PhosCo (ASX:PHO) has a big night in Tunisia

![]() Nick Sundich, December 2, 2024

Nick Sundich, December 2, 2024

For years now PhosCo (ASX: PHO) has been labouring away at building a new phosphate mine in the small North African nation of Tunisia. The company discovered a phosphate deposit in the country which it called Chaketma way back in 2012 and the resource there currently stands at a not insignificant 146 million tonnes at 20.6% P2O5.

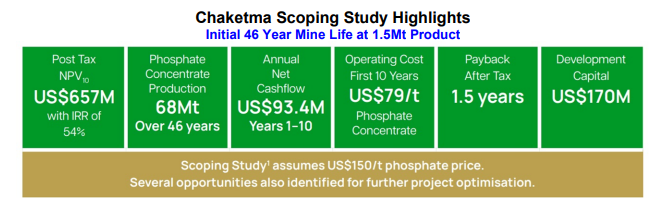

For a variety of legal and regulatory reasons, PhosCo has never been able to develop this project, even though a 2022 Scoping Study showed it to be a long-life, low-cost operation and put a post-tax NPV of US$657m on the project. We suspect many people familiar with the PhosCo story have given up hope of the company ever developing a mine in Tunisia. In late 2024, however, PhoCo may be closer to realising some serious shareholder value in Tunisia than those naysayers thought possible.

Source: Company

The reason is a transformational set of events which have taken place for the company in recent weeks, including the potential involvement of the European Bank of Reconstruction and Development. PhosCo was able to announce on 26 November that it had signed a non-binding Memorandum of Understanding with Tunisia’s Ministry of Industry, Mines and Energy as well as the EBRD to ‘collaborate on exploring and developing Tunisia’s Northern Phosphate basin’.

At the same time, it was announced that the Ministry granted to PhosCo a new Exploration Permit called Gassaat, pending official publication, which not only covers the Chaketma project, but also potential extensions to the Chaketma resource. Gassaat, and Sekarna before it, are both wholly-owned by PhosCo and mark the first time in Tunisia’s history that a phosphate exploration permit has been granted to a foreign company at 100%.

Source: Company

The scale of the PhosCo story has widened

The European Bank of Reconstruction and Development (EBRD) is important because that multilateral development bank, headquartered in London, has the resources that can potentially fund PhosCo’s mine down the track. The EBRD started life in 1991 and Tunisia is one of the jurisdictions in which it is highly knowledgeable. Indeed, the Bank has now funded in excess of 70 projects in Tunisia worth more than €2.3bn in total.

The November 2024 non-binding MoU paves the way for EBRD to assist with funding for a feasibility study and subsequently with a financing package for the development of a long-life phosphate project. PhosCo sees its relationship with EBRD as being highly strategic, bringing important in-country connections, project financing capacity and the possibility of parallel investment in government infrastructure to support the project.

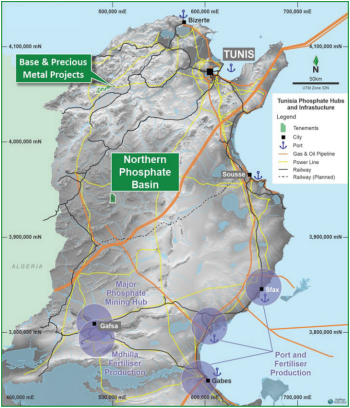

Then there’s the ‘Northern Basin’ part of the story. Tunisia has three major phosphate rock provinces: the Northern Basin, the Eastern Basin and the Gafsa Basin. To date most of the country’s phosphate production has come from the Gafsa Basin, which hosts the world’s fourth-largest phosphate reserve and is mined by a state-owned company. Gassaat lies in the Northern Basin with the recently approved Sekarna permit just 10km away. Development of the Northern Basin could see Tunisia build a sizeable phosphate rock industry that would allow the country to regain its position amongst leading global producers such as Morocco.

A new Permit with local support

Which brings us to the Gassaat Exploration Permit which the Tunisian government has just granted to PhosCo. The willingness of the government to issue this Exploration Permit, in addition to the Sekarna Exploration Permit, which was approved in October 2024 (both 100% owned by PhosCo), suggests that the larger Northern Basin approach has substantial support from the government as well as the EBRD. The government has so far declined to issue an Exploration Permit for Amoud, which sits next to a monster undeveloped phosphate deposit called Sra Ouertane. But encouragingly, PhosCo ‘remains in active discussions with the Ministry about this project ‘.

All of this suggests that PhosCo remains on track to ultimately develop a mine in Tunisia, and one potentially bigger than what was originally envisaged with Chaketma. PhosCo has the local knowledge and the relationships, including with local community groups in the Northern Basin that supported the Gassaat application and will likely have some kind of stake in the project. And the Northern Basin phosphate opportunity remains relevant to Tunisia as a project of national importance.

This project looks economical

Complicating matters slightly is the fact that phosphate rock prices in 2024 are lower than they were in 2022. Back in 2022 phosphate rock phosphate went over US$300 per tonne due to the disruptions caused by the war in Ukraine. The price dropped to about US$150 in late 2023 due mainly to lower demand, but, importantly, PhosCo priced its 2022 Scoping Study at just that price, which is still favourable given the Study used costs for the first ten years of only US$79 per tonne.

Also, many expect prices to stay above the historical average in the medium term, since the world’s top three exporters – China, the US and Morocco – aren’t greatly expanding supply. One of the attractions of Tunisia as a reborn phosphate rock exporter is that it offsets the power these three countries currently enjoy.

Even after the re-rate in late November 2024, PhosCo still has a low market cap. The November 26 announcement has revealed a company on the brink of a breakthrough with far-reaching implications that the market may not yet fully appreciate. This pivotal moment could mark the beginning of a new chapter for the company. Investors should keep this one on their watch list.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Paladin Energy (ASX:PDN) Jumps 10% as Revenue Surges Past A$177M

Paladin Energy (ASX: PDN) Surges as Uranium Producer Era Begins Paladin Energy (ASX: PDN) gave investors reason to cheer as…

Metal Powder Works (ASX: MPW) Falls 14% — Growing Pains or a Setup for Long-Term Gains?

Metal Powder Works Plunges 14% as Growth Story Faces Reality Check Metal Powder Works (ASX: MPW) took a sharp fall…

Blinklab (ASX:BB1): Is this exciting company the next ResApp?

Blinklab (ASX:BB1) is the answer to the question of how you could help children with autism – a response that…