Should you buy Rio Tinto shares? Here’s why investors should tread with caution

![]() Marc Kennis, March 20, 2024

Marc Kennis, March 20, 2024

Should you buy Rio Tinto shares? This is one of the most asked questions by investors, given how prominent a company it is. It is only behind CBA (ASX:CBA) and BHP (ASX:BHP), sitting at a market capitalisation of ~$160bn as of mid-March 2024.

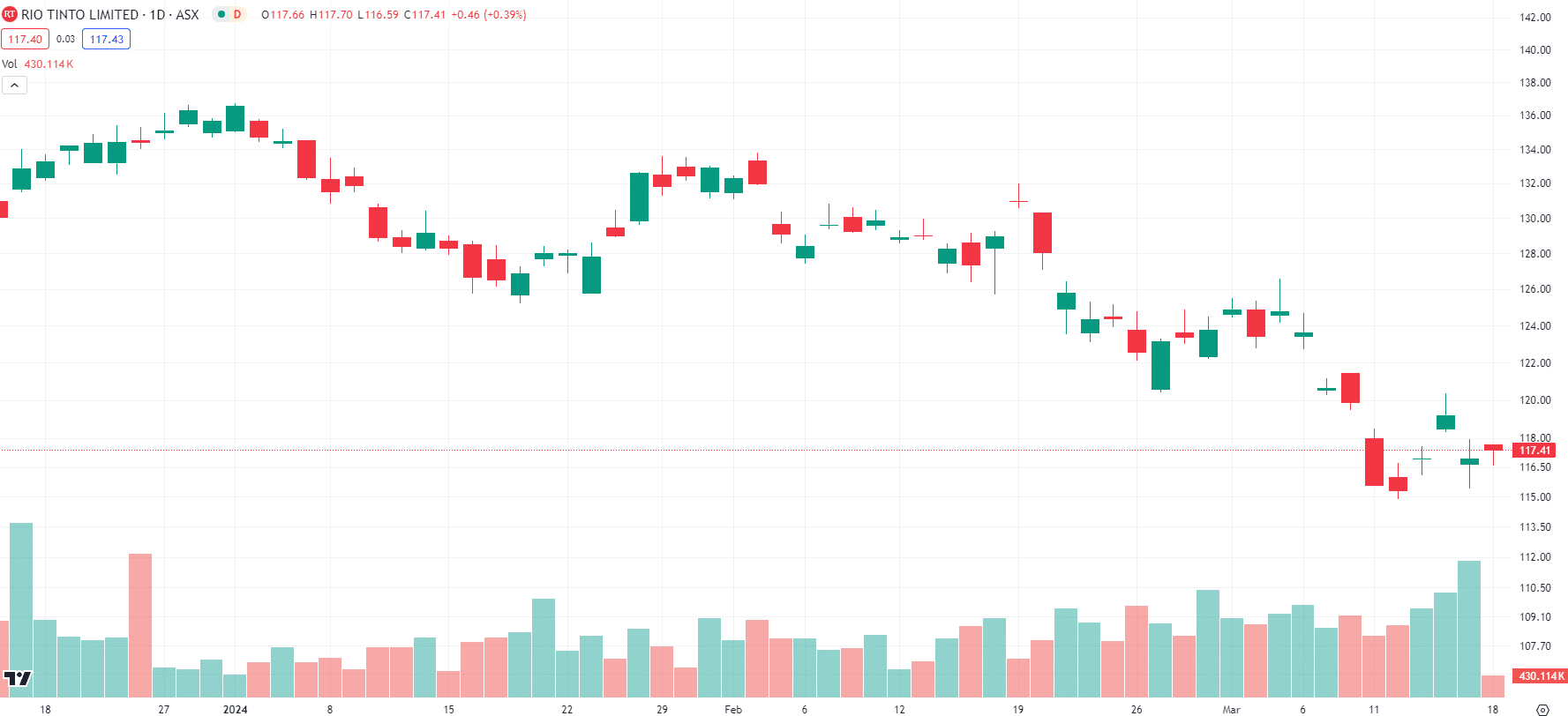

The first few months of 2024 have been tough for Rio Tinto (ASX:RIO). The preeminent miner has seen its ASX price tumble to $116.95 AUD, down over 12% from where it sat just before the new year. The company’s prices at its LSE and NYSE listings have experienced very similar trends.

Rio Tinto (ASX:RIO) share price chart, log scale (Source: TradingView)

So, what’s going wrong with Rio Tinto?

It is a simple problem – iron ore prices. Yes this is not an issue unique to Rio Tinto given its contemporaries in mining and natural resources are all sailing through pretty harsh headwinds as a result of sharp global downturn in iron ore prices. Glencore, BHP, Rio Tinto and Fortescue have all seen their share prices slump around 15-20%. It is an issue facing the company nonetheless.

