TSMC: The ~TW$30tn company that’s the reason why China has an eager eye on Taiwan

![]() Marc Kennis, July 30, 2025

Marc Kennis, July 30, 2025

Have you ever heard of TSMC (Taiwan Semiconductor Manufacturing Company)? If you haven’t, there are good reasons why you should know about it.

Namely, because it is a major force in the world’s electronics supply chain. It produces over 50% of the world’s contract chips and over 90% of the world’s most advanced chips. Its key customers include Apple and Nvidia. And it is also why Beijing wants control of the island of Taiwan.

First published in October 2021, last updated in July 2025.

What are the Best ASX Semiconductor Stocks to invest in right now?

Check our buy/sell tips

Meet TSMC: Taiwan Semiconductor Manufacturing Company

TSMC is based in the Republic of China (Taiwan).

In that context, TSMC is Taiwan’s crown jewel. It is listed on the Taiwanese and New York stock exchanges (TPE:2330 and NYSE:TSM) and (as of late July 2025) is capped at TW$30tn which is US$1tn/A$1.5tn. It is worth 5 Commonwealth Banks, 7 Adobe’s and 4 Salesforces.

TSMC is a so-called semiconductor foundry that manufactures computer chips for other companies that don’t own their own chip manufacturing plant, or fab.

Think of consumer electronics companies, like Apple and Nvidia as well as a range of other companies in all sorts of sectors, including Automotive, Medical, Industrial and … Military! In some cases, the companies directly (like Tesla and Sony), but in other cases it is the customers’ customers. In other words, companies like AMD and Qualcomm buy the chips and AMD and Qualcomm’s customers get devices that AMD and Qualcomm assist in making.

All of these need semiconductors, such as those from TSMC – but remember that last sector as you read on.

In TSMC, China wants what Taiwan has

When the communists won control in 1949, the anti-communists fled mainland China and set up shop on the island. China has claimed that Taiwan, or Chinese Taipei as the Communists like to call it, has never ceased to be a part of Greater China.

Obviously, not owning Taiwan for the last 70 years or so has been a thorn in China’s side, especially since the country has been thriving as a free market economy. And for ideological reasons, Chinese president Xi Jinping wants the island back under Chinese control.

However, ideology is only part of the reason.

You see, in TSMC, Taiwan has something that China doesn’t, which is access to the most advanced semiconductor manufacturing equipment in the world. But more on that later.

From nothing to the world’s biggest fab in less than 40 years

TSMC was founded in 1987 by Morris Chang and was the first pure-play foundry. Chang served as CEO up to 2005 and chairman until 2018, founding the company after a >20 year career at Texas Instruments and had a brief stint as the head of Taiwan’s Industrial Technology Research Institute (ITRI), only starting the company as an ITRI spin-off.

ITRI had been founded in 1973 to help Taiwan develop its industrial and technological capabilities, using Japan and South Korea as playbooks. Semiconductor making was planned to be one of the pillars of this and Taiwan licensed a chip-making process from RCA.

ITRI had managed to build a full-scale production line that was high-yielding, but needed someone like Chang with commercial experience to succeed. Chang eventually agreed and won Phillips as an early business partner and joint investor (with the Taiwanese government being another).

The first customers were Taiwanese but its first non-Taiwanese customer was Intel, something that sent a strong signal to competitors about TSMC’s competence. Many others followed, finding not just that TSMC could do the jobs but they could get higher yields and save money by outsourcing chip making. The first factory was a repurposed ITRI building but the second was a brand new development that doubled capabity.

TSMC listed on the Taiwan Stock Exchange in 1994 and in New York in 1997. By 2000, it had five factories and was making 3 million a year. This company has always been at the forefront of chip innovation, which is basically having the chips smaller and smaller while storing more and more data, which means being able to do more and more things.

Today, TSMC is leading the way in chips ramping down to 3nm and down to 2nm. In the 2000s, it led the way in sizing chips down from 130nm to 40nm, which made smartphones possible. In turn, smartphones led to rapid growth. Today, TSMC’s key 2 customers are Apple and Nvidia. And it will be opening a US fab in the next 12 months.

While Chang has retired, he turned 94 in July 2025 and has a net worth of over US$5bn according to Forbes. But let’s go back to the 1980s and 90s for a moment.

