AuMega Metals (ASX:AAM): At the centre of Canada’s latest gold rush

It has been nearly a year since Matador Mining changed its name to AuMega Metals (ASX:AAM).

This company may at first glance appear to be just another gold explorer in Canada – a less risky bet than lithium right now, but more risky than established miners. And any suggestion of a ‘gold rush’ may make sense in the context of gold prices and envisioning investors piling into gold stocks (which is happening), but not in the sense of 19th-century gold rushes which involved a ‘rush’ of people and companies seeking to create wealth from mineral discoveries.

What many investors may not realise is that even though Canada is well established, the province of Newfoundland is not – at least not so much as mainland provinces. Moreover, there is a need for more gold mines – there’s limited ‘low-hanging fruit’ which is why any ‘fruit’ to be found gets picked up. These are where AuMega has an opportunity.

There’s a need for more gold mines

The last gold ‘crash’ occurred in the early 2010s after the peak in the post-GFC cycle. This led to a significant degree of cost-cutting and write-offs. Companies like Kinross and AngloGold Ashanti have seen huge drops in their reserves since 2012. Some have increased their reserves, but only through M&A activity. It is difficult to find assets, especially in tier-one jurisdictions like Canada.

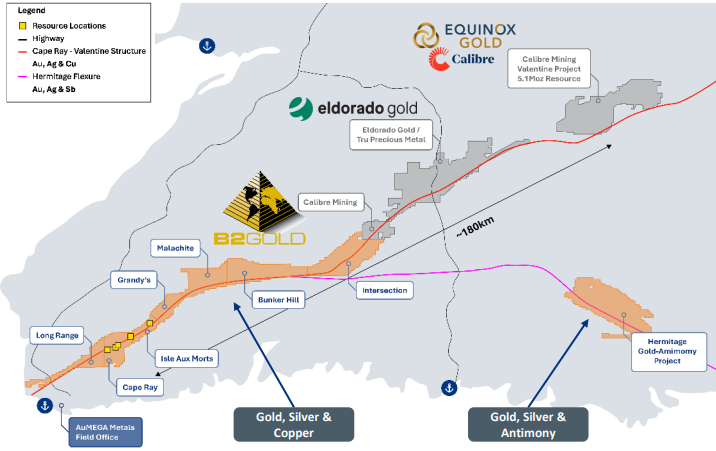

But Canada’s easternmost province, Newfoundland (which lies right off Canada’s east coast), isn’t as established a mining jurisdiction as the rest of the country. This is why the major miners are looking to this region, partnering with companies and even acquiring them. Companies working in the region include B2 Gold, Eldorado Gold and Calibre. The latter’s project has over 5 million ounces. But only a few of these companies have a formal resource, and most of them have been focused on deposits in the Cape Ray area.

Source: Company

What’s unique about AuMega Metals (ASX:AAM)?

First of all is the company’s management. It has a diverse mix of geologists and financial professionals. For instance, Chair Justin Osborne was at Gold Road and played a major role in the Guyere discovery. And CEO Sam Pazuki has 20 years’ experience in corporate development, consulting and engineering in the context of mining and energy.

It has 3 projects (see above):

- Bunker Hill

- Cape Ray, and

- Hermitage (Gold-Antimony)

The bulk of the AuMega’s defined mineral resources have come from Cape Ray. The company has a resource of 450,000/oz as Indicated and 160,000/oz Inferred.

But it is Bunker Hill which has shown the most potential in recent months. AuMega told investors last month it returned one hole that was 417 ppb gold average over 6 metres, the strongest result to date. The company is using bottom-of-hole (BOH) and base-of-till (BOT) methods. These are uncommon in Canada, but more common in Australia and have led to major gold discoveries (including Hemi and Gruyere).

The result at Bunker Hill could well represent a pivotal moment if follow-up drilling confirms this. The company has C$13.1m in cash, funding it well for the upcomng summer drilling campaign. Drilling at Bunker Hill will resume in mid-July and a 5,000-metre diamond drill program will commence at Cape Ray in June.

Conclusion

Resources exploration plays are always a risky investment prospect – the company will do or die based on its exploration results.

Nonetheless, companies with the right management team and focused on an established jurisdiction are worth considering ahead of companies that lack these factors and AuMega is one such company with those 2 traits. Add into the mix how hot gold is going right now, as well as the need for new mines, this company presents itself as an appetising prospect.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Imricor Medical (ASX:IMR) FDA Approval Ignites Shares, but the Real Test Starts Now

FDA Approval Is a Big Win, Not the Finish Line Imricor Medical (ASX:IMR) received FDA clearance for its Vision-MR diagnostic…

How Nuclear Energy Became the World’s Most Feared Energy Source

Why Nuclear Energy Still Scares Us and What Really Went Wrong Many investors may remember periods when nuclear energy captured…

Dateline Resources (ASX:DTR) From 60c Highs to Hard Lessons

A Rare Earth Story the Market Loved Then Questioned For investors who have followed Dateline Resources (ASX:DTR), the past year…