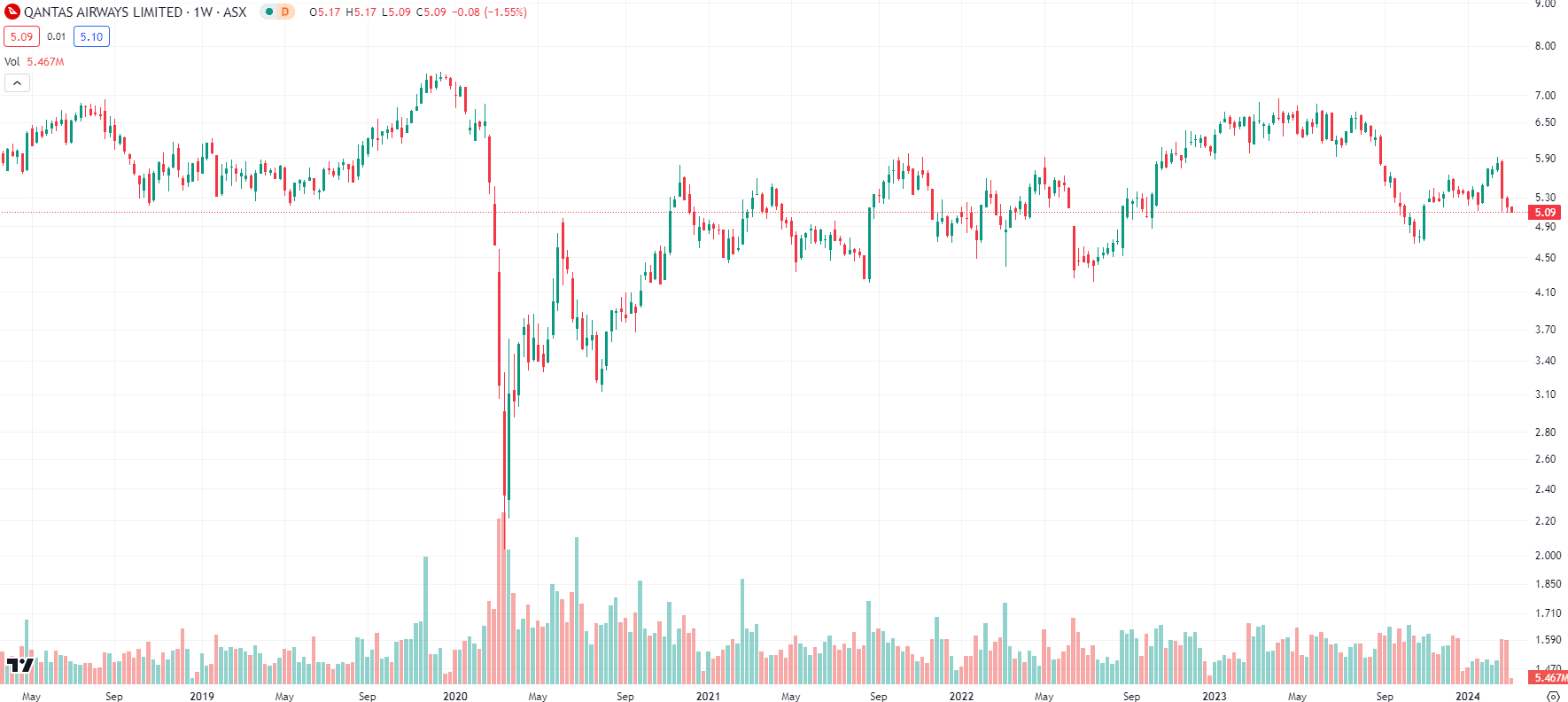

We all know why Qantas’ share price dipped in 2020…it must not be named. OK, but why hasn’t it recovered all the way then travel almost has? Why has it actually lost ground in the past year?!

Qantas share price chart, log scale (Source: TradingView)

Well, the company has weathered its fair share of turbulence over the past 6 months in facing a PR nightmare on multiple fronts. There was the supposed questionable treatment of both staff and customers.

Then there was the Albanese government’s decision to block additional Qatar Airways flights in Australia, which then CEO Alan Joyce came out in support of claiming doing otherwise would “distort the market”. This amongst other things caused investors to flee, with the airline’s share price dropping below $5 AUD in November 2023. There were also of course global macroeconomic phenomena not specific to Qantas including the supply bottlenecks and fuel price hikes brought about by Russia’s invasion of Ukraine.

Still not at pre-Covid levels

In terms of other global factors, although travel constraints have eased up since the convalescence of COVID-19, demand for flights hasn’t bounced back to pre-COVID-19 levels as a result of high interest rates/sustained inflationary pressures/cost-of-living.

It’s getting there though. International passenger traffic in November 2023 was 3.112 million, getting closer to the 3.4 million figure recorded in November 2019 just before the onset of the pandemic.

The elephant in the room

More recently, a tremendous deal of downward pressure was placed on Qantas stock after new CEO Vanessa Hudson announced a plan to increase the airline’s capital expenditure (CapEx) bill to drive investment in a newer and larger fleet. The bill was big enough as it was. This had a number of investors turn their heads on the stock after the increase in spending became conducive to a 13 percent reduction in profit for the first half of FY24. Granted, it was still over $1bn.

