Strickland Metals (ASX:STK): Another day, another intriguing ASX goldie; but this one has shovels in the ground in Serbia

Strickland Metals (ASX:STK) is the latest ASX goldie (i.e. ASX gold company) that we are taking a closer look at.

You may have observed we are looking closely at the gold sector right now, and you’d be right given gold stocks are in vogue for several months now – those who’ve been on Planet Mars can easily find out why gold has been on a tear here.

Of course, not all gold stocks are created equal, and it is worth taking a look at individual stocks. And we’re looking at Strickland. This is a company that hasn’t been on a tear with a 30% decline in 12 months, but it may be in a position to turn a corner relatively soon.

Strickland Metals: Focused on Serbia

Nearly two years ago now, Strickland solds its Millrose gold deposit in WA to Northern Star Resources (ASX:NST) for $61m. Not a bad return considering Millrose was only bought for $10m another 2 years prior. Then again, Strickland has build up a resource of 346,000oz by then.

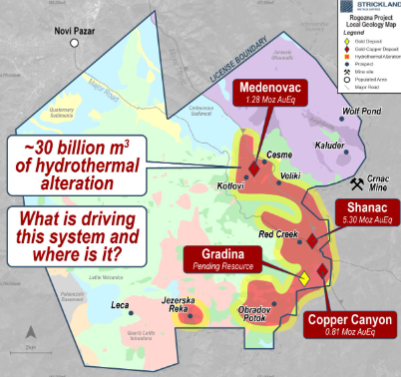

Nowadays, Strickland’s focus is on its Rogonza Project in Serbia and the Yandal Gold Project in WA. It is at the former where it is most advanced with 7.4Moz defined at Rogonza and 0.26Moz at Yandal.

Serbia is not the most popular destination for ASX-listed mining and resources companies, but there are a handful of them. And more important, Serbia is renowned amidst the broader global mining sector.

The country is Europe’s 2nd largest copper producer, is well positioned to supply metals into the European market, has existin mining infrastructure and has a number of gold miners too. Active miners include ASX-listed giants BHP and Rio Tinto, not to mention Dundee Precious Metals and Zijin – the latter is listed in China and capped at just under A$100bn.

Source: Company

There are other miners too, but Zijin is notable as it just invested $5m for a 2.4% stake. Strickland has stressed to investors that it did not need to raise capital, but thought the benefits of having Zijin on its register outweighed the dilutionary impact. As a matter of fact, this deal was completed at no discount to the share price.

Touching briefly on Yandal, the company has defined a modest resource and is targeting an initial eight-hole diamond program to start in early May 2025. It most recently updated its Mineral Resource estimate at the end of March 2025 off the back of drilling done in 2024.

This positions the company well for further growth. Keep in mind that this resource is bigger than Millrose, so Strickland could have a strong case to sell down the track, but likely wouldn’t settle for less than the $61m it received from NST for Millrose.

The next steps with Rogonza

Rogonza consists of 4 particular deposits close to each other. Between them, they host 199Mt @ 1.2g/t for 7.4Moz gold equivalent. The bulk of this lies at one particular deposit Shanac with 5.3Moz gold equivalent, including 1.85Moz of higher-grade resources. However, the company is confident there could be more between these deposits as it is all in the middle of 30 billion cubic metres of hydrothermal alteration.

Source: Company

6,000m of drilling is planned for the rest of 2025. The company plans as well for metallurgical testwork, mining, environmental & social impact studies as well as a further improvement of the resource model.

Conclusion

Strickland is one of the few ASX goldies to have missed out on the benefit of surging gold prices. But it may not miss out on it much longer if it executes on its planned objectives. In other words, if it finds more gold at Rogonza.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…