Should I buy Xero stock? We have believed in this share since the 2020 low!

![]() Marc Kennis, May 24, 2024

Marc Kennis, May 24, 2024

Should I buy Xero stock?

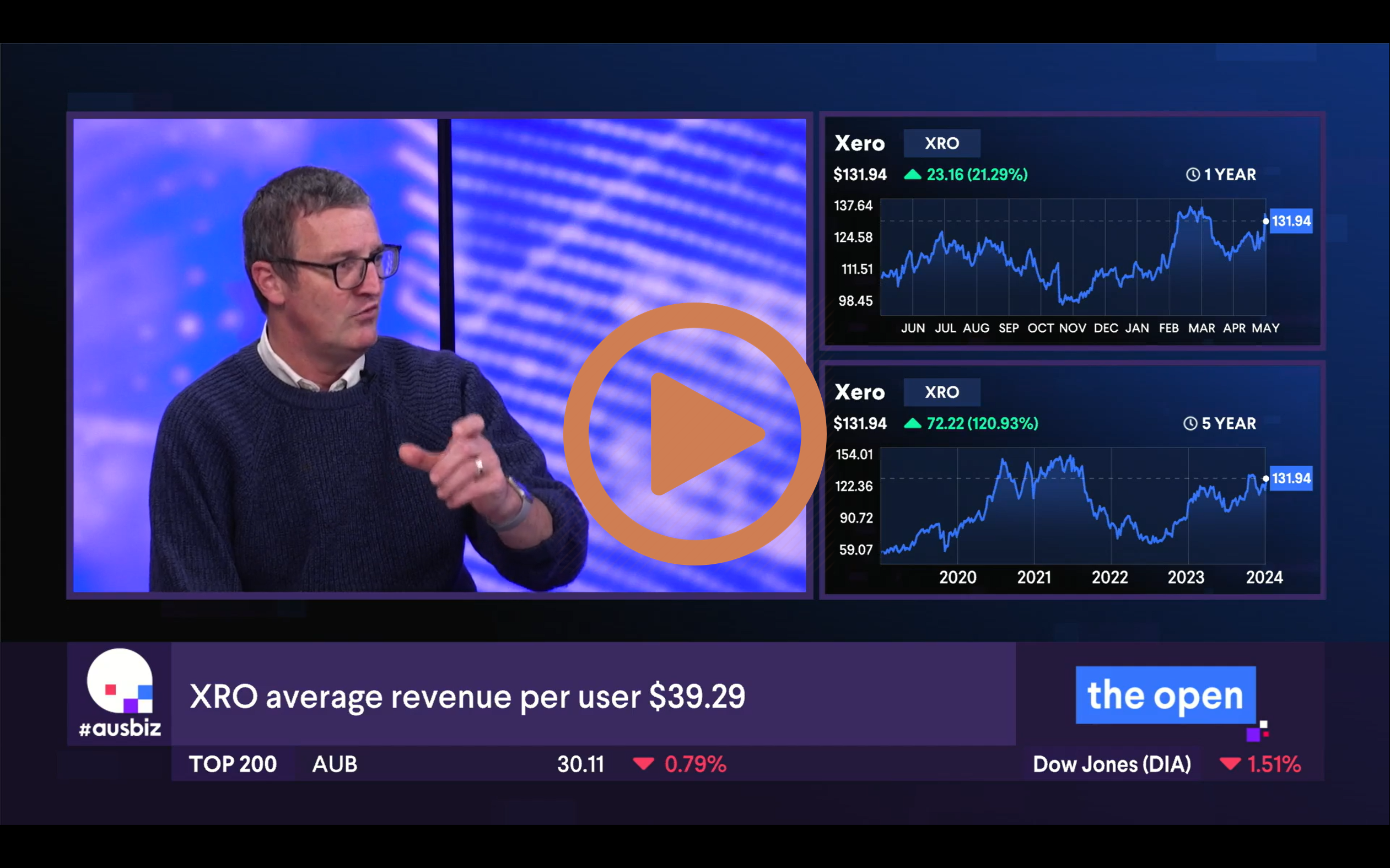

From Xero to hero: Stuart always believed in this stock. In order to answer the question “should I buy Xero stock”, Stuart Roberts shares his thoughts on Xero’s (ASX: XRO) success and future prospects. Stuart points out that Xero stands out as an accounting solution for small businesses that outsource its accounting needs. He believes the company has proven its market leadership from New Zealand to Australasia and, ultimately, the global scale.

As Stuart observes, Xero’s growth potential remains immense, citing its share price jump from $69 in November 2022 to $135 on 24 May 2024. Xero’s recent financial results were also remarkable, he says, exceeding consensus by about 100 Kiwi million dollars.

What are the Best ASX Technology Stocks to invest in right now?

Check our ASX buy/sell tips

The Rule of 40

Stuart emphasises Xero’s (ASX: XRO) ‘Rule of 40’ strategy, wherein revenue growth and earnings total more than 40. The company’s conservative yet effective financial management strategy includes calculating free cash flow rather than EBITDA. Stuart also shines a light on Xero’s (ASX: XRO) responsive approach to customer demands despite increased fees. The company’s potential to double in the next 3 to 4 years is discussed, despite the questions it poses for analysts. Stuart contrasts Xero’s 88% gross margins to the pharmaceutical industry, which is the only product line that does better.

What’s next for Xero?

Lastly, Stuart considers the future scope of Xero, predicting growth outside Australasia particularly in the US, Canada, Europe and possibly emerging markets. The company’s adaptability in foreign markets is characterised by acquiring other businesses. The incoming influence of generative AI on Xero’s already successful business model is considered a potential booster for profitability.

So, to answer the question should I buy Xero stock, Stuart draws a comparison to Nvidia (NASDAQ: NVDA) and encourages investors to consider similar burgeoning tech companies, like Xero.

Watch the entire interview here

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

5 ASX Stocks to Buy (and 3 to Avoid) as the Iran War Shakes the Market

ASX stocks to buy and avoid as the Iran war shakes markets The ASX 200 shrugged off the initial shock…

Qatar Halts 20% of Global LNG Supply: Why Woodside, Santos and Beach Energy Are Soaring

European gas prices surged as much as 54 per cent this week after QatarEnergy suspended all LNG production at its…

The 10-Year US Treasury Yield: Here’s what Australian investors need to know!

For Australian investors, the 10-Year US Treasury Yield can serve as an indicator of market volatility, global borrowing costs, equity…