Build to Rent Apartment Construction is on the rise! Here’s how to access this sector on the ASX

For years, investors have heard hype about the Build to Rent, but the hype has not matched reality…until now.

What are Build to Rent Apartments?

As is self-explanatory from their name, these are apartments built exclusively to be rented. They are owned by institutional landlords or funds. This business model is well established in other Western jurisdictions – worth 12% of housing stock in the US. It is less so in Australia, at just 0.4% of completed housing stock as of last year. Nonetheless, a few years ago, we saw Mirvac (ASX:MGR) – then and now the largest player on the ASX – struggle to even get one project off the ground. Things have improved since then, even if 2024 has been a year of retreat thus far.

How prevalent are Build to Rent Apartments in Australia?

There are only a handful of completed projects across Australia – with one example being Mirvac’s flats at Sydney’s Olympic Park. According to Oxford Economics, there were 6543 rental units completed in 2023 and another 5,290 in 2024. Yes, this was a retreat, but still nearly triple 2019-20 levels. It is anticipated that this figure will surpass 7,200 in 2025 and 8,000 in 2027. Furthermore, Oxford estimates that there are 14,000 under construction right now.

There is hope this will happen as interest rates fall, supply chain issues ease, and the federal government introduces incentives to invest in the sector. In particular, the 30% withholding tax on managed trusts which hold build to rent flats will be halved so long as 10% of the dwellings are ‘affordable tenancies’.

But the biggest elephant in the room is the rental shortage in capital cities. The government forecasts 1.2m new dwellings will be needed by 2028, because this will be the number of new migrants arriving in Australia during that time. Clearly, we need to get cracking.

Large scale build to rent apartments can generate large returns for investors because renters pay a premium to use these apartments – they tend to be furnished with facilities such as pools, gyms and other communal spaces. And these are the reasons why renters like them – they are willing to pay a premium for them. The name of a renowned company carries more weight than some anonymous landlord, doesn’t it?

So who is in the BTR space on the ASX?

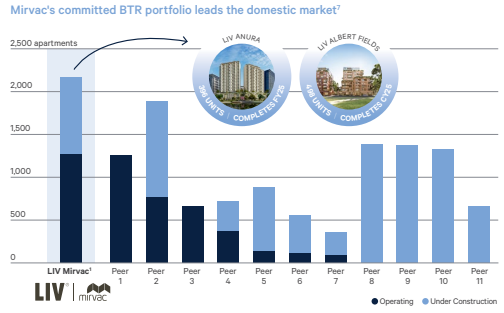

We already mentioned Mirvac. It is easily the largest player in the build to rent space with 1,279 operational apartments as of June 30, 2024, across 3 properties (1 at Sydney’s Olympic Park and 2 more in Melbourne, one near the Queen Victoria Markets and the other is at the corner of Spencer and Flinders Streets). These properties are branded ‘LIV’.

Collectively, these build to rent flats have >1,100 residents and are 94% occupied. Mirvac has told investors that there is a strong sector outlook supported by restricted supply, tight capital city rental markets across the East Coast and the low sector penetration as opposed to offshore markets.

Source: Mirvac

Another player is Stockland (ASX:SGR) which is building its first project as part of its Triniti development in the Sydney suburb of North Ryde. Then there’s Lendlease (ASX:LLC) that plans to build a 37-storey 443-unit BTR tower at Brisbane Showgrounds.

Then there’s Cromwell (ASX:CMW), although it is an investor rather than a builder, so you’ll have to invest in its funds directly to gain direct exposure – investing in the company on the ASX provides broad exposure across Cromwell’s entire portfolio.

Conclusion

You’ll be hearing a lot more about the Build to Rent sector in the years ahead. It has been a rising dark horse as a solution to Australia’s housing crisis and one that can be profitable for companies that build them – even before you consider the forthcoming incentives that will aid the cause even further.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

JB Hi-Fi Earnings: Good Results and AI Optimism Spark a 12% Re Rate!

JB Hi-Fi Earnings: The Market Reprices Quality And AI Exposure JB Hi-Fi has seen a strong re rate over the…

Nanoveu (ASX:NVU) NTU Drone Swarm IP, GPS Free Navigation Goes on Trial

Testing GPS Free Swarm Tech With NTU Nanoveu today announced it has entered an exclusive evaluation licence with Nanyang Technological…

Botanix (ASX:BOT) Down 40% on a $45m Raise, Dilution Shock Hits Hard

A Steep Discount, A Big Dilution, A New Valuation Anchor Botanix started the session with a sharp sell off, falling…