Telix SEC Subpoena Explained: Why the Stock Plunged 31%

What Investors Need to Know About the Telix SEC Subpoena

What happens when a fast-growing biotech lands a major U.S. listing, then suddenly finds itself in the SEC’s crosshairs?

That’s the question Telix Pharmaceuticals (ASX:TLX) investors are now asking after the company disclosed it had received a subpoena from the U.S. Securities and Exchange Commission. The stock plunged nearly 20 percent in a single day, wiping hundreds of millions from its market cap.

The cause? A “fact-finding” request about whether Telix may have jumped the gun in calling one of its cancer therapies “Phase 3 ready” before getting full FDA sign-off.

What Telix Pharmaceuticals Actually Does: A Quick Company Overview

This article is going to focus on the subpoena and the sharp price drop, but first, it’s important to give context on what the company actually does.

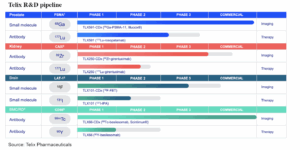

TLX is a biopharmaceutical company that makes medical treatments and medical imaging tools using radiopharmaceuticals, a type of medicine that combines radiation with drugs to help diagnose and treat cancer. The company is based in Melbourne, Australia, but operates in many countries, including the U.S., UK, Brazil, Canada, parts of Europe, and Japan.

TLX is working on a range of products, some already on the market and others still in development, all focused on helping patients with cancer and rare diseases where better treatment options are still needed.

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Why is the SEC targeting Telix, causing a 31% percent price drop from the 22nd of July

TLX has been making headlines lately, not for a breakthrough, but for something far more unsettling: a subpoena from the U.S. Securities and Exchange Commission.

As someone who has followed TLX closely, this caught my attention. After listing on the Nasdaq in November 2024, Telix gained access to U.S. capital markets, but also took on new disclosure requirements under SEC regulations. On July 22, 2025, the company revealed in its Q2 earnings that it had received a subpoena. Telix called it a “fact-finding” request, not an accusation, but the market didn’t wait. The stock dropped nearly 20 percent in a single day.

The issue?

Regulators are looking into whether Telix may have overstated the readiness of one of its prostate cancer therapies. The company used terms like “Phase 3 ready,” which usually implies the FDA has signed off on trial plans, but it’s unclear if that was actually the case.

Why Telix’s Stock Crash Might Be an Overreaction

What’s fascinating here is how quickly markets react to uncertainty. This is where understanding human psychology comes in. As investors, we’re often emotional and fear driven, especially when confidence is shaken, and Telix is a clear example of that.

After the SEC subpoena was announced, Telix shares dropped sharply, between 10 and 16 percent on the day, marking the steepest fall in almost two years. As of August 5, the stock is down around 31 percent since the announcement. Personally, I believe this reaction may be overstated.

This kind of move is known as a non-earnings correction, meaning it’s not about the company’s financial performance deteriorating, but rather external events affecting investor sentiment.

That said, it’s worth considering the worst-case scenario. If the SEC finds Telix guilty of misleading investors, a few things could happen. The company may face financial penalties, but unless there is outright fraud, those fines are typically manageable for a business of Telix’s size.

The bigger risk is reputational. If trust is damaged, especially among U.S. institutions, it could affect future capital raising and investor confidence, which in biotech is critical.

In short, while the headlines have caused a strong emotional reaction, the long-term impact depends on how the investigation unfolds.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…