Curvebeam AI (ASX:CVB): Could this company be the next Pro Medicus?

Not many ASX medtech companies can boast of a then US President elect as a patient, but Curvebeam AI (ASX:CVB) is one of them. And there’s good reason too – because its technology can detect injuries and fracture risk where its peers cannot.

CurveBeam AI and the secret sauce behind its technology

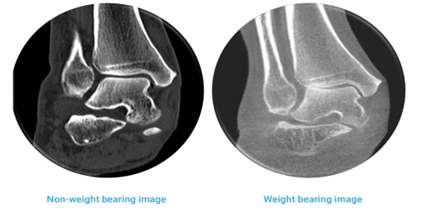

CurveBeam AI develops and commercialises medical CT scanners that are Weight-Bearing, meaning they can capture images of a joint when weight is applied to it. This may not sound like a big deal, but a weight-bearing image can detect ailments, injuries and fracture risk that non-weight bearing images cannot. This is particularly true with foot and ankle disorders where conditions such as flatfoot, high arch and foot deformities may be missed entirely when the feet and ankles are in a non-weight bearing position.

Source: Company

CurveBeam AI’s scanners – of which its flagship is HiRise – looks for Bone Mineral Density, a measure of calcium and other minerals in the bones. The higher the BMD, the less likely there is of a risk of fracture.

BMD is widely used to diagnose or monitor osteoporosis as well as to risk the assessment of fractures. Guidelines from the American Academy of Orthopaedic Surgeons (AAOS) require a bone quality assessment to make decisions in total joint replacements and BMD can fulfil this objective.

Although there are devices that can detect BMD right now, they underserve the market for several reasons including an inability to identify the loss of bone microstructure as well as the devices’ sizes and training requirements.

CurveBeam AI’s flagship device, HiRise (pictured below), solves all the shortcomings of current devices.

Source: Company

It is FDA-cleared, CE-marked and ARTG listed in Australia. HiRise is the first product capable of conducting bilateral weight bearing CT imaging of the entire lower extremities in a surgeon office setting (point of care) – the feet, ankle, knees and hips. It has the flexibility to scan with patients in a variety of positions, with a radiation dose 30 to 60% less than traditional CT, is compact and has simple protocols that can easily be learned by frontline healthcare staff. It takes less than 55 seconds to scan per joint and provides less than 18 seconds of X-ray exposure.

America’s Commander In Chief was once a client

In late 2020, the company counted US President Joe Biden as a patient. Just prior to his inauguration, America’s Commander in Chief suffered a hairline foot fracture and underwent a weight bearing CT scan using one of CurveBeam’s devices to monitor the fracture’s healing.

The President’s experience was an eye-opening event for the US medical imaging market, not just the fact that CVB’s scanner (it was PedCat in this instance) confirmed a hairline fracture, but also that the initial X-Ray did not show any obvious injury because it was too small to be picked up. Even existing CT scanners can struggle to pick up hairline fractures, although CurveBeam AI’s scanners are able to.

A big market opportunity

CVB believes there is a combined Total Addressable Market of >A$10bn, just for HiRise . This is split across medium to large hospitals ($3.4bn), Orthopaedic Surgeon Group Practices ($3.6bn) and Imaging Chains ($3.7bn). This would equate to more than 17,000 potential installations. A further 4,387 centres have been estimated to exist in Germany

But CVB wants to go further and is looking at commercialising its BMD algorithm as a standalone SaaS product that could be generated from HiRise scans. This will assist surgeons in identifying fracture risk and potentially pre-treating bone fragility, as part of the treatment plan for a patient’s other conditions. The assessment is automated for the surgeon and means a patient can have their diagnosis and surgery plan done at the same appointment, avoiding the need for another DEXA scan. The company is seeking a dedicated FDA clearances for BMD scans at the hip. When it is approved, the company will charge a fee of US$90 per scan and envisions there is a revenue opportunity of $35m just from just 100 scanners, a very small proportion of the 17,000+ devices the company estimates as a market opportunity.

For BMD, the company has estimated there is an A$2.7bn market per annum. This assumes A$350,000 per target SaaS revenue and the same number of installation sites as assumed in the forecast for HiRise’s TAM. It also assumes 10 CMD CT scans per day, 5 days a week for 50 weeks a year at a price of US$90 per scan.

The next Pro Medicus?

Our sister company, Pitt Street Research, has this morning issued a note on the company, valuing it at A$0.60 per share in a base case scenario and $0.79 per share in an optimistic case. The report looked at the question as to whether or not CVB could be the next Pro Medicus. While Pitt Street concluded a future valuation of A$13.6bn was too far-fetched, there were some similarities between the two companies’ business models. In particular, the high gross margins the company can make from its business model, as well as that which its surgeon clients make too.

It is important to note that CVB and PME sell somewhat different products. CVB sells the imaging devices themselves and will eventually sell an AI based diagnosing mechanism (BMD). PME has a software (Visage) that allows the sharing and analysis of images taken by other devices – rather than streaming thousands of 3D images, all of them are merged into a 3D image and can be streamed to a doctor or radiologists’ office, computer or phone in a file size appropriate for those smaller devices. Both, however, achieve a similar feat in increasing a surgeon’s productivity by speeding up tasks that other technologies can only accomplish in time-consuming manners.

There are a couple of disadvantages CVB has compared to PME that would limit CVB’s potential growth. Firstly, while PME’s Visage software can integrate into any brand or type of imaging hardware, CVB intends to sell it only through HiRise devices. Second, although CVB has a ‘per use model’ per scan, it is not as stingy as Visage which has a ‘per click’ model where it is charged just for viewing images. It is plausible these realities could eventually change.

CurveBeam AI is one of the most exciting medtechs on the ASX

CurveBeam AI is an exciting company to watch. This company has a medical device already approved in the US, the world’s largest healthcare market. It is superior to its competitors, more profitable for its surgeon clients and provides a better experience for patients. The momentum the company has witnessed in recent quarters bodes well for its future.

CurveBeam AI is a research client of Pitt Street Research.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…

Star Entertainment (ASX:SGR) Drops 16% Despite First EBITDA Profit in Quarters: Buy, Sell, or Wait?

Star Entertainment turns EBITDA positive but survival risks remain Star Entertainment (ASX: SGR) plunged 16 per cent to A$0.14 on…