Capstone Copper (ASX:CSC): Exposed to the growth commodity of the 2020s

Capstone Copper (ASX:CSC) wouldn’t come to mind when thinking of the ASX’s major miners. But it is capped at over A$6bn, is dual-listed on the ASX and TSX, is a member of the ASX 300, and is exposed to the growth commodity of the 2020s – copper. It boasts a portfolio spreading all over the Americas, its most recent annual production was 164,000t and it faces a future with higher production, but lower costs.

Overview of Capstone Copper (ASX:CSC)

Capstone is a classic ‘rags to riches’ story. It was born from the acquisition of the Cozamin copper mine in Mexico. It bought Far West Mining in 2011, which gave it the ownership of the Santo Dimingo copper project in Chile. And in 2013, it acquired Pinto Valley, directly from BHP.

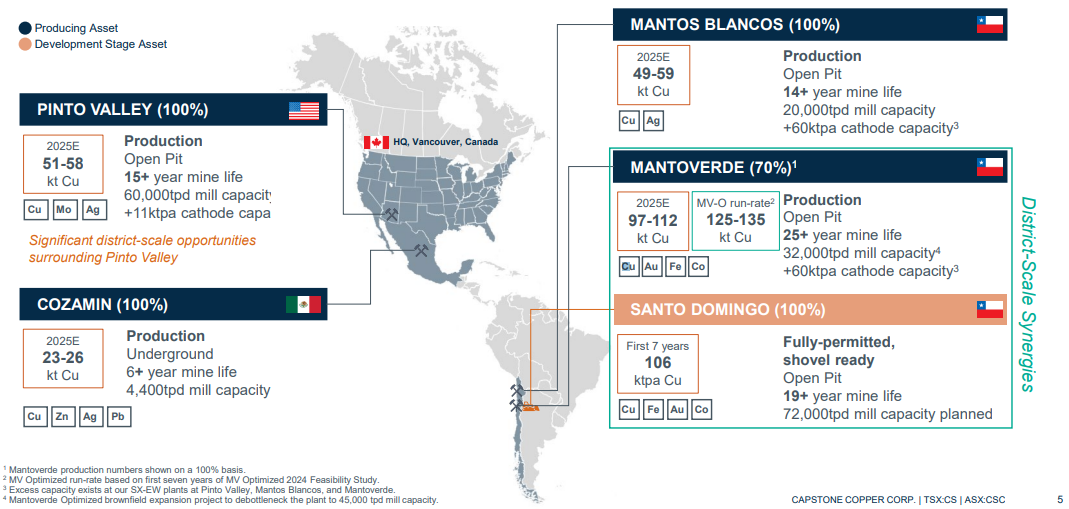

Right now, Capstone has 4 operating mines with a further mine being ‘shovel-ready’. Its corporate headquarters are in Vancouver. The company boasts $516m in liquidity – $377m in undrawn debt and $139m in cash & short-term investment. As we noted, it produced 164,000t in its most recent audited figures but is expected to deliver 184,000t in CY24. The company thinks it can get to 280,000t due to an upgrade of Mantoverde, and to 400,000t in the long term as Santo Domingo comes online. The upgrade of Mantoverde alone is expected to deliver a post-tax NPV of $2.9bn, $600m annual EBITDA and 120,000t of production over 25 years.

Source: Company

In the immediate term, the company is expecting 220,000-255,000t in 2025. But more importantly, the company is expecting reduced costs due to economies of scale. During Q4 of 2024, its C1 costs were US$255-2.60 per pound, but anticipates $2.20-2.50 for 2025. It will spend $25m in brownfield and greenfield exploration in 2025.

Copper will be the growth engine of the 2020s

Copper is a critical industrial mineral, both in respect of ‘conventional industrial technologies’ like in wiring, but also decarbonisation technologies such as in renewable energy systems and in electric vehicles. An EV uses nearly four times the quantity of copper compared to a traditional fuel-powered car. According to the International Energy Agency (IEA), the number of electric vehicles on the road is expected to reach 145 million by 2030. This will drive the enormous demand for copper in the coming years.

BHP reckons that copper demand will increase 70% by 2050. But it is not as if copper mines will come onto market at the same rate – in fact, many of the world’s renowned mines are ageing, most notoriously the Escondida mine in Chile. This will mean existing copper mines, particularly those that are big producers will be in demand and buyers will pay a premium. This is why copper prices are forecast for great things in the years ahead. UBS thinks LME copper prices will average $10,500 and $11,000 per metric tonne in 2025 and 2026 whilst it trades at just over US$9,000 now. There could be a deficit as high as 200,000 tonnes.

This demand is not just for copper itself, but also for copper companies – BHP went so far as to offer A$75bn for Anglo American, but still got knocked back. Capstone could well be a takeover target in the years ahead. It is a similar situation with ASX copper stocks. There is a shortage of pure-play copper stocks since Oz Minerals’ acquisition. This was a successful acquisition of BHP which paid $10bn about a year ago to take it over.

Conclusion

Capstone Copper could be the dark horse of ASX mining stocks, if not the entire market. With Oz Minerals now swallowed up by BHP, it is the best pure-play copper exposure amongst producing miners. But, who knows how long it’ll be before it is snapped up too by BHP given the copper crunch?

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Gold Slides After Trump Picks Kevin Warsh for Fed Chair

Trump’s Fed Pick Sparks a Rates Reset, Gold Reacts President Donald Trump has nominated Kevin Warsh to succeed Jerome Powell…

Here’s Why Gold and Silver Are Falling and What It Means for Your Portfolio

Here’s Why Gold and Silver Are Falling Gold and silver have been all over the headlines lately. Gold fell more…