Less and less nanometres are the key, but its easier said than done

When we say nm we mean nanometres which is the linewidth of the chip circuitry. A nanometer is one-billionth of a meter and is about the length that your fingernail grows each second.

A strand of human DNA is about 2.5 nm in diameter and a human hair is roughly 100,000 nm wide. So, you’d likely agree when we say that a nanometer is pretty small.

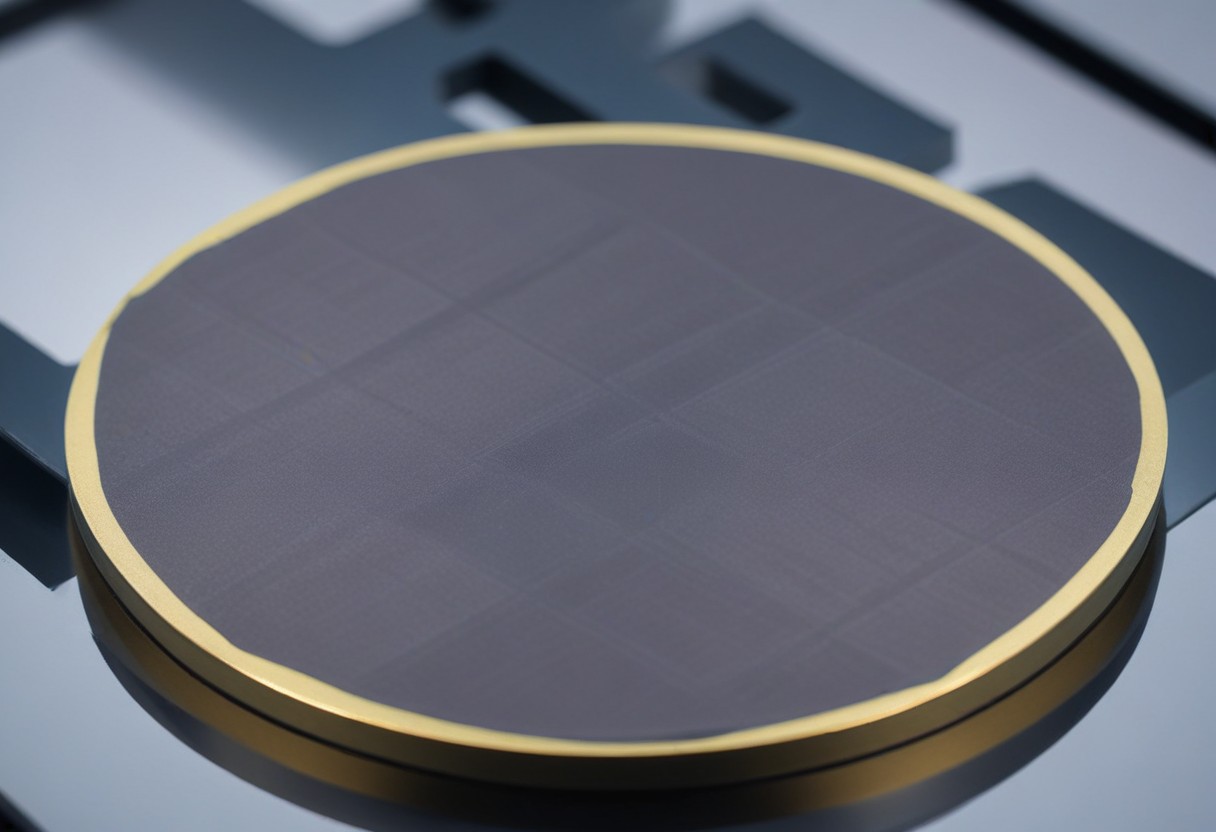

Semiconductor wafer

In order to create chip circuitry, a semiconductor wafer needs to go through a very large number of process steps.

The most advanced computer chips require around 700 steps as the chips are built up layer by layer. With up to 75 layers for advanced chips, this process typically takes around 3 months.

While each production step is advanced in itself, the most critical part of chip manufacturing is the so-called lithography step.

This is where the circuitry of a specific layer gets “printed” on the wafer by shining laser light through a so-called photo mask that contains the design for that layer.

Think of it as an old-fashioned slide projector where the beamer is the source of the laser light, the slide is the photo mask with the chip design and the white screen is the semiconductor wafer.

Once the circuitry is projected on the wafer, the circuitry layer is “developed” through further process steps before going into another round of lithography until all layers have been built.

