What is Options Trading, and How Does It Work?

What is Options and Options trading?

Options trading is a pivotal aspect of the financial markets, allowing investors and traders to hedge against risks or speculate on future market movements without directly purchasing the underlying assets. An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specific date. The buyer pays a premium for this right, which can be lost if the option is not exercised, making options a form of leveraged investment that can offer high returns or lead to significant losses.

The concept of options has been around for centuries, but the modern form of options trading began in 1973 with the establishment of the Chicago Board Options Exchange (CBOE). This marked the start of regulated options trading with standardized contracts, paving the way for the rapid growth of options markets globally.

The Australian Stock Exchange (ASX), for example, introduced Exchange Traded Options (ETOs) in 1976, which have grown to include a variety of asset classes and now serve as a fundamental component of the trading strategies of investors and financial institutions worldwide.

Understanding Key Option Types

Call Options

A call option gives the holder the right to buy the underlying asset at a strike price within a certain period. The value of a call option increases as the market price of the asset rises above the strike price, making it a popular choice for traders who anticipate market gains. For instance, if a trader buys a call option on Company X’s stock at a strike price of $100, and the share price rises significantly above $100, the trader can purchase the stock at the lower strike price, potentially earning a substantial profit.

Put Options

Conversely, a put option provides the holder with the right to sell the underlying asset at the strike price. This type of option is valuable in bearish scenarios, where the price of the underlying asset is expected to fall. For example, if a trader anticipates a decrease in Company X’s stock price below $100, purchasing a put option allows them to sell the stock at the higher strike price, even if the market value drops far below.

The choice between a call and a put option depends on the trader’s expectation of future price movements. If they expect the stock to rise, a call option is suitable, while a put option is appropriate if a decline in the stock price is anticipated. Both types of options are crucial for risk management and investment strategies, allowing traders to gain exposure to price movements without the full cost of owning the actual asset.

Fundamental Advantages of Options Trading

Risk Management Through Options

Options provide a significant advantage in terms of risk management. Traders can use options to protect against losses in their investment portfolios through strategies such as protective puts, where buying put options helps secure the downside risk of a stock holding. For example, if you own shares of a company and worry about a potential decline in stock value, purchasing put options can ensure you can sell your shares at the strike price, regardless of how low the market price may fall.

Speculation and Leveraging Opportunities

Options allow for high degrees of leverage, meaning traders can achieve large exposures for a relatively small initial outlay (the premium paid). This potentially unlimited gain makes options an attractive tool for speculation. For instance, by purchasing call options, a trader can benefit from the potential rise in the share price without having to invest the full amount required to buy the shares outright.

Income Generation

Options can also be used to generate income through strategies such as covered call writing, where a stock owner sells call options against their stock holdings. This strategy provides extra income from the premiums received, which can be especially attractive in flat or slowly appreciating markets. Additionally, options allow investors to diversify their portfolios by introducing different types of assets and positions that can hedge against various market conditions.

Option Features

The underlying asset of an option can be individual stocks, index options, or other financial market instruments. Exchange Traded Options (ETOs), for instance, are commonly based on stock indices like the S&P ASX 200 or individual stocks. Understanding the characteristics of the underlying is crucial as it affects the options pricing and strategic approach.

Contract Size and Expiry Dates

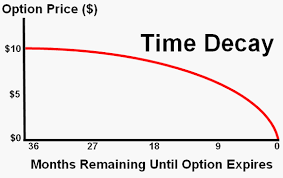

Options contracts specify a particular size — typically, one contract represents 100 shares of the underlying asset. The expiry date is also a critical feature, determining the timeframe in which the option can be exercised. This data is crucial for planning the trading strategy, as the time value of the option declines as the expiry date approaches, a phenomenon known as time decay.

Impact of Exercise Prices

The exercise price, or strike price, is the price at which the underlying asset can be bought or sold when the option is exercised. This price is central to an option’s value; options are described as “in the money” if exercising them would be profitable, “at the money” if the exercise price equals the current market price of the asset, and “out of the money” if they would not be profitable to exercise. The choice of exercise price plays a pivotal role in the options trading strategy and affects both the risk and return of an options position.

Premium in Options

The premium is the price paid by the buyer to the seller (or writer) of the option. It is determined by several factors, including the underlying asset’s market volatility, the time until expiration, and the distance between the market price and the exercise price. The premium represents the income received by the seller, and the potential loss for buyers if the option is not exercised.

Option Pricing Fundamentals

Option pricing is driven by two main components: intrinsic value and time value. The intrinsic value of an option is the difference between the underlying asset’s current market price and the option’s strike price, applicable only when the option is “in the money.” For example, if a call option has a strike price of $50 and the underlying share is trading at $55, the intrinsic value is $5.

The time value, on the other hand, represents the additional amount that traders are willing to pay based on the probability that the market price of the underlying will increase (for a call) or decrease (for a put) before the option expires. The time value decreases as the expiry date approaches, which is known as time decay.

Factors Influencing Option Pricing (Volatility, Time Decay)

Several factors affect an option’s premium beyond just the intrinsic value and time value:

- Volatility: Higher market volatility increases the premium because there is a greater chance that the option will end up in the money.

- Time Decay: As mentioned, options lose value as they approach their expiration date.

- Interest Rates: Changes in interest rates can affect the cost of carrying a position and thus influence option pricing.

- Dividend Payments: Expected dividends on the underlying shares can also affect call and put premiums, as options do not entitle the holder to receive dividends.

