The Good Times Seem to Be Back for Appen (ASX:APX), What is Driving This Growth and is It Too Late to Get in?

One of the strongest characteristics of a company that is showing growth is its comeback after a challenging period. Appen Limited, a resilient company listed on the Australian Securities Exchange (ASX), showing promising signs of recovery. Known for providing data solutions to support artificial intelligence and machine learning applications, the company has seen renewed interest in the ASX, with recent stock performance suggesting potential growth. However, is it truly a turnaround, and is there still time for investors to enter the game?

Quick Review of Appen’s Performance

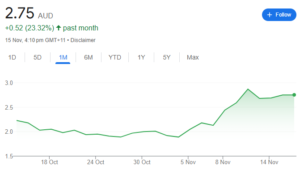

Appen has weathered ups and downs in recent years, with a significant dip due to increasing competition and changing demands in the AI industry. As of early 2024, Appen’s stock price surged by around 230% over the past year. The improvement is fueled by a market re-focus and strategic shifts, despite Appen being significantly down from its peak.

The company has been facing financial challenges and reported a net loss of $17.75 million for the half-year ended on June 2024, compared to a loss of $43.31 million in the same period the previous year.

While this represents a significant improvement in net loss, the company’s overall financial performance remains under pressure. The company has shown resilience, gaining traction in high-demand sectors for data annotation and AI training.

Drivers of its Growth

The company’s impressive comeback is due to many growth factors:

Increased Demand for AI Solutions

Appen’s primary service, providing data solutions for AI, is increasingly sought after as the AI market expands. Generative AI, natural language processing, autonomous systems, and smart assistants all rely heavily on quality training data. Appen’s services in all these aspects, help bridge the gap between technology and data. The company has positioned itself strategically to serve a wide range of AI applications, which should keep demand high.

Global Diversification and Expansion

Previously reliant on a few tech giants in the U.S., Appen has diversified its client base and expanded its services to new regions. With operations growing in Europe and Asia, the company has reduced dependency on specific clients and gained resilience against regional market fluctuations.

In recent quarters, Appen has made a push to establish partnerships across the AI and machine learning ecosystem, securing contracts not only with tech giants but also with emerging AI startups and academic institutions. These collaborations help Appen tap into cutting-edge AI developments and broaden its client base, driving consistent revenue growth.

Operational Efficiency and Cost-Cutting Measures

Appen’s recent operational restructuring has allowed it to improve productivity while reducing costs. By streamlining internal processes and improving data project management, Appen has successfully bolstered its financial standing. This move has also allowed the company to focus on high-margin projects, leading to better profitability.

Focus on High-Margin Services and Customized Solutions

Appen is moving toward offering more customized, high-margin services. Custom data solutions tailored for advanced AI models, such as those used in specialized sectors (e.g., military, biotech, and finance), allow Appen to command premium pricing. This shift helps balance its portfolio and improve margins by focusing on quality over quantity. The company has streamlined its workforce and improved operational efficiency, boosting overall productivity.

Appen’s Operational Excellency

Appen’s operations are focused on delivering high-quality data solutions that cause the development of artificial intelligence (AI) and machine learning (ML) models for some of the largest and most advanced technological companies globally.

The company’s core business involves data annotation, a process where raw data, including text, images, video, and audio, is labelled for the training purposes of AI models. With a huge global workforce of over a million contractors, Appen can focus on their core business on a massive scale. This provides quick and flexible services to its clients and thereby Appen stands as an industry leader in this field.

Appen’s strong global footprint allows it to source diverse datasets that are critical for creating and training relevant AI models. Its crowdsourcing network spans over 170 countries and supports over 235 languages. This significant feat allows the company to stand out from its competition.

Given the increasing concern over data ethics and privacy, Appen has included strong ethical guidelines and stringent compliance measures in its operations. The company strictly adheres to GDPR and other global privacy regulations, ensuring that data is handled securely.

Appen is gradually moving into supporting non-tech sectors that are rapidly adopting AI. Prominent sectors include retail, education, and customer service where Appen’s services are transforming their operations. This diversification strategy aligns with Appen’s goal to expand its operations beyond just tech giants.

Is it Too Late to Get In?

Appen’s recent stock surge and financial restructuring are attracting both new and seasoned investors. The company shows promising potential for investors to consider.

With AI technologies on the rise and its demand only seems to increase in various sectors, Appen is well positioned to gain from the ongoing need for operational efficiency. The company’s role as a leading provider will help Appen to sustain its growth.

As new companies adopt AI-based solutions, Appen’s data service centre is becoming crowded with more innovative solutions taking centre stage. If Appen strategically moved their coins, the company could see solid returns from the shift.

Appen’s recent trading rates are below its previous marks. This makes it an affordable entry point for investors looking to capitalize on the AI boom.

The Road Ahead: Should You Consider Appen?

While the initial signs of recovery are encouraging, Appen’s future success will largely depend on its ability to stay competitive. The company must continuously innovate to meet the evolving needs of the AI landscape.

As generative AI becomes more complex, Appen will need to stay relevant and provide meticulous datasets that can train systems in contextual and advanced understanding.

The company is already practising certain cost-cutting measures. It is however vital to sustain their processes in the same way for a long time to see long-term benefits.

Appen holds the potential to diversify further into new sectors. And if the company starts to tap into markets, it can significantly enlarge its current footprint on the market.

Appen also invests in research and development to stay at the forefront of AI and machine learning advancements. By exploring new data types and refining its annotation methods, Appen stays responsive to evolving industry needs, helping clients implement the latest AI technologies in their products and services.

For investors looking to capitalize on the ongoing AI boom, Appen can give exposure to the field of tech-based stocks. It is however crucial to consider your investment goals and measure your risk appetite to maintain a better investment portfolio. Investors need to conduct due diligence about the company and the market before making vital investment decisions.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

FAQs

- How is Appen’s cost-cutting impacting its growth rate?

Appen has taken significant strides in streamlining its operations without compromising on its service quality. This paved the way for the company to attain stable growth.

- Is it a good time to invest in Appen?

While Appen’s turnaround is promising, potential investors should assess both the AI market’s growth and Appen’s strategic positioning within it before investing.

- How does Appen identify new growth markets?

Appen caters to a wide variety of sectors with personalized AI solutions that holds the potential of transforming that company’s operations.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…