Titanium Sands (ASX:TSL): Eagerly anticipating a long-awaited mining license for its mineral sands project in Sri Lanka

Titanium Sands (ASX:TSL) has been working on its Mannar Island Project in Sri Lanka for over a decade now. It has been a long wait for investors, but the wait might be nearly over. TSL is expecting a Mining License in the coming months, and to commence production in the back end of 2026.

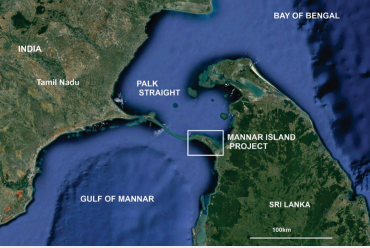

Titanium Sands’ Mannar Island Project

Mannar Island is off the north-western coast of Sri Lanka. It is an island that is connected to the Sri Lankan mainland by causeway. It is also 40km away from India.

The project consists of 69sqkm of predominantly underutilised land, with 5 exploration licenses across that space. There is local infrastructure in place including road and rail systems, accessible water and power too.

Source: Company

Over the last decade, Titanium Sands has dreamt of bringing this into production. The trouble is for much of that time, it has had to deal with the tumultous political situation as well as the pandemic. The good news is that both have come to end, and just at the right time.

TSL has found a JORC Resource of 318MT @ 4.17% THM, with one particular zone containing 82mt @ 6.03%. A 2023 Scoping Study found an NPV of $545m and IRR of 52% over a 20-year life. It would deliver revenue of $2b and EBITDA of $1.2bn over Stage 1, off the back of 4Mt per year. This would equate to 117,010t/year of ilmenite, 2,911t/year of rutile and 2,970t/year of zircon.

With much of the resource being at the surface, Mannar Island is a low-cost project. And it is targeting an important resource.

Mineral sands are important

Mineral sands is a broad term describing minerals usually found in sand deposits along riverbeds, coastlines and seabeds. Mineral sands are formed over a natural process that spans millions of years. These processes include erosion and weathering to form crystals.

When rocks containing these minerals break down (due to severe atmospheric conditions), these minerals are carried by the flow of river water and are eventually deposited along the coastlines. Over time, the lighter materials wash away, leaving behind concentrated areas of heavy minerals. These are the mineral sand deposits that we extract today.

Examples include ilmenite, rutile and zircon. The latter of these may be familiar to investors, becuse it has made Iluka Resources (ASX:ILA) a fistful of dollars. For Titanium Sands, zircon is one mineral present, but ilmenite will be most important.

The global ilmenite market is expected to grow at a 4.1% CAGR up to 2032, by which point it would be US$16.6bn. This market is driven by the rising demand for titanium dioxide – ilmenite is the most important use of titanium. And titanium is used in many industrial applications seeing rising demand including paints, coatings, auomotives and aerospace, with a focus on lightweight alloy applications.

The key door to be unlocked is the obtaining of a mining license

TSL hopes to obtain its Mining License in the coming months, with a more stable political situation compared to a few years ago, and positive signs from regulators. The company is also conducting environmental studies, and is seeking offtake and joint venture partners.

Although the project will have a payback period of just under 2 years, it will cost $122m to bring into production. Clearly, obtaining a license will be crucial in these regards – to finding partners who can provide at least some of the funding.

Investors could be forgiven for disregarding Sri Lanka as a destination for any resources developer or for disregarding mineral sands as an opportunity. But the opportunity is right here before investors’ eyes. There are few other developers trading at less than 2% of NPV, so close to production as TSL is.

What are the Best ASX stocks to invest in right now?

Check our buy/sell tips:

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Can AI predict future stock returns? Here’s what the statistics suggest!

Can AI predict future stock returns? Some might say yes, and even that artificial intelligence can outperform human analysts. Certainly,…

ASX Casino Stock Investment Analysis Guide

Investing in ASX-listed casino stocks demands a unique blend of market analysis and sector-specific insight. It is a high-stakes game…