AFT Pharmaceuticals (ASX:AFP): A gem of a dual-listed healthcare company

AFT Pharmaceuticals (ASX:AFP) may not spring to mind as the best company to have come out of New Zealand. Many investors would say that title belongs to Xero (ASX:XRO). Nonetheless, however much AFT Pharmaceuticals has slipped under the radar, it deserves a lot more attention than it has received from investors, given its progress since it listed and future outlook.

Who is AFT Pharmaceuticals?

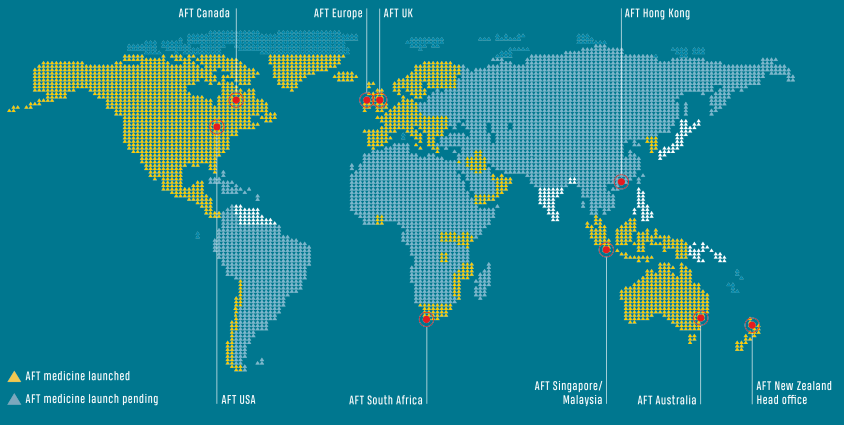

AFT Pharmaceuticals is a drug maker that is based in New Zealand, headquartered in the Auckland North Shore suburb of Takapuna and is dual-listed on the ASX and NZX. Started by Hartley and Maree Atkinson in 1998, AFT began as a small local business that imported and distributed other company’s medicines. The Atkinsons are still involved with the business and own a majority stake in it.

In 2009, the company commercially launched Maxigesic, which is its flagship medicine, developed in-house through R&D. The company is best known for Maxigesic, but also in-licenses and distributes over 100 other pharmaceutical products in pain relief, eyecare, allergy relief, digestive health and skin care in dozens of countries across the world.

Source: Company

It also has an extensive pipeline of assets that could be commercialised eventually. The most notable of these is Pascomer which is a dermatology treatment – for facial angiofibromas or port wine stains. This ailment is exactly what the latter description sounds like, skin marks that look like spilt port wine.

But it is Maxigesic that most excited us about this company.

What is Maxigesic?

Maxigesic is a pain-killing drug that combines two popular OTC analgesics, paracetamol and ibuprofen, into a unique patented formulation. It is licensed in over 100 countries all up, in tablet, IV and oral (i.e. drink) forms, for the treatment of mild to moderate pain experienced post-operations.

Maxigesic is differentiated and more superior compared to other pain-killing options given it is non opioid-based (and thus avoids all the problems that opioids can cause) and because of the synergistic effect of using multiple analgesics.

Maxigesic is now OK for the USA

For many years, the USA was not a country Maxigesic was approved in, but the tablet form was approved in March 2023 and the IV form in October 2023. It is distributed in the US by Hikma Pharmaceuticals and AFT is entitled to milestone payments and a profit share on sales under its licensing deal.

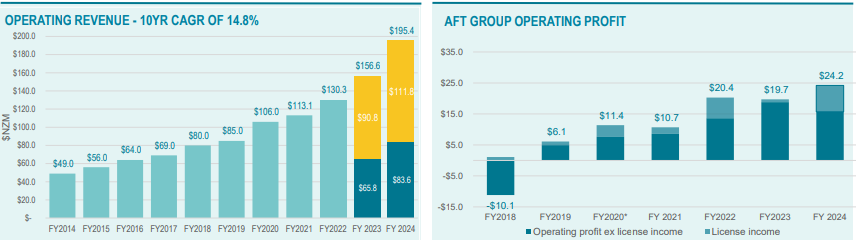

In FY24 (the 12 months to March 31, 2024), AFT Pharmaceuticals recorded $195.4m, up 25% in 12 months and nearly quadruple what it was a decade ago, and it made a $15.6m post-tax profit (up 47%). When it listed in 2015, the company had been profitable, but moved to a more aggressive (and loss-making) R&D-led growth strategy. With the company having risen to the next level, the company pivoted to profitability again, and has reached that high mark.

Having nearly reached $200m, it upped its revenue target to $300m, although without a clear time frame to reach it. Analysts covering the company expect 2-4 years for this to happen. And given the track record of growth, we wouldn’t be surprised.

Source: Company

Then in FY25, the company made $208m in revenues. Product sales and royalties were up by 11%, Australian sales grew by 17%. The company’s EBITDA was down 20% to $20.9m and its profit was down by 27% to $17.6m, but investors did not react too negatively because the company had indicated this. And most importantly, the company broke through the $200m barrier, on the way to $300m. It guided to a $20-24m operating profit for FY26.

Highlights included the launch of Maxigesic tablets in the US, following on from the intravenous form of the medicine, the launch of its proprietary antiseptic cream in mainland China and several licensing agreements including Maxigesic IV in China and Brazil.

A good company, but you should cross the Ditch for it

AFT Pharmaceuticals is a company we like, but with a caveat. Any investors wanting to buy it should do so on the NZX rather than the ASX. Although the NZX is typically a less liquid exchange than the ASX, this is not the case with AFT’s own shares which are more liquid in New Zealand than in Australia. And we think the sacrifice and burdens of investing in international shares are worth it for a company like this.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Objective Corporation (ASX:OCL) is a superb ASX 200 tech stock

Objective Corporation (ASX:OCL) is one of a kind. There are few companies with a 2-decade listed life without raising a cent…

AI-Media Technologies (ASX:AIM): Investors are panicking that it’ll be a victim of AI

AI-Media Technologies (ASX:AIM) is not the only ASX stock with investors panicking that AI will make it go the way…

Geopolitics, AI, and Energy, The Three Pillars of Investment Growth in 2026

Investing right now feels riskier than ever – messy geopolitics, the AI boom, and power shortages are all piling on.…