Patriot Battery Metals (ASX:PMT): It has a 4.88Mt lithium deposit, and Volkswagen just invested C$69m!

Patriot Battery Metals (ASX:PMT) has capped off 2024 in stellar fashion, unveiling an investment deal with Volkswagen.

Patriot Battery Metals will be 9.9% owned by Volkswagen

Not a non-binding MoU, not a ‘binding term sheet’, but a binding offtake and investment deal with Volkswagen (specifically its holding and financing company Volkswagen Finance Luxemburg S.A.). Volkswagen will invest C$69m to buy 9.9% of Patriot Battery Metals, paying C$4.42 per share which marks a 65% premium to the 30-day volume weighted average price.

Moreover, Volkswagen’s integrated battery manufacturing subsidiary will receive 100,000 tonnes of spodumene concentrate per year over a 10-year term. This represents 25% of Stage 1 production from its project in Quebec.

This may not be the end of it. Volkswagen will, after the release of a feasibility study for the project, have the opportunity to act as a cornerstone investor for further funding in return for additional offtake. There will be an advisory technical committee to support the Shaakichiuwaanaan Project on which Volkswagen and PowerCo will be represented.

The Shaakichiuwaanaan Project

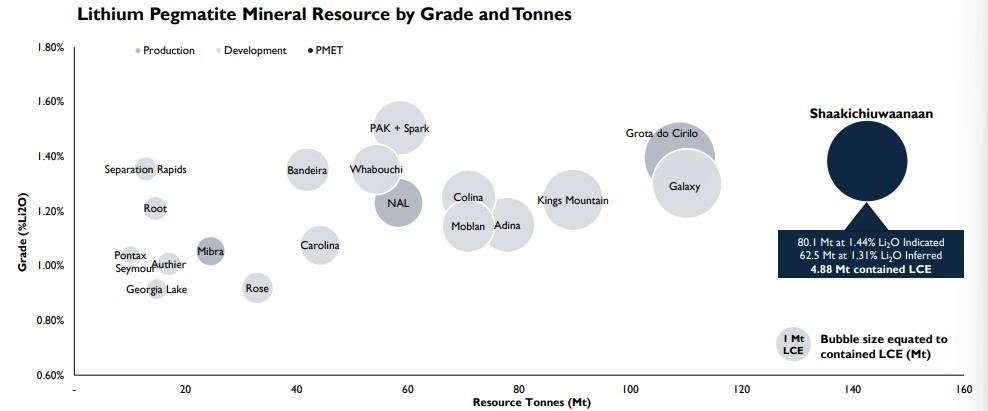

Patriot owns the largest lithium pegmatite/hard-rock resource in the Americas. It had 80.1Mt at 1.44% lithium indicated and 62.5Mt at 1.31% inferred for 4.88Mt lithium. None of the other neighbouring companies come close. Moreover, it is the 8th largest deposit in the entire world.

Source: Company

The project has existing infrastructure including a workers’ camp, fuel and water supply, as well as a road that will mean it will be accessible even in winter. This overcomes a major impediment that projects in Canada (particularly the north of the country) face. The environmental and mining approval processes are works in progress although a fair proportion of it has been done.

The company has continued exploration work even whilst defining a resource. It estimates an exploration target of 146-231Mt at 1-1.5% lithium and plans to undertake 80,000m of drilling over the next 12 months.

At the same time will plan for eventual production. At Stage 1, it anticipates 400ktpa extraction and a 2.5Mtpa plant. The next Stage will involve 800ktpa extraction and a 5.0Mtpa plant. The key to this will be accessing one high-grade underground zone that includes 21.8Mt at 2.1% lithium. There will need to be an expansion of existing infrastructure here. In the longer-term, Patriot envisions building a downstream processing business.

The company’s management includes former Pilbara executives Ken Brindsen, CEO, and Alex Eastwood, Executive Vice President. The pair took Pilbara from an exploration company to an ASX 50-producer. Its other executives boast experience in developing resources projects in Canada, as well as raising and investing capital.

A C$2.9bn post-tax NPV

A Preliminary Economic Assessment for Shaakichiuwaanaan showed a post-tax NPV of C$2.9bn and a post-tax IRR of 34% with a 24-year operating life. This only includes Stage 1 and Stage 2, and not the longer-term downstream business. It envisions capex of C$640m for Stage 1 with potential for Stage 2 to be funded through internal cash flows. It estimates a payback period of 3.6 year based on US$587/t. Inevitably this will be shorter if lithium prices rise.

Still some wait

Patriot is targeting a Final Investment Decision in 2027 and commissioning from late 2028. So there’s still some time for investors to wait to see those events. But hopefully, lithium prices will be in another bull market. After all, it has been a dour 18 months for the industry and there is little light at the end of the tunnel in the short-term. In the longer term, the picture looks a lot rosier, as demand is expected to take off in the 2nd half of this decade and faster than new supply is being bought online.

Nonetheless, the low-cost operation certainly doesn’t hurt this company’s causes, and it is why Volkswagen had faith in it. And it would not be too big a leap of faith for other investors to have faith in this company too.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…