Why has the price of iron ore gone down?

The price of iron ore has taken such a large hit because of how intertwined it is with the Chinese economy, the state of which as of late is looking particularly dreary because of a crisis in the nation’s real estate sector. To be even more precise, the price of iron ore isn’t just interlinked with the Chinese economy but is strongly correlated with demand deriving from both the nation’s construction and property industries.

Iron ore’s biggest application by far is steelmaking. It is smelted with metallurgical coal to make steel which is then overwhelmingly used to construct new homes and apartments, of which many were needed in China as the country started to rapidly urbanise and its economy began to boom. Over the past 5 years, however, the middle-income trap has caught up with China. Its swift development is starting to erode its competitive advantage in manufacturing because of higher wages but it isn’t yet developed enough to proficiently compete with advanced nations as a service-oriented economy.

The China crisis

What has manifested from such a predicament is a real estate crisis permeating far and wide across the nation, with property developer Evergrande recently ordered into liquidation and its industry competitor Country Garden looking likely to follow suit. Not to name names, but many analysts initially predicted China’s economic slump to be transient. They said the government would have to make concessions by bailing out the large developers and pump prime the economy to keep it on two feet. What has been borne out in reality has been quite the contrary.

The value of new home sales among the 100 biggest real estate companies are now down 34.6% year-on-year whilst iron ore stockpiles at Chinese ports are at their highest levels in a year. The Chinese Communist Party (CCP) led by an ideologically obstinate Xi Jinping continues to reiterate its stance that homes are for residents to live in and not for speculation. No major fiscal stimulus has arrived and the government is doing what the American government didn’t do during the GFC, it is letting companies fail.

As a result, the Hang Seng Index — the most accurate and widely-recognised barometer for the performance of the Chinese economy — continues to falter.

So, what does this all mean for Rio?

Well, despite being a natural resources industry leader, Rio Tinto isn’t as diversified as it could be. Its portfolio mainly comprises a handful of commodities like iron ore, copper and aluminium. The major warning signs are the fact that its largest revenue-generating region is China and of that the greatest share of which comes from its iron ore segment.

You can compare this with rival mining giant Glencore to understand how much Rio is lacking on this front. Like Rio, Glencore’s geographical reach extends across over 35 countries but deals with over 60 commodities. To its credit through, Rio has been making efforts to diversify the composition of its portfolio to encapsulate opportunities involved with the rapidly changing nature of the 21st Century.

Rio is diversifying!

Just last month, it signed Australia’s biggest renewable energy deal to buy 80% of green asset manager Windlab’s 1.4GW Bungaban wind energy project over the next 25 years. The purchase is part of an overarching plan to repower its Gladstone aluminium smelters and refineries with renewables.

What’s more promising with Rio’s latest developments was last year’s acquisition of the Platina Scandium Project in New South Wales, as part of its strategic goal to rapidly scale up production of rare earth metals and critical minerals as part of its export portfolio.

More green projects

Rio’s executives have also continuously pledged their support for the energy transition, currently exploring for 8 new commodities in 18 of the countries they operate in. However, it’s important to note that whilst these projects sound great, it’s unlikely that Rio will be able to diversify its portfolio as such as to effectively hedge against economic turbulence by crowding out its dependence on the price of iron ore in a narrow time frame.

It’s fair to class these initiatives as long-term prospects. Yes, you can have more trust that Rio Tinto can easily pivot, given its track record and capital position, but it will still take some time (and capital) to see these initiatives become major money makers.

Although the miner proclaims its portfolio to be a diverse one, it also admits that its iron ore products comprise 65% of its portfolio. Talk about putting your eggs in one basket. So, yes, to conclude, iron ore accounts for the majority of Rio Tinto’s revenue, most of which is overwhelmingly being shipped to China, a nation incurring serious economic structural fractures.

So should you buy Rio Tinto shares?

That’s a decision for investors to make for themselves, but for our part, we’d tread lightly on this one. Caveat Emptor.

What are the Best ASX stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Donald Trump Trade Fears Fade, Stocks Jump, Gold Hits Record Highs

Tariff Drama, NATO Talks and a Market Reset in One Volatile Week Markets entered the week on edge after renewed…

Amaero (ASX:3DA) Where US Reshoring Meets High-Value Metal Powders

Critical Metals, Defence Demand and a US-Focused Growth Story For investors looking to uncover opportunities in structurally growing sectors, the…

How Australians Are Using Crypto Beyond Investment

For most Australians, cryptocurrency entered the mainstream through investing. Bitcoin and Ethereum were framed as speculative assets, discussed in the…