Adavale Resources (ASX:ADD) wants to be a Lachlan Tiger!

The acquisition that Adavale Resources (ASX:ADD) made back in November 2024 was nothing short of masterful. This junior explorer announced that it had picked up 354.15 sq km of gold and copper prospective ground out near Parkes in western NSW, around 350 km west of Sydney.

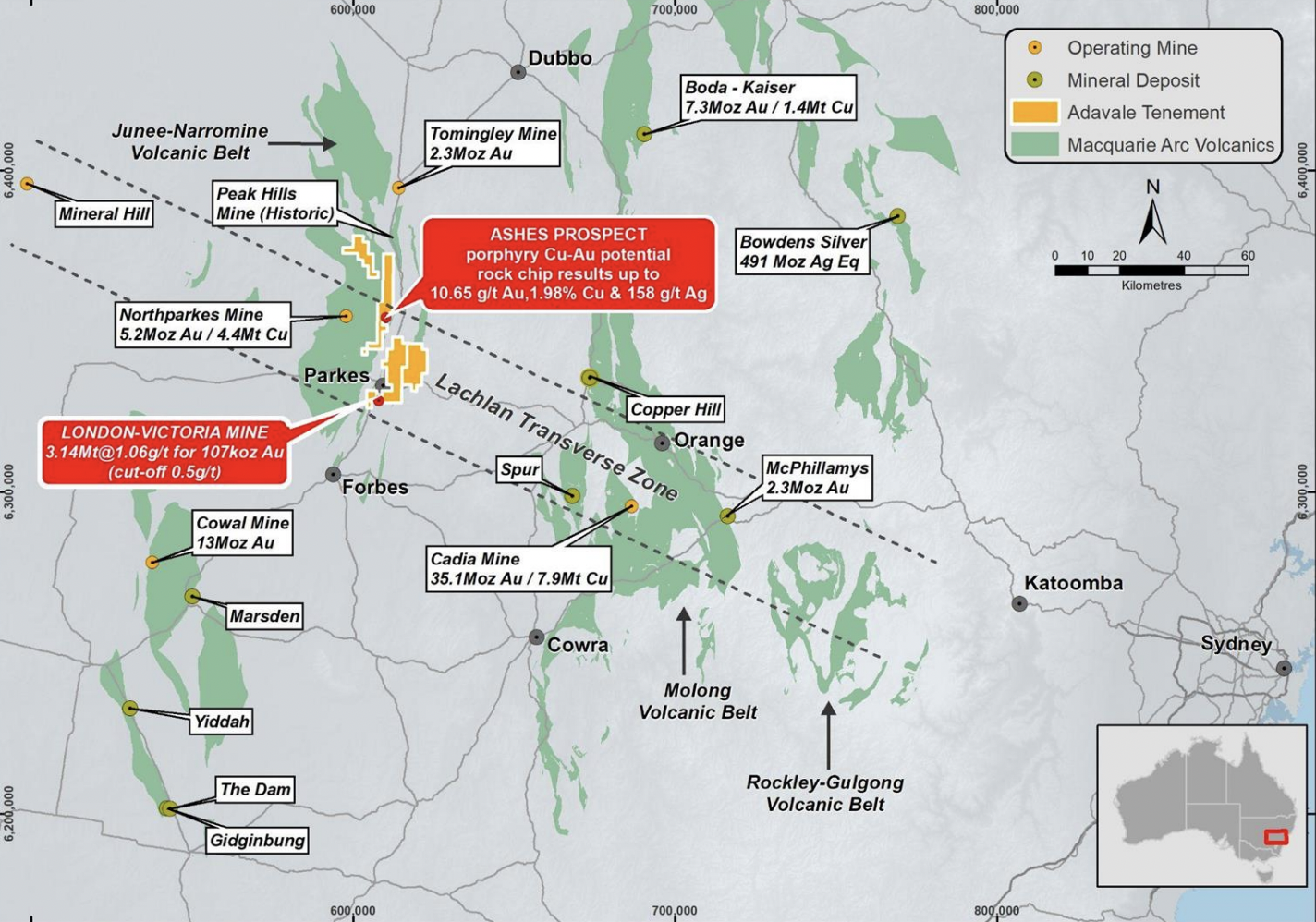

The licenses sat between three of Australia’s largest gold/copper mines: Newmont/Newcrest’s Cadia and the Northparkes and Cowal mines of Evolution Mining. The price? A mere A$900,000 in Adavale scrip, with the vendor betting that Adavale would re-rate considerably on the back of some solid exploration work. The transaction closed in January 2025.

Less than four months later, Adavale was able to announce a maiden JORC resource on one of the acquired projects, called London-Victoria. It was only 115,000 ounces of gold, but that was less than A$8 an ounce on the vend price. We expect there’ll be more where that came from.

Everyone loves the Lachlan Fold Belt

Adavale is now working in elephant country. Over the years the Lachlan Fold Belt has proved highly dependable in terms of yielding some great discoveries. The greatest of all was Cadia near the town of Orange, discovered in 1992 and now up to about 35 million ounces of gold and 8 million tonnes of copper.

