The Webjet demerger is complete, but which side of the demerger will win?

Earlier this week, the Webjet demerger was complete. The entity known as Webjet (ASX:WEB) still owns the consumer facing businesses including the Webjet travel agency as well as the GoSee and Trip Ninja businesses. But…it is now known as Web Travel Group.

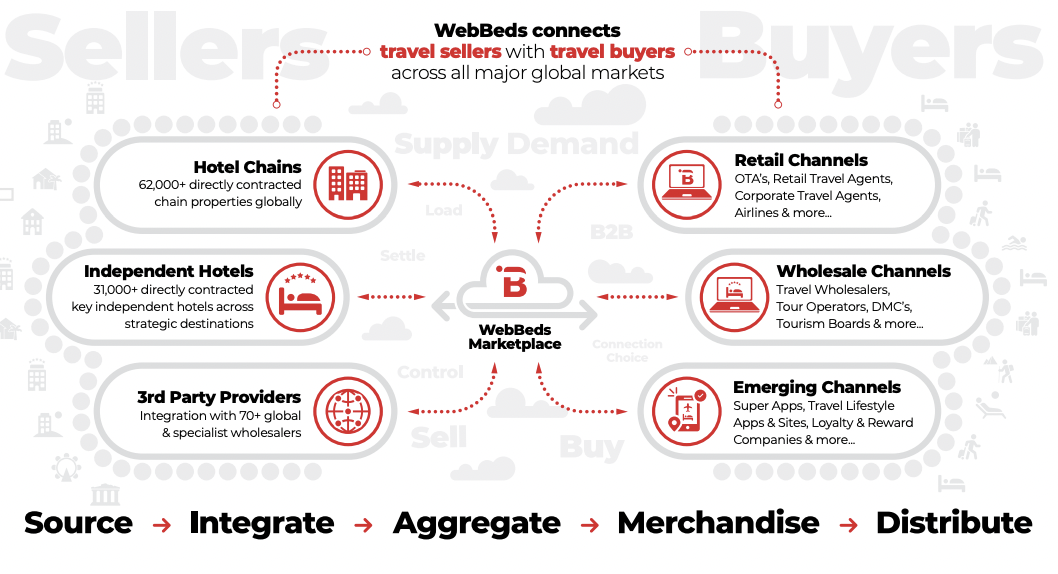

And more importantly, the wholesale hotel bookings business WebBeds is (as of last Tuesday October 1 2-24) now its own company with a ticker WJL. Web Beds is a wholesaler that distributes inventory to travel agents who sell them to the public. Is Web Beds another Siteminder (ASX:SDR) – a competitor to the late 2021 listee? No, in fact these two companies have worked together closely. It’s a complicated relationship but essentially WebBeds uses data from SiteMinder and passes it to distribution partners, enabling business for all parties. SiteMinder is a platform for the hotel’s perspective helping them manage incoming bookings from all the platforms, while Web Beds is an inventory seller to the OTAs themselves.

Source: Company

For investors who’ve been on Planet Mars about the Webjet demerger, let’s bring you up to speed.

Why did the Webjet demerger happen?

Whenever demerger happen, companies argue that the individual businesses will gain more attention than they otherwise would in one entity. This was the case here too. Let’s briefly bring up the example of Chalice (ASX:CHN) to illustrate.

Prior to discovering Julimar, Chalice was a gold-focused company with multiple projects that it aspired to generate shareholder value from. Once Julimar was discovered, all the attention went to Julimar – rightly so, but it meant the projects would not reach their full potential if they were retained in the same company. So Chalice spun it off into a new company Falcon Metals.

It was a similar story here, with Webjet management seeing that the B2B and B2C segments would not reach their full potential in the same company, and so decided to spin off the latter. Although both the B2B and B2C businesses of Webjet served as important intermediaries, they were different. WebBeds connected hotel and travel product suppliers with travel trade buyers, while Webjet B2C enabled travel booking.

‘The digital travel industry is dynamic and fast-changing, with customers’ travel preferences continuously evolving,’ company chairman Roger Sharp said in the Webjet demerger booklet. ‘Given this industry dynamism and the distinctly different customer profiles that each of our businesses serve, the Webjet Board believe that the demerger will enhance shareholder value by enabling highly focused management teams to pursue their own strategic priorities, making more targeted capital allocation decisions’.

Which will be the better business?

This is the question we seek to answer in this article. Both these companies are exposed to the travel sector so their fortunes will be intertwined with that of the sector. But we would go with WebBeds, for a few reasons.

First, B2B companies in general tend to be higher margin and have a stickier customer base. We imagine it would be little different with WebBeds. Second, while Webjet has a high market penetration, WebBeds is not so much because it represents just 0.65% of the total global hotel market. There is a larger growth opportunity with WebBeds.

Thirdly, consider this. When demergers happen, a big hint as to which business has the better prospects is where the bulk of the company’s board and management go to and/or where the most senior people do. There were 6 people on Webjet’s board prior to the demerger: Roger Sharp, John Guscic, Don Clarke, Brad Holman, Denise McComish, Katrina Barry. Clarke, Barry and Holman are now on the bard of the B2C business and will be joined by Shelley Beasley (COO of Webjet)

The board of the new B2B entity comprises Sharpe, Guscic, Holman, McComish. With:

- 4 of the prior 6 being involved with the B2B company compared to 3 of the 6 with B2C, and

- Webjet’s Chair and Managing Director Sharp and Guscic joining B2B,

We’re going to give this one to WebBeds.

Conclusion

It is very rare that spin-offs turnout to be the win-win that management purports it to be – generally only one of the demerged companies does. At this point in time, it is easier to imagine it will be WebBeds for the reasons mentioned above, although this thesis could ultimately be wrong.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Amazon (NASDAQ:AMZN) Down 9%, Is Capex Becoming the Story?

14% Sales Growth, 128B Spend, Now What? Amazon has fallen about 9%. While we are holders of the stock, when…

The proposed Rio Tinto Glencore merger failed, here’s why and what it means for the companies!

The proposed Rio Tinto Glencore merger is off. The deal would have created the world’s biggest mining company, capped at…

Tech and AI Stocks Sell Off, This Reckoning Was Always Coming

The Tech and AI Valuation Reality Check When it comes to stock prices, they usually rise when fundamentals and earnings…