This Phase 3 ASX biotech is on the brink of unlocking market opportunities worth a cumulative US$9.1bn

Recce Pharmaceuticals (ASX:RCE, FSE:R9Q) is a Phase 3 ASX biotech that is close to unlocking its market opportunity. It is expecting to complete its Phase 3 trials during FY26 (the 12 months starting on July 1, 2025), and success here would lead to unlocking of market opportunities worth a cumulative US$9.1bn. Specifically, the global DFI (Diabetic Foot Infection) market which is worth US$5.2bn and the global sepsis market which is worth another US$3.9bn.

Reintroduction to Recce Pharmaceuticals (ASX:RCE) and R327

Recce is a biotech drug development company, based in Sydney, that is developing anti-infective treatments for infections caused by superbugs. Examples include sepsis, Urosepsis infections, Diabetic Foot Infections (DFIs) and Burn Wounds. Many of these conditions are extremely hard to treat, as bacteria has evolved to resist conventional antibiotics.

Many of these have millions of annual cases annually and high deaths. In the case of sepsis, for instance, there are 48.9m cases annually and 11m deaths – more than deaths from prostate cancer, breast cancer and HIV/AIDs put together. The average hospitalisation cost is more than US$32,000. Looking at DFI, they occur due to intensive pathogens that can devastate the feet of diabetics. In fact, there is a one in six mortality within 1 year of infection.

Early treatment with an effective antibiotic is key to the outcome of patients with these conditions and this is where Recce has been seeking to make a difference. Its flagship drug candidate is RECCE® 327 (R327), currently being trialled in multiple formulations including as a topical gel and intravenous liquid.

It has a unique Mechanism of Action, working fast and continuing to work just as effectively with repeated use. Endurance is something existing antimicrobial solutions tend to stumble at, especially when bacteria mutate. Mutation occurs when the sequence of bacteria alters and one of the consequential effects can be resistance to antibiotics.

R327 is protected with a robust patent portfolio and has proven to be capable of being manufactured at scale and in an economically viable way – with the ability to complete 5,000 doses per week and with a 99.9% product yield.

Where Recce is at

As of May 2025, Recce’s key focus is a 300-patient Phase III trial for Diabetic Foot Infections (DFIs) in Indonesia which is set to start shortly. Success here could see R327 commercialised in Indonesia and the broader ASEAN region in CY26.

The biggest news from the company so far this calendar year, has been the success of its Phase 2 ABSSSI Clinical Trial (Acute Bacterial Skin and Skin Structure Infections) which showed 93% efficacy. A Phase III study in ABSSSI in Australia is planned in the coming months, the company has undertaken a $15.8m capital raising for this purpose which could leave it with a $17.7m cash balance, not counting an anticipated $8.5m R&D rebate in Q4 of this year.

Other positive news has included a Cooperative Research and Development Agreement (CRADA) with the United States Army Medical Research Institute of Infectious Disease (USAMRIID), the US’ Leading BSL-4 Biodefence Laboratory. The deal will see R327 tested against a panel of biodefence pathogens in USAMRIID’s established in vitro models. Recce is additionally supported here by a recently received US$2.2m grant from the US Department of Defence for R327’s ongoing testing against Burn Wound Infections.

Recce Pharmaceuticals: A Phase 3 ASX biotech with US$9.1bn in market opportunities

Recce has an enormous addressable market. The market for Diabetic Foot Infection is US$5.2bn according to GrandView Research. The market of Indonesia alone is US$189m, a market where DFI impacts 11% of the population. Moreover, the broader Asia Pacific market is US$1bn per year, and approval in Indonesia could unlock this quickly, even if western markets like the US might take a couple more years following ASEAN approval to unlock because of differing regulatory protocols.

The sepsis market is worth another US$3.9bn and is expected to reach US$5.6bn by 2030, representing 6.18% CAGR growth. The Australian and US markets at US$1.5bn between them. As we noted, there are few (if any) effective treatments for sepsis and DFI. And so the markets are ripe for the taking for a company such as Recce with a legitimate solution.

Recce has also told investors that the estimated value of significant additional opportunities in the broader anti-infectives market could be up to US$135.4bn. This may include burn wound infections, skin and soft tissue infections post-operation.

Conclusion: An exciting 12 months await

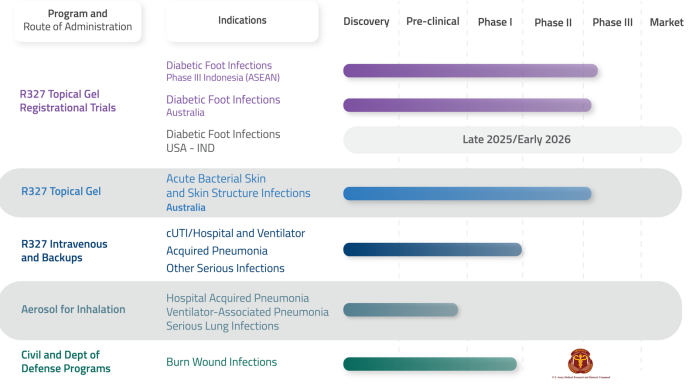

Beyond the two Phase 3 trials set to imminently commence: the Indonesian DFI trial and ABSSSI trial in Australia; there are another two Phase 3 trials to get underway in the next 12 months – DFI trials in Australia and the USA. The company will also continue its other clinical programs, including its program with the US Department of Defence for Burn Wound Infections.

Source: Company

Pipeline Overview:

- Approval received from the Indonesian Drug and Food Regulation Authority, Badan POM, to initiate its Registrational Phase 3 clinical trial in Indonesia;

- ABSSSI includes postoperative infection, wound infections and diabetic foot infections;

- Completed pilot civil Phase II Burn Wound Infections Study; US$2M grant for Department of Defense pre-clinical pipeline in progress; and

- Cooperative Research and Development Agreement signed with US Army Medical Research Institute of Infectious Diseases, to test R327 against biothreat pathogens in established in vitro.

Recce is a biotech that investors should pay attention to!

This is a sponsored article.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Capstone Copper (ASX:CSC) Hits Record Production Despite Chile Strike: Is This Copper Giant a Buy?

Capstone Copper Achieves Record Production Despite Strike Capstone Copper (ASX: CSC) jumped 7% to AU$15.63 on Friday after the company…

1414 Degrees (ASX:14D) Surges 20% on AEMO Approval: Is This $9M Energy Stock a Buy?

1414 Degrees wins AEMO approval for Aurora battery link 1414 Degrees (ASX:14D) jumped 20% to A$0.030 on Friday after getting…