What is Discounted Cash Flow (DCF)? Formula and Examples

What is Discounted Cash Flow?

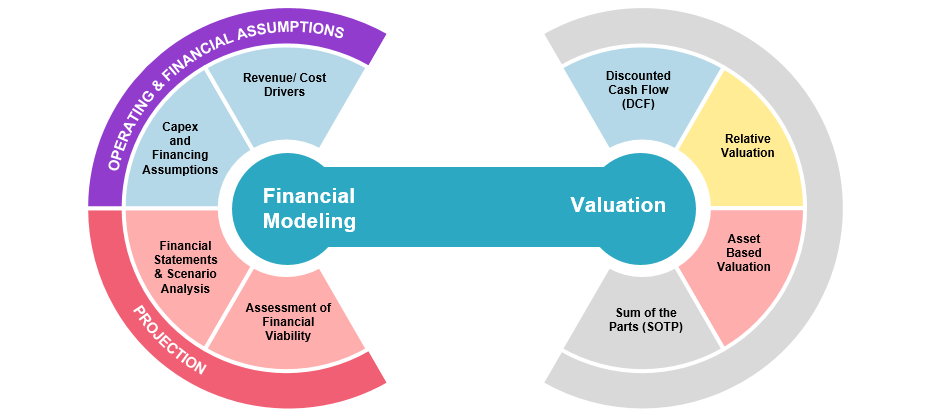

Discounted Cash Flow (DCF) is a valuation method used extensively in finance to determine the present value of expected future cash flows. The core principle of DCF is that a dollar today is worth more than a dollar tomorrow due to the time value of money—this underpins the utility of DCF in evaluating investments by discounting future cash flows to present terms. Essentially, DCF assesses the attractiveness of an investment opportunity by considering the future cash flow the investment will generate and converting it into a single present value using a discount rate.

Purpose of DCF

The purpose of DCF is multifaceted. Primarily, it’s used to estimate the intrinsic value of an investment, be it real estate, a business, or financial securities. By calculating the present value of expected future cash flows, investors can make more informed decisions about the worth of various investment opportunities. It helps answer the critical question: “What is the current worth of cash that I am expected to receive in the future?” This methodology is vital for comparing the profitability of projects that may have different cash flows and timelines.

By setting a strong foundation on what DCF is and why it’s used, investors can gain insights into both the potential returns and the risks associated with future cash flows. This approach is integral in corporate finance, equity valuation, and financial modelling to guide decisions that require an understanding of future performance to justify current investment outlays.

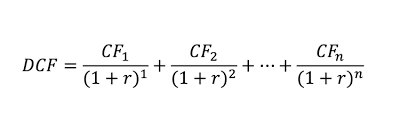

The Discounted Cash Flow Formula

The Discounted Cash Flow (DCF) formula is essential for conducting thorough financial analysis. It comprises several key elements:

- Cash Flows (CF): These are the net amounts of cash that are expected to be received or paid out over the investment period.

- Discount Rate (r): This rate is used to translate future cash flows into present values and reflects the investment’s risk and the cost of capital. Commonly, the weighted average cost of capital (WACC) is used as the discount rate in corporate finance.

- Calculation Period (n): This is the duration over which the cash flows are projected and discounted.

The basic DCF formula looks like this:

To illustrate, consider a project with an initial investment of $100,000 and expected cash inflows of $30,000 annually over the next five years. Assuming a discount rate of 10%, the DCF can be calculated as follows:

- Year 1: $30,000/(1+0.10)^1 = $27,273

- Year 2: $30,000/(1+0.10)^2 = $24,793

- Year 3: $30,000/(1+0.10)^3 = $22,539

- Year 4: $30,000/(1+0.10)^4 = $20,490

- Year 5: $30,000/(1+0.10)^5 = $18,628

Adding these discounted values gives the total present value of future cash inflows: $113,723. Subtracting the initial investment, the net present value (NPV) is $13,723. This positive NPV indicates that the project is expected to generate more value than the cost of the investment under the given assumptions, making it a financially viable option.

Application of DCF in Investment Decisions

Project Evaluation

DCF is a powerful tool in project evaluation, particularly in assessing the profitability and viability of new projects. By discounting future cash flows, investors and managers can determine whether the present value of future benefits outweighs the current costs associated with the project.

Company Valuation

DCF is also instrumental in company valuation, a process vital for investors and potential buyers. By forecasting a company’s free cash flows and discounting them back to their present value, analysts can derive an enterprise’s equity value. This valuation technique is commonly used by investment bankers and corporate finance professionals to advise on mergers, acquisitions, and other investment-related decisions.

Steps to Conduct a DCF Analysis

Forecasting Cash Flows

To conduct an effective Discounted Cash Flow (DCF) analysis, the first step is forecasting cash flows. This involves estimating the future cash inflows and outflows that an investment is expected to generate. This estimation is typically based on historical data, industry benchmarks, and projections of the company’s future performance. It’s essential to consider factors such as revenue growth, operating expenses, capital expenditures, and working capital requirements. Accurate cash flow forecasting is crucial as it forms the basis of the DCF valuation and heavily influences the outcome.

Choosing a Discount Rate

Selecting an appropriate discount rate is a critical component of discounted cash flow (DCF) analysis. This rate is used to discount future cash flows back to their present value, reflecting both the time value of money and the risk associated with the investment. Commonly, the Weighted Average Cost of Capital (WACC), which includes the cost of equity and the cost of debt, is used. However, adjustments may be necessary to account for the unique risks of the project or investment, such as industry risk, market volatility, and specific company risks.

