After Nvidia’s Rally: Is It Time to Invest in Asian Chip Stocks?

Nvidia, a top-tier company in the world of graphics processing units (GPUs), has recently enjoyed a meteoric rise in its share prices, brought by the overwhelming demand for AI chips. As Nvidia continues to set records based on its AI-related innovation, attention is now also being drawn to investors across the world. Nvidia’s rally, which began post-release of its Blackwell chips along with increased demand for AI computational power, has now set a standard in the semiconductor space.

While Nvidia’s surge does deserve global recognition; focused attention to the broader impact on the semiconductor supply chain leading up to the rally, particularly surrounding Asian chip manufacturers is warranted. There is no question that companies such as Taiwan Semiconductor Manufacturing Company (TSMC), Samsung, and SK Hynix are a part of the production of high-performance Asian chips for artificial Intelligence, automotive, and data centre applications coming out of Nvidia. Again, the question shall remain ” Is this the time to invest in Asian chip stocks?”.

Nvidia’s Rally and Its Impact on the Semiconductor Industry

Nvidia’s rally primarily surrounding the extreme demand for AI has changed the paradigm of the semiconductor industry. Nvidia’s stock price surged on the successful release of its Blackwell chips, produced for the next generation of AI applications. Nvidia’s latest quarterly earnings report and similar forecasts have driven large investments into the organisation on the premise of further AI infinities.

Nevertheless, the success of Nvidia is not an exception. The widespread effect of Nvidia’s rally has been substantial, leading to many Asian semiconductor manufacturers experiencing stock rises. Asian companies like TSMC, SK Hynix, and Foxconn, who are all key suppliers to Nvidia, are among those benefiting from the rise in demand. Nvidia’s strength in AI chip manufacturing, as cited by Bloomberg, has led to an increased demand within ‘global chip shortages.’ As the semiconductor tightens, Asian manufacturers have an advantageous position to react quickly to this trend.

Performance of Major Asian Chip Stocks

Several major Asian semiconductor companies have experienced positive performance corresponding with Nvidia’s rally, specifically, those engaged heavily in the supply chain centred around AI chips.

TSMC (Taiwan Semiconductor Manufacturing Company)

TSMC is the world’s largest contract chip manufacturer, and naturally plays a critical role in the Nvidia supply chain. TSMC’s stock has reportedly increased by around 7% since Nvidia’s stock began its rally, and analysts suggest that with surging demand in AI, their stock will continue to increase.

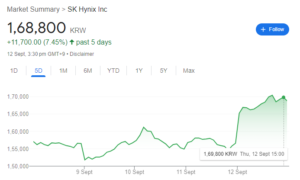

SK Hynix

Producing memory chips for applications including AI, thus SK Hynix has had a notable rebound in their stock. SK Hynix’s stock is up around 6% due in part to the growing demand for performance memory from data centres as well as AI developers looking for higher-performance chips.

Samsung Electronics

Samsung, which excels in memory chip production and logic chips, has been up by a modest gain of about 4%. The relationship between Samsung’s diverse portfolio that entails semiconductor manufacturing and seasonality in demand for consumer electronics leads the company to a significant position within the AI sector.

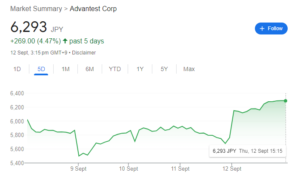

Advantest

The Japanese company that specialises in semiconductor testing equipment (from testing process to packaging) saw a remarkable increase in their stock by around 10%. As more semiconductors are produced, demand for testing sub-panel will naturally increase which provides Advantest a prime opportunity for growth.

The companies benefiting from Nvidia’s leadership face challenges of their own. Supply chain disruptions, geopolitical risks, and unexpected consumer demand can always create headaches when looking forward ahead. But with no end to the AI boom in sight, Asian chip stocks remain appealing to several investors.

Market Trends: Why Asian Chip Stocks Could Be a Good Investment Now

Various current market trends suggest the potential for strong returns from Asian chip stocks:

- Growing AI Demand: The AI boom driven by technological advances in machine learning and automation needs cutting-edge or high-performance semiconductors. Asian manufacturers such as TSMC and Samsung are in prime positions to manufacture this cutting-edge technology microchips and semiconductors that will fuel AI applications across industries, especially in healthcare, automotive, and finance. AI Demand is expected to grow at a rate of over 40% CAGR, making the chip supplier a very attractive sector.