Northparkes took a while to get going after its 1977 discovery, but the endowment these days is in the order of 5 million ounces of gold and 4 million tonnes of copper. Cowal with its 13 million ounces represents extensive exploration by North Ltd in the 1990s to understand where all that gold from the 1890s West Wyalong fields came from.

Source: Company

What interests investors about the Lachlan is that we don’t usually have to wait long for the next success to come along, because some company or another generally is kicking around in the belt in season and out of season. Moreover, once a mine is up and running, some major wants to buy it, which puts more money for future exploration back into the Belt.

The other notable feature of the Lachlan is that discoveries will often start small but then grow. That’s because a typical deposit sits under a lot of cover and doesn’t hit the big time until it is probed by deep drilling.

Adavale now has four licences in the Lachlan. There’s the aforementioned London-Victoria, which covers an old gold mine, and three other licences called Front Gate, No Mistake and The Dish. All abound in gold and copper targets. No Mistake covers a historic gold mine called Welcome where the average reported head grade back in the day was 11 g/t Au, but the mine has yet to be tested by modern exploration for depth or strike extensions.

London-Victoria Mark II

London-Victoria, just to the east of the town of Parkes and 20 km south of the Northparkes mine, had the misfortune of being developed by BHP Gold and Hargraves Resources when gold prices were miserable in the late 1990s. As a consequence, it only produced about 155,000 ounces before it was shut down in 1998. That left behind a lot of ore that is highly relevant at the gold prices prevailing in 2025.

No surprises then, that last month Adavale could announce an Independent Maiden JORC 2012 Inferred Mineral Resource Estimate of 115,000 ounces Au had been defined at the London-Victoria Gold Project. Within this estimate there is a higher-grade mineralised total of 3.14Mt with a not too bad 1.06g/t Au for 107,000 ounces.

And there’s likely more where that came from. Just a bit more drilling from the pit floor, and shallow drilling at that, lets Adavale potentially includes a whole bunch of ore the geologists are pretty sure is down there. Obviously some work needs to be done before the mine can restart but the fact that there are several processing plants in the region running below capacity suggests that the new London-Victoria will be capital-light.

Adavale Resources has multiple shots on goal

For the other projects, the one which Adavale is playing up is Ashes. It sits in the Front Gate area adjacent to the Northparkes mine. At Ashes the rock chip samples historically came back with assays like 8.8g/t Au and 19.2 g/t Ag; 5.5% Cu & 13.3 g/t Ag; and 1.5g/t Au, 84g/t Ag and 2.1% Cu. Adavale’s people have walked the ground again and got even better assays like the 10.65 g/t Au, 1.98% Cu & 158 g/t Ag, and the there’s an IP anomaly that a couple of historical drill holes narrowly missed and now Adavale think it can hit after the relevant IP geophysics were reprocessed.

Adavale now has multiple shots on goal with its project portfolio. As well as Parkes there’s still a potential company maker in 1,315 sq km of licenses near the massive Kabanga Nickel Project in Tanzania that BHP and an American company called Lifezone Metals (NYSE: LZM) are continuing to pursue.

Then there’s the 4,959 sq km uranium portfolio in South Australia, much of it acquired last year near ground staked out by serious players such as Heathgate Resources (the American owner of Beverley uranium mine and its current incarnation, Beverley 4 Mile), Tri-Star, FMG and Orpheus. However, we think in 2025 much of the running will come from Parkes, at both London-Victoria and Ashes.

The next Waratah Minerals?

At London-Victoria a maiden drilling programme is expected to start shortly will feed into the definition of an exploration target for Phase 2 drilling late in 2025. Ashes potentially could see the first hole targeting that IP anomaly, as well as more mapping and sampling to generate more targets.

Adavale is now target rich across the ground at Parkes, and doubtless we’ll be hearing more about prospects such as Myalls and Corner in the Front Gate license and Parkvale in the No Mistake license.

Adavale will be hoping that its acquisition of ground in the Lachlan Fold Belt will mirror that of Waratah Minerals (ASX: WTM) back in October 2023. The same vendors as those in Adavale’s recent transaction sold the company now called Waratah Minerals a project called Spur just 14 km from Cadia. Waratah stock was 3.5 cents at the time. Some good exploration results later, and Waratah is now a ten-bagger from that level.

Stay tuned.

What are the Best ASX Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

The Metals Driving Australia’s Market in 2026

Australia will still be a metals market in 2026; that part is not up for debate. What is changing is…

Patagonia Lithium (ASX:PL3) Surges 53% on Ameerex Partnership: Is This Lithium Explorer a Buy?

Patagonia Lithium Secures Key Partnerships for Growth Patagonia Lithium (ASX: PL3) surged 53% to A$0.13 on Friday, hitting its highest…

Aristocrat Leisure (ASX:ALL) Extends $750m Buyback: Time to Buy Australia’s Gaming Giant?

Aristocrat Leisure: A Compelling Investment Opportunity Aristocrat Leisure (ASX: ALL) rose 1.01% to A$57.22 on Friday after announcing a A$750…