Calculating Present Value

The final step in conducting a DCF analysis is calculating the present value of the forecasted cash flows. This calculation involves applying the chosen discount rate to the projected cash flows for each period of the investment’s expected life. The formula for DCF, as previously discussed, sums these discounted cash flows to determine the total present value. This figure represents the intrinsic value of the investment based on its ability to generate cash flows in the future.

Examples of DCF

Corporate Investment

Consider a company evaluating whether to pursue a new product line. By using DCF analysis, the company forecasts the cash flows generated from this new product and discounts them back to the present using its WACC. This analysis helps determine if the present value of the future benefits outweighs the initial investment cost, guiding decision-makers on whether to proceed with the investment.

Stock Valuation

Discounted cash flow (DCF) is extensively used in stock valuation to determine the fair price of a stock. Analysts forecast the company’s free cash flows into the foreseeable future and discount them to present value. This method offers a way to assess if a stock is undervalued or overvalued based on the current market price compared to its calculated DCF value.

Advantages of Using Discounted Cash Flow (DCF)

Informed Investment Decisions

One of the most significant advantages of the Discounted cash flow (DCF) analysis is that it provides a rigorous, quantitative foundation for making investment decisions. By evaluating the present value of future cash flows, investors and financial analysts can make more informed judgments about the potential return on investment. This method allows for a more detailed assessment of an investment’s profitability compared to other methods, such as simple payback periods or earnings multiples, by considering the time value of money and the associated risk.

Flexibility in Scenarios

DCF is highly adaptable and can be used to analyze a wide range of financial scenarios. By altering assumptions about cash flows, growth rates, and the discount rate, analysts can explore different scenarios and their outcomes. This flexibility makes it possible to perform sensitivity analyses, which help identify how changes in key assumptions impact the investment’s value. This capability is particularly valuable in uncertain economic climates or for investments with long-term horizons where various future states are possible.

Limitations and Challenges

Reliance on Estimates

A key limitation of DCF is its dependence on the accuracy of forecast cash flow projections. The entire value derived from a discounted cash flow (DCF) model is sensitive to these estimates, which numerous unpredictable factors like market conditions, regulatory changes, and technological advancements can influence. Overly optimistic or conservative forecasts can significantly skew the results, leading to potential misjudgments in the investment’s value.

Sensitivity to Discount Rates

The choice of the discount rate is another critical factor in DCF calculations, and small changes in this rate can lead to large variations in the calculated value of an investment. This sensitivity underscores the importance of choosing a correct discount rate that appropriately reflects the risk profile and the capital structure of the investment or project.

Complexity in Application

Applying DCF in complex financial environments poses substantial challenges, particularly when future conditions are uncertain. For industries undergoing rapid change or startups with limited financial history, Discounted cash flow (DCF) models require robust, adaptable financial modelling skills and a deep understanding of the market and economic trends that could affect the projected future cash flows.

Discounted Cash Flow (DCF) vs. Other Valuation Methods

While DCF is a comprehensive valuation method, it’s often beneficial to compare its results with those derived from other valuation techniques, such as NPV, Comparable Company Analysis, and Capital Asset Pricing Model (CAPM). Each method has its strengths and can provide additional insights or corroborate findings from the DCF analysis. For instance, NPV provides a direct measure of the added value of an investment after subtracting the initial costs, which can complement the insights from a DCF model.

Conclusion

Discounted Cash Flow (DCF) is an essential tool in financial analysis, offering a detailed mechanism to evaluate the intrinsic value of an investment by considering its future cash-generating capabilities.

When used judiciously and with other valuation methods, DCF can provide valuable insights into investment decisions. However, users must remain cognizant of its limitations, particularly the dependence on accurate future projections and the correct application of discount rates.

FAQs

What is the importance of discounting cash flows in DCF analysis?

Discounting cash flows in discounted cash flow analysis helps determine today’s value of future cash flow, reflecting the principle that receiving money today is more valuable than the same amount in the future due to its potential earning capacity.

How does terminal value fit into a discounted cash flow model?

Terminal value estimates the bulk of a company’s value beyond the forecast period in a DCF model, reflecting expected cash flows into perpetuity after the initial analysis period.

What is the difference between unlevered free cash flow and net income in DCF valuations?

Unlevered free cash flow represents cash available to all investors, free from interest payments, unlike net income, which is the profit after all expenses, including taxes and interest, are paid.

How does enterprise value relate to discounted cash flow valuation?

Enterprise value in a discounted cash flow valuation represents the total value of the company, encompassing all ownership interests and net debt, reflecting its market value as derived from expected future operating cash flows.

What role does the weighted cost of capital play in a DCF calculation?

The weighted cost of capital is used as the discount rate in DCF calculations to adjust for the time value of money and additional risk, providing a minimum rate of return expected by investors.

How do exit multiples impact the DCF valuations of companies?

Exit multiples help estimate a company’s market value at the end of the financial model period, typically applied to the final year’s cash flow to calculate terminal value, which is critical in determining the DCF.

Why consider market capitalization and preferred stock in DCF analysis?

Market capitalization reflects the total market value of a company’s equity; including preferred stock in the calculation affects the equity value derived from the discounted cash flow method, aligning it closer to actual market assessments.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…