Examples of Pricing for Call and Put Options

Consider a scenario where Company XYZ is trading at $100, and a call option with a strike price of $100 and an expiry in three months might sell for a premium of $10. The intrinsic value might be zero (since the strike price and the share price are equal), and the entire premium consists of time value expecting the share price rise.

Role of Parties in Option Contracts

In the options market, there are two main roles:

- Option Takers (Buyers): Higher market volatility They have the right, but not the obligation to buy or sell the underlying asset. They pay the premium and will profit if the market moves in their favour.

- Option Writers (Sellers): They receive the premium and must fulfil the contract if the option is exercised against them. They profit if the option expires worthless but face potentially unlimited losses.

The taker’s main responsibility is to decide whether to exercise the option, let it expire, or close the position before expiry. The writer, however, must ensure they can meet the obligations to provide or purchase the underlying asset if the option is exercised, which might involve significant risk management strategies.

For example, if an option writer sells a call option for a premium of $5 and the market stays flat or falls, they keep the premium as profit. However, if the market surges and the underlying stock price exceeds the exercise price significantly, the writer could face large losses as they might have to buy the stock at the higher market price to sell it at the lower strike price to the option holder.

Practical Aspects of Trading Options

Options traders have access to numerous platforms to track their options investments, ranging from brokerage websites to specialized software tools. These platforms allow traders to monitor current market prices, volatility levels, and expiration dates, providing essential data to make informed trading decisions. For example, an options trading account might include real-time updates and analytics to help traders understand how market movements affect their positions.

Margin requirements are crucial for options traders, especially for those writing options, as they must provide collateral to cover potential losses. Margins ensure that the writer has enough capital to fulfil the obligations if the market moves against them. Traders must understand how margins are calculated, which typically involves the volatility of the underlying asset and other market factors, and ensure they have sufficient funds to maintain their positions, avoiding margin calls that could force them to liquidate positions unexpectedly.

Trading options also involve various costs, including premiums paid for buying options, commissions, and other fees charged by brokers and exchanges. Additionally, there are potential costs related to margin interest if traders use borrowed funds to finance their options purchases. Understanding these costs is vital for calculating potential returns and managing a profitable options trading strategy.

Risks and Taxation in Options Trading

Options trading carries unique risks. Since options can expire worthless, buyers risk losing their entire investment (the premium paid) if the option does not become profitable. For writers, the risks can be even greater, including potentially unlimited losses if the market moves significantly against the position. Market volatility can also exacerbate these risks, making effective risk management strategies imperative for anyone involved in options trading.

Options trading also has complex tax implications, which can affect the profitability of trading strategies. In some jurisdictions, gains from options trading may be treated as capital gains or business income, affecting tax rates and reporting requirements. Traders must keep detailed records of all transactions to accurately report gains or losses and understand how options contracts are taxed in their respective countries.

Conclusion

The benefits of options are numerous, including leverage, which allows for significant potential returns from relatively small initial investments. However, the risks are equally notable. The complexity and inherent leverage of options can result in substantial losses, especially for unwary or inexperienced traders. Understanding these risks is crucial for anyone looking to incorporate options into their trading portfolio.

Incorporating options into a diversified portfolio should be done with careful consideration of the market volatility, expiry dates of options, and the financial markets‘ overall condition. Investors should also be aware of the tax implications and ensure that any options strategy aligns with their overall investment goals and risk management framework.

FAQs

What is a trade options account, and how does it differ from a share trading account?

A trade options account is designed for options trading, where investors can buy and sell options contracts. In contrast, a share trading account is primarily for trading stocks. Options provide the right to buy or sell shares at a set price before a specific date, whereas shares involve actual ownership in a company.

What factors should be considered in options trading assessment?

An options trading assessment should consider multiple factors including the underlying security, market volatility, and the trader’s target market determination. Understanding the risks involved and the potential for limited risk or significant loss is crucial. The assessment ensures that the chosen options strategies align with market conditions and investment goals.

What are the key components of an options contract?

An options contract involves several key components: the underlying security, the option’s expiry date, the set price, and whether it is a call or put option. Additionally, factors like option prices and the closing price of the underlying asset play a significant role in determining the value and profitability of the contract. share trading platform, same stock, option contract, start trading, market makers, trading level, complex strategies, trade shares, stock options

How do European-style options differ from American-style options?

European-style options can only be exercised on the option’s expiry date, offering no flexibility for early exercise. They are often cash-settled, unlike American-style options, which can be exercised at any time before expiry. This feature typically reduces the risk involved in European-style options due to the absence of early exercise risk.

What are the advantages and risks of selling options in volatile markets?

Selling options in volatile markets can provide premium income and take advantage of high option prices. However, the risks involved include potentially unlimited losses if the market moves significantly against the position. Understanding these dynamics is crucial for managing options trading strategies effectively.

How do I start trading stock options on a share trading platform?

To start trading stock options, first open an options account on a share trading platform. Ensure the platform supports options contracts and offers tools for executing trades. Begin by selecting the same stock you want to trade and familiarize yourself with trading levels and complex strategies offered by the platform. Understanding the role of market makers in providing liquidity is also essential.

What role do market makers play in options contracts, and how does it affect trading levels?

Market makers provide liquidity by offering to buy and sell options contracts at quoted prices. Their presence ensures smoother transactions and tighter bid-ask spreads, which is crucial for executing complex strategies effectively. They help maintain consistent trading levels, making it easier for investors to trade shares and stock options without significant price discrepancies.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…