The secret sauce

Following Moore’s Law, chip resolutions have shrunk quite dramatically in the last 20 years. And with shrinking chip sizes came the requirement for different light sources like Extreme Ultra Violet (EUV). There are companies trying to keep up but just cannot match TSMC.

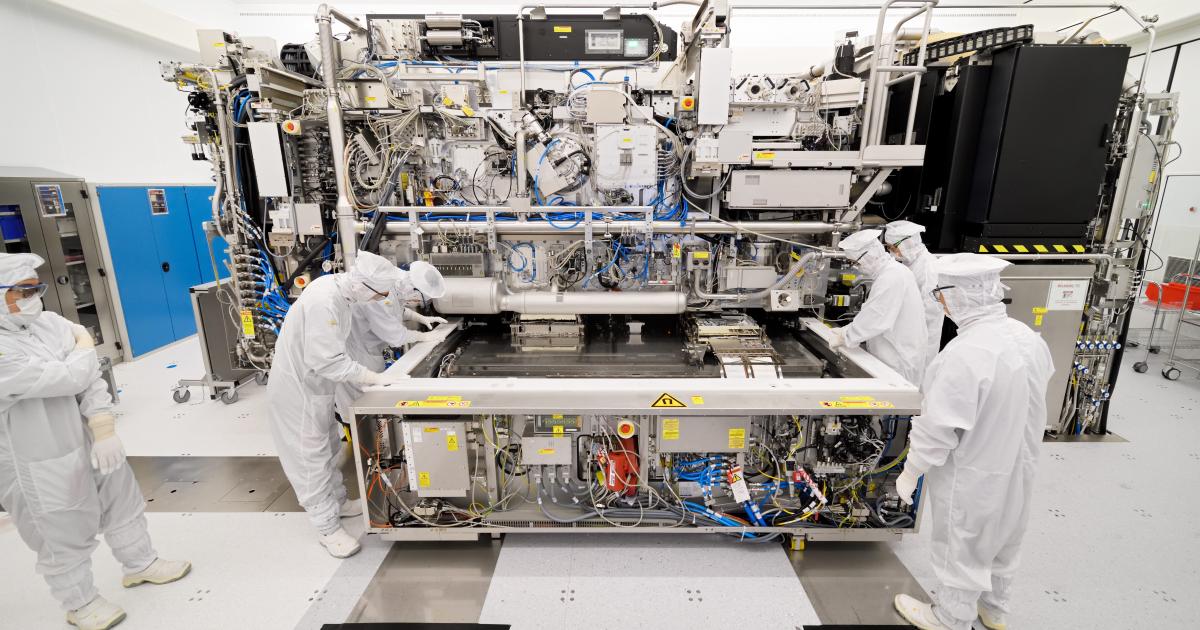

Arguably the closest is ASML (AEX:ASML) from The Netherlands which has arguably better machines than TSMC but doesn’t have the same expertise as TSMC.

In 2012, TSMC, Samsung and Intel invested a combined US$6.5 billion in ASML enabling the company to accelerate its research into EUV systems. The investment has paid off, not only through the meteoric rise of ASML’s share price, but also because these three amigos had early access to EUV systems. In turn, this has allowed them to stay ahead of the curve, especially TSMC and Samsung. Intel has dropped the ball in the last 10 years, but that’s a story for another time.

Because an EUV lithography system costs about US$130 million, only a select few companies can afford to buy them. But money is not the only obstacle – geopolitics is too.

Remember we mentioned the military as an important sector for semiconductors? As weaponry and surveillance systems get more advanced, the requirements on their individual components goes up too, including computer chips.

Rockets, drones, fighter jets, satellites, decryption systems, opto-electronics systems, to name a few, all require increasingly advanced semiconductors.

And when you add a layer of Artificial Intelligence (AI) to these systems, it is clear that tomorrow’s computer chips will all require EUV lithography and other advanced mechanisms, because they need to scale down well below 10 nm to allow for more powerful, faster and more energy efficient chips to do all the things AI could do.

An ASML EUV system being assembled

The next big thing

TSMC is building a presence in the USA, specifically in Arizona. The plans were unveiled in 2020 and the first of multiple fabs is expected to begin producing in the coming months. The initial investment was US$40bn, the largest foreign direct investment in US history and came with US government support. The first fab will make 4nm chips but eventually make 3nm chips (at the second fab).

