Findi (ASX:FND): It’s quadrupled in 12 months off the back of financial services in India

Until Findi (ASX:FND) came along, there were practically no ASX companies making money from India (or at least not many of them). But not only has Findi ‘come along’, it has grown to a $200m company off the back of India, specifically its banking system.

Introduction to Findi (ASX:FND)

Findi is a banking company that runs ATMs and has a payments system FindiPay.

The company has built up its revenues and ATMs under management through M&A activity. The company’s history goes back to 2005 and it had a cybersecurity company for a number of years but sold that business to CyberCX at the end of 2020.

The company had a good year in 2024 because it substantially broadened its base. As of November 2024, it had a retail merchant network of 45,000 and ATM network of 8,000. In Findi’s most recent annual results (the 12 months to March 31 2024), it delivered $66.5m revenue, $27.4m EBITDA, $4m NPAT and $26.7m operating cash flows. The first of these figures was only 22% up from the year before, but the next two over 60% and the latter figure 472%. All but the first were ahead of the company’s guidance.

Findi has guided to $80-90m revenue and $30-35m EBITDA, for FY25, telling investors it remained on track in its half-yearly results in November.

A big opportunity

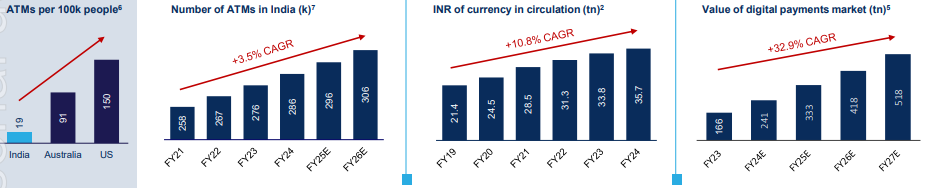

Obviously, India is an opportunity just because of its population – it is the largest country in the world with over 1.4bn. But more importantly, it has a significantly younger population than China. It has 36 trillion rupees of currency in circulation, a figure that has grown by a CAGR of 15% in 7 years.

The digital payments system is estimated to reach 518tn rupees by FY27, or $9.4tn, as cash is replaced by digital payments. Only 25% of the adult population is ‘banked’ representing a big market opportunity. Even amongst ATMs, there is an opportunity – the number of ATMs per capita is 4.5x less than Australia and the US.

Source: Company

2025 set to be big

Findi has begun 2025 by unveiling its latest acquisition – BankIT Services Private. It provides last-mile banking, financial, insurance and payment services in India. Findi will pay A$30m, $19.5m of which will be a net initial cash payment. This provides Findi with access to an extensive customer base with ~3m monthly transactions and A$3bn annual Gross Transaction Value (GTV). It is not the largest base. It has a 99.96% transaction success rate and has 130,000 retail merchants.

The company declared itself ‘the largest Pan-Indian phygital business’ – not a typo. It has told investors it is building a larger hub for financial services offering wealth management, bill payments, money transfer, forex, loan applications, insurance and government services.

And next year, the company intends to IPO its TSI India business on the Bombay Stock Exchange (BSE). This will make this company the only ASX companies that has itself or and subsidiaries listed in India. The company has indicated this will occur by the conclusion of next year, but the recent acquisitions could accelerate the timing. In the longer-term, it aims to become a full-service payments bank.

Conclusion

Findi is a company to watch if it can deliver on its objectives. OK, this can be said with any company. But there are hardly any others that are trying to make it in India, let alone have such positive momentum.

In our view, the only potential concern could be potential regulatory hurdles – the very reason not many ASX companies have targeted India is because of the red tape in that space. And putting India to one side, it doesn’t matter where you do business if you’re in banking…it is a highly regulated industry.

Keep your eye on this company as a potential growth opportunity in 2025, but of course don’t put all your eggs in its basket.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

EOS (ASX: EOS) Crashes 46% From All-Time High After Short Seller Attack- Buying Opportunity or Time to Run?

Electro Optic Systems (ASX: EOS) has been placed in a trading halt at A$6.00 after falling roughly 33 per cent…

Lotus Resources (ASX:LOT) Drops 28% After $76M Raise- Is the Dip a Buy or a Dilution Warning?

Lotus Resources (ASX: LOT) shares fell sharply on Friday, dropping 28% from A$2.88 to A$2.08. The fall happened after the…

Amazon (NASDAQ:AMZN) Down 9%, Is Capex Becoming the Story?

14% Sales Growth, 128B Spend, Now What? Amazon has fallen about 9%. While we are holders of the stock, when…