IPD Group (ASX:IPG): It’s still the best way on the ASX to gain exposure to electric vehicles and its cheap

If you thought all IPOs that listed during the pandemic turned out to be flops, you’d be wrong – because IPD Group (ASX:IPG) has been one exception. It has grown from a $100m company to a >$350m company in less than 4 years. But it is off its all time highs. Where to next?

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Who is IPD Group?

IPD Group is a company that provides electricity services, headquartered in the Western Sydney suburb of Weatherill Park. Its flagship brand IPD is a distributor of electrical equipment, such as distribution boards, switchboard systems and power meters. IPD has thousands of customers which include switchboard manufacturers, electric wholesalers, and electrical contractors.

The group has 3 other businesses:

- CMI, a manufacturer and distributor of electrical cables and speciality plugs

- EX Engineering, specialists in the supply, modification, repair and design of hazardous area electrical equipment,

- Addelec, a provider of engineering services with EV charging infrastructure specialisation

The former two businesses were bought during FY24 with $65m in fresh capital.

It holds a market share of just under 10% and has over 8000 customers across a wide range of sectors including water, energy, resources exploration and development, construction, manufacturing and infrastructure.

Why IPD has done well

Australian power consumption keeps going up in conjunction with population growth and adoption of new technologies, from EVs to data centres. Although the average energy use per person can fluctuate annually, the country’s total generation and consumption are only going in one direction – up.

Because of rising energy usage (and costs), infrastructure operators are upgrading their assets and putting more effort into proactive maintenance to avoid the costs of potential malfunctions. According to the Australian Bureau of Statistics, private capital expenditure on equipment, plant and machinery grew by 14% – from $13.8bn to $15.8bn – in the past five years.

Additionally, asset owners monitor their energy usage more regularly, which IPD can also help with. The company sells products to commercial buildings and utility operators, providing them with the ability to analyse energy usage at a granular level., Using IPD’s equipment, customers can also get early indications of problems and obtain necessary data to ensure they can earn and maintain sustainability certifications, such as Greenstar and NABERS.

A way to gain exposure to EVs on the ASX – and perhaps the best way

IPD’s most significant end-market users are commercial construction, infrastructure and resources companies, which account for 60% of its revenue. But IPD is one of a few ASX companies offering exposure to electric vehicles, albeit indirectly. Australia’s EV sales are beginning to take off – sales grew from 6,900 in 2020 to over 20,000 in 2021 and are set to be over 85,000 in 2024. Although this is far behind other markets such as North America and Europe, and growth is nearly flat in 2024, the Australian market is taking off thanks to government support, declining upfront costs and growing public support.

But it’s not just car makers that will benefit. Companies that provide the necessary infrastructure for EVs will benefit as well. European equipment and automation company ABB, which was IPD’s largest supply partner by share of revenue at the time it listed, provides electric vehicle chargers – both alternating current (AC) and direct current (DC) chargers. IPD provides installation, testing, commissioning and ongoing maintenance services required for the charging stations and any associated infrastructure that provides the energy to feed these outlets. In its prospectus, IPD credited the latest distribution agreement with ABB, which includes EV chargers, as a key catalyst for revenue growth.

A less than ideal FY25

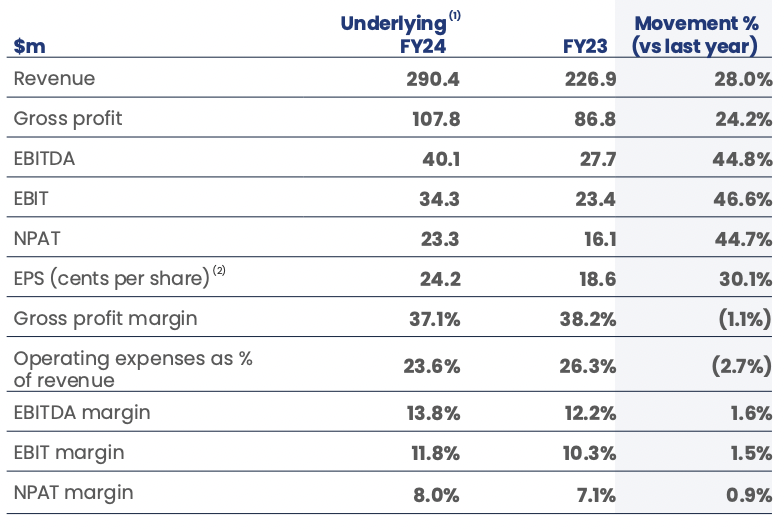

FY25 began on a good note as investors welcomed its FY24 results. The company closed FY24 with $290.4m revenue (up 28%), $40.1m EBITDA (up 45%) and a $23.3m profit (also up 45%). It paid 10.8c in dividends across the year.

Source: Company

But things started going downhill when it issued a trading update at its AGM in November 2024. It issued guidance of $22.5-23.1m EBITDA and $19.2-19.8m EBIT. The company told investors it saw its order book move to larger and more complex orders resulting in invoiced revenue forming ann increasing backlog. The company had to invest into its operating cost base to generate and grow these orders.

Although its statutory results for 1H25 appeared impressive with >40% revenue, EBITDA and profit growth, its underlying results painted a less impressive picture with just 2% revenue growth, a 5% retreat in EBITDA and profit, with a bottom line margin of 8%. A trading update in May 2025 caused further concern with the company guiding to a 7.6% EBITDA retreat and a 9.1% EBIT retreat.

Consensus estimates for the years ahead suggest the company is just getting started. For FY25, they call for $382.3m revenue (up 32%) and a $31.1m profit (up 34%). For FY26, $419.3m revenue and a $34.2m profit (both up 10%). And for FY27, $459.3m revenue and a $37.3m profit (up 10% and 12% respectively). Even so, the company is reasonably priced at 16.5x P/E, a PEG of less than 0.5x and of course a market cap of under $500m.

Still some upside to be realised

Analysts covering the company call for $382.3m revenue and $0.26 EPS, followed by $407.2m revenue and $0.28 EPS. The mean target price is $4.28, suggesting 19% upside. Its EV/EBITDA is 8.3x and its P/E is 13.9x. Not bad in our book.

For a further hint of what IPD could become, we suggest investors look at Quanta Services (NYSE:PWR), it is also an infrastructure services provider for the electricity sector in the US – it is a US$46.3bn company and it is off the back of demand for EV infrastructure. If EV penetration grows in Australia, IPD Group may not reach that level, but it may have some growth runway left.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Nanoveu (ASX:NVU) Hits Tape Out Milestone as Chip Moves From Design to Manufacturing

Nanoveu Sends Chip Design to Foundry Tape Out Nanoveu (ASX:NVU) reached an important chip manufacturing milestone today, known as the…

What happened to Botanix (ASX:BOT) and why are investors sweating

From A$0.53 to A$0.118 Botanix Shows How Fast Biotech Narratives Turn Botanix (ASX:BOT) is a clear example of how quickly…

DroneShield (ASX:DRO) FY25 A$216m Revenue, Strong Cash, and Rising Defence Demand

DroneShield Delivers Breakout FY25 Growth and Converts It Into Cash DroneShield’s (ASX:DRO) numbers this quarter did not come as a…