In March 2025, TSMC announced it was investing another US$100bn with 3 new fabs, two advanced packaging facilities and a major R&D team centre. Obviously this is so it can meet the needs of customers like Apple, Nvidia, AMD, Broadcom and Qualcomm. But Beijing isn’t too happy about this.

China wants Taiwan, but it wants TSMC more

In light of rising geopolitics, China wants its own semiconductor supply chain to power its own tech industry, doesn’t want to rely on the US and isn’t content with just being TSMC’s business partner. In our view, the Dutch governments decision pre-COVID to not grant ASML an export permit to sell EUV systems to China (at request of the US) was key.

China is now in a position where it can see and smell EUV systems working in TSMC’s fabs across the Taiwan Straight, but it has none of its own. And that doesn’t sit very well with Xi Jinping and his military advisers.

Not only is China unable to manufacture the most advanced semiconductors itself, the perceived renegades in Taiwan are manufacturing them and also selling them to customers around the world, including US-based defence companies.

For this reason, we believe that at some point, China will make a move on Taiwan. Probably not in the very near term, but we think military action within the next five years is quite likely as TSMC has become the plaything of the world’s largest powers.

What would this mean for TSMC? Well, its fabs at Taiwan could be at the least shutdown, or perhaps even damaged or destroyed. And there’ll be a chip supply crisis. Granted, this could be mitigated once its US fabs come online, but whether it can instantly replace Taiwan with no disruption to the supply chain will depend on when China advances.

What does this all mean for TSMC as an investment?

Well, it is complicated. Let’s recap all of the positives:

- It is the world’s largest chip maker

- It has an enormous supply chain and customer book

- Demand is only expected to go up and up as AI is adopted by its customers

- Despite its large market capitalisation, it is only at a P/E of 17.1x and a PEG of 0.9x for CY26.

- Analysts in Taiwan expect 17% share price growth in the next 12 months, and

- The company is diversifying itself by building a presence in the US.

On the other hand:

- Shares can be volatile day to day dependant on what President Donald Trump posts on social media,

- There is the risk of an invasion of Taiwan by China and even though the impact may be mitigated by TSMC haivng fabs in the US, there will inevitably be some disruption; and

- Chip-making is a high-cost industry

Plus there’s the usual complications of buying international stocks for Australian investors to face. It might make you reconsider an investment in TSMC, doesn’t it?

If you take nothing else from this article, keep an eye on TSMC if you invest in any tech companies whatsoever. In particular, new products it is developing and the progress it is making on its US presence. It could tell you where your own tech investments are headed, and perhaps even indicate if a Chinese takeover of Taiwan is close.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

- If China invaded Taiwan, what would that mean for TSMC?

TSMC’s fabs at Taiwan could be at the least shutdown, or perhaps even damaged or destroyed. And there’ll be a chip supply crisis. Granted, this could be mitigated once its US fabs come online, but whether it can instantly replace Taiwan with no disruption to the supply chain will depend on when China advances.

- Is TSMC a good buy right now?

It depends from investor to investor. There is growth potential in the long-term, but TSMC’s shares can be volatile and there is the risk of a potential Chinese invasion disrupting the company.

- Does Nvidia rely on TSMC?

Yes Nvidia is a major customer of TSMC, relying on it for GPUs and AI chips.

- Does Apple rely on TSMC?

Yes, Apple is TSMC’s biggest customer using it for chips for its iPhones, iPads and Macs.

- What semiconductors does TSMC make

It builds logic chips (i.e. GPUs, SoCs and AI processors), process nodes as small as 3nm and packaging technologies.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Sonic Healthcare (ASX:SHL) Still Compounding, Integration Is the Near Term Drag

The Quality Compounder, With a Margin Reset Under the Hood Sonic Healthcare is one of the ASX 200’s higher quality…

Zip Co (ASX:ZIP) Down 31% on a Strong Half, What Did the Market See?

Zip Co US Growth Story Is Working, Investors Fear the Mix Shift There was a lot of panic selling in…

Sports Entertainment Group (ASX: SEG) Doubles EBITDA and Upgrades Guidance – Is This Small Cap a Buy?

Sports Entertainment doubles EBITDA and lifts guidance Sports Entertainment Group (ASX: SEG) was in serious trouble two years ago. In…