- Supply Chain Advantages: Many of the world’s largest chip manufacturers are based in Asia. This gives Asian chip suppliers a logistical advantage in controlling the parts of the semiconductor supply chain. Taiwan and South Korea have spent considerable investment in semiconductor infrastructure making them invaluable to the advanced chip manufacturing work. Further, these companies have a long relationship with tech giants like Nvidia, Apple, and Alphabet’s Google product lines, giving them a steady demand for their products.

- Diversified Applications of Semiconductors: Besides AI applications parse, Semiconductor chips are at the centre of many industries including; automotive industries, telecommunications, and consumer electronics. As more devices become “smart,” the demand for chips that can parse massive datasets will grow too. No need to mention the global demand for semiconductors leaves TSM and Samsung both in a position for long-term strong growth.

- Positive Analyst Forecasts: Many industry analysts have given optimistic projections for the semiconductor sector, particularly in Asian markets. With the rise of AI, 5G technologies, and electric vehicles, the demand for semiconductors is expected to grow exponentially. Analysts predict steady revenue growth for companies like TSMC and Samsung as they continue to lead in cutting-edge chip manufacturing. Additionally, many investment firms have revised their target prices upward for key Asian chipmakers, citing their strategic position in the global supply chain and long-term contracts with tech giants. This positive sentiment from analysts reflects confidence in the sustained growth of Asian semiconductor companies over the next decade.

Risks to Consider Before Investing

Although there are several reasons to be positive about Asian chip stocks, investors should also consider the risks:

- Economic Slowdown: A global economic slowdown could lead to reduced demand for consumer electronics, which will impact chip manufacturers. With the economies of China and the U.S. battling inflation and potential recessions, manufacturers that rely on global demand may experience reduced earnings.

- Geopolitical Risks: Tensions between China and Taiwan represent a significant risk to companies like TSMC, which is located in Taiwan. Any disruption to Taiwan’s semiconductor manufacturing could be disastrous for the semiconductor global supply chain and lead to volatility in chip stocks.

- Supply Chain Disruptions: The semiconductor industry continues to be particularly susceptible to supply chain disruptions. Global shortages of key materials like silicon have had an impact on production, and further supply chain issues could limit growth for some of the largest manufacturers in the semiconductor industry.

To mitigate risks, investors should consider building a diversified portfolio that includes both semiconductor stocks as well as stocks in related tech sectors. It is important to be aware of global economic and political developments as part of the investment process.

Conclusion & Investment Takeaway

In conclusion, as well as our investment takeaway, Nvidia has had an AI-fueled rally, which has significantly affected the entire semiconductor sector with impacts in the global supply chain, benefiting the major Asian chipmakers – TSMC, Samsung, and SK Hynix – who now have the opportunity to meet the ongoing demand for high-performance semiconductors (AI, automotive, data centre, etc.).

Nonetheless, investors should balance the reward with the risk from geopolitical issues and the potential for an economic slowdown. This dynamic has created an attractive opportunity in proper Asian chip stocks, but investors need to be diligent with their market research about the stock’s opportunity and to remain informed about global events.

Before investing in stocks, it can also be prudent to seek out advice from your financial advisor, and it can be prudent to examine your portfolio and assess diversifying further to not concentrate investments in one area. Overall, Nvidia’s rally may be indicative of growth characteristics within the semiconductor industry; however, smart investing will always include an aspect of opportunity and concern.

What are the Best ASX Technology Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

EOS (ASX: EOS) Crashes 46% From All-Time High After Short Seller Attack- Buying Opportunity or Time to Run?

Electro Optic Systems (ASX: EOS) has been placed in a trading halt at A$6.00 after falling roughly 33 per cent…

Lotus Resources (ASX:LOT) Drops 28% After $76M Raise- Is the Dip a Buy or a Dilution Warning?

Lotus Resources (ASX: LOT) shares fell sharply on Friday, dropping 28% from A$2.88 to A$2.08. The fall happened after the…

Amazon (NASDAQ:AMZN) Down 9%, Is Capex Becoming the Story?

14% Sales Growth, 128B Spend, Now What? Amazon has fallen about 9%. While we are holders of the stock, when…