We happen to be in agreement with Hudson in her view that only short-term investors will be scared off by the company’s decision and that long-term investors understand the need for increased capital expenditure to drive future earnings growth.

After all, the new planes Qantas plans to invest in will almost certainly pay for themselves in the long-run. The 11 new airbus A321neos operating under subsidiary Jetstar boosted earnings by $20 million in the first half of FY 24. Not surprising given the A321 is a far more economical model than the A320, burning 20 percent less fuel per seat.

Anyhow, in our view, none of the factors just outlined will continue to hold anywhere near as much weight in determining the Qantas stock price as much as the lack of competition within the aviation sector.

It is all about competition

Competition within any industry plays a huge part in determining investor sentiment and it is particularly so in the airline sector. As Milford Asset Management’s Jason Kururangi said, the one thing that mainly concerns investors at the moment pertaining to Qantas is the potential return of competition, especially for routes to and from the United States.

The Australian Competition & Consumer Commission (ACCC) has long characterised the Australian domestic airline industry as a duopoly given that 9 in 10 domestic passengers on regular scheduled flights have either flown with Qantas or Virgin since 2002 when Ansett Australia ceased operations. In fact, since Ansett shut up shop, the sector has been Australia’s most concentrated by a considerable margin. As such, barriers to entry are high and cost-based competition doesn’t last long as it is typically conducive to significant financial losses.

In the early 2010s for example, low-cost carrier Virgin Blue launched a vigorous price war with Qantas that served consumers well for a number of years with commercial capacity improving and airfares suppressed. It fizzled out after about 7 years though with both airlines’ balance sheets taking huge hits.

Our point being that healthy price-driven competition and good old market economics isn’t particularly sustainable in the Australian airline industry, especially because of the slim margins maintained by high operating costs. Now of course, this isn’t particularly good news for you, but it is tremendous news for Qantas given that the company’s large respective slice of market share doesn’t seem to be particularly transient.

Australia needs more competition in the air

Putting aside the fact that The Albanese Government’s decision in 2023 to block Qatar Airways’ application to run additional routes to and from Australia may be testament to the fact that Qantas is protected by government, whether deliberately or non-deliberately, it is extraordinarily difficult for smaller airlines to steal market share from the more established players.

According to an ACCC report published in June 2023, more effective and meaningful competition in the future will rely entirely on the ability for regional carrier Rex and low-cost carrier Bonza to make SIGNIFICANT strides to steal greater chunks of the market. As you may have guessed, this isn’t a particularly easy feat when you break down the current figures.

Bonza currently covers 27 routes with a fleet size of 6 planes whilst Rex carries a fleet size of 67 planes flying to 60 destinations. Qantas on the other hand carries a fleet size of 337 aircraft that fly to 65 destinations. Our other market leader Virgin Australia and its subsidiary Jetstar on the other hand boast a combined fleet size of 195 aircraft. So yes, best of luck to Bonza and Rex.

The system is rigged in favour of domestic airlines

There’s also the reality of concrete legislation in place that continues to stifle competition in the industry. For example, Australia formally prevents foreign airlines from picking up domestic passengers on a domestic leg of an international flight in a type of restriction known as cabotage.

The Productivity Commission inquiry into airport regulation also found that some contracts between airports and airlines contained provisions preventing the airport from offering lower charges or other incentives to a rival airline.

Australia’s major airports share a common interest with its major airlines in maintaining high prices and airfares to increase revenues, hence why they might price discriminate and offer contracts to airlines with the highest airfares.

The other big elephant in the room

…is the Qantas loyalty program. It delivered hundreds of millions of dollars in profit even during the pandemic shutdowns. For the most part, a significant proportion of people feel sentimental loyalty to Qantas being our national carrier. In other aviation markets like North America and Europe, there’s none of this – airlines are viewed in the same ilk as telcos.

Just look at annual Double Status Credit offers to see how engaged people are with the whole Frequent Flyer program – the company revealed one person in the 2023 offer booked 66 flights during that week alone.

Few other business can boast sentimental loyalty in the way that Qantas can.

So, should I buy Qantas shares?

What does all this spell? That an extremely low magnitude of competition within Australia’s airline industry is going nowhere. This is why we don’t believe that investors in Qantas have anything to worry about other than the odd scandal or PR upset.

Qantas’ high concentration of market share within the Australian aviation sector is far too deeply entrenched for their share price to take a serious hit anytime soon.

And so to answer the question, we think growth investors should buy Qantas shares. Income investors probably shouldn’t, given the company has not resumed paying dividends – preferring share buybacks.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Amazon (NASDAQ:AMZN) Down 9%, Is Capex Becoming the Story?

14% Sales Growth, 128B Spend, Now What? Amazon has fallen about 9%. While we are holders of the stock, when…

The proposed Rio Tinto Glencore merger failed, here’s why and what it means for the companies!

The proposed Rio Tinto Glencore merger is off. The deal would have created the world’s biggest mining company, capped at…

Tech and AI Stocks Sell Off, This Reckoning Was Always Coming

The Tech and AI Valuation Reality Check When it comes to stock prices, they usually rise when fundamentals and earnings…