The Gold Price in 2022 … about to break out!

![]() Marc Kennis, January 25, 2022

Marc Kennis, January 25, 2022

The gold price has held up nicely recently, but we think there’s more upside now that the inflation cat is out of the bag!

Bitcoin is not an inflation hedge

If the past two weeks in the financial markets have shown anything. It’s that Bitcoin (BTC) is not a viable alternative to gold as an inflation hedge. Falling from more than US$67,000 back in November to as low as US$35,000 this week, we think it’s safe to say BTC is not a “store of value” like gold.

Contrary to BTC, the gold price has held up pretty nicely around US$1,840 an ounce this week in all the recent financial market turmoil, with the US Federal Reserve (Fed) flagging stronger than earlier anticipated interest rate hikes.

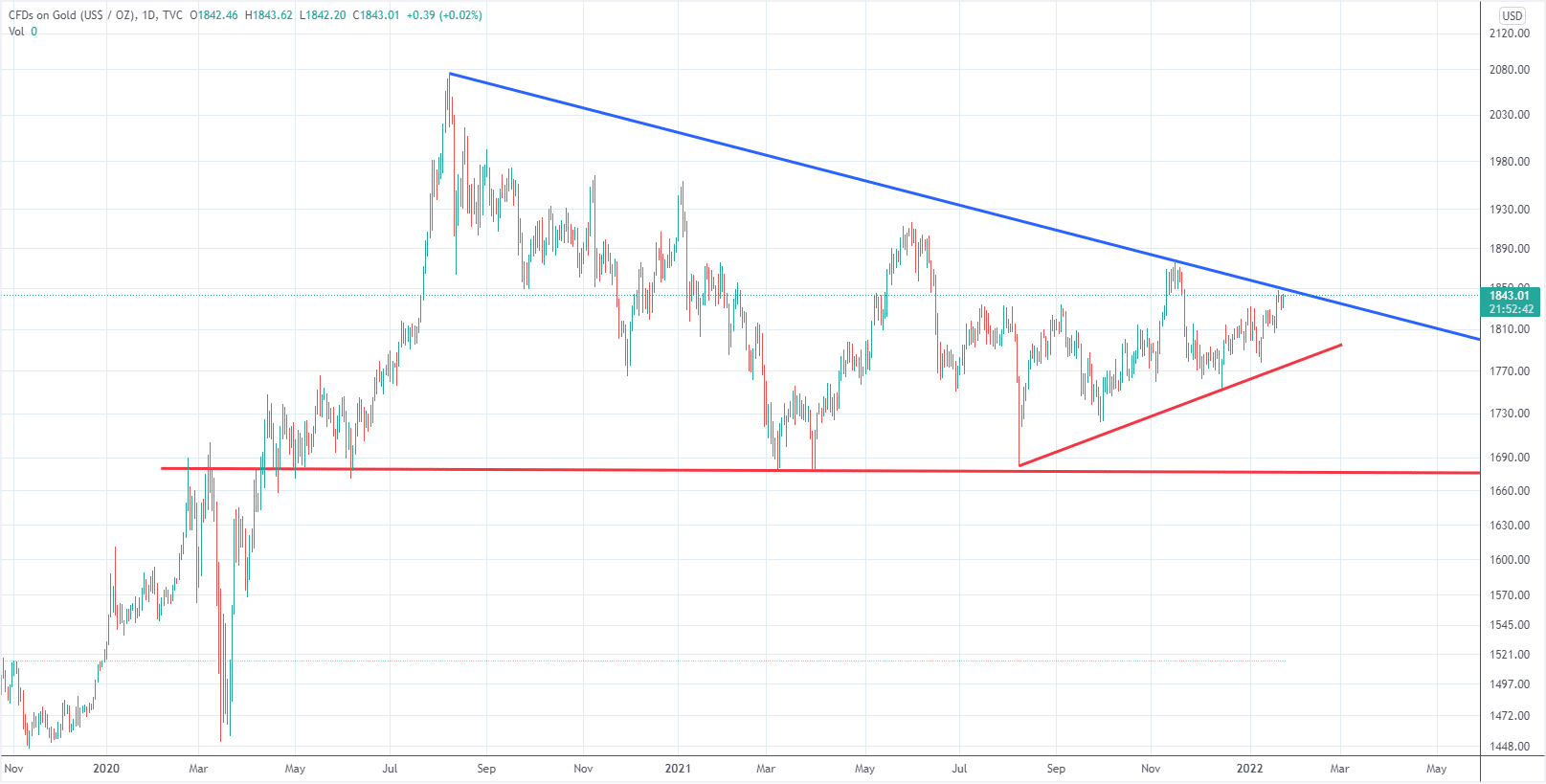

Gold price in USD from November 2019 (Source: Tradingview)

The Fed is behind the curve

As we have previously argued, inflation isn’t transitory and by now the Fed is well behind the curve when it comes to fighting inflation, in our view. The cat’s out of the inflation bag with the US seeing the highest inflation numbers in almost 40 years. December 2021 saw inflation accelerating to 7% with almost all components, except Medical Care Services, contributing to that number. In other words, it’s not just energy prices or food prices rising fast, it’s almost everything. And we see the same patterns all over the world.

We think it is going to be tough for the Fed to that get the current, COVID-induced, wave of inflation under control without killing off the economy. So, we expect inflation will be with us for a while longer.

The gold price … something’s got to give

In an inflationary environment, we expect the gold price to continue to do well with gold currently around US$1,840. Looking at the chart above, we can see that the red ascending short term trend line from August 2021 looks set to coincide with the medium descending trend line that started in August 2020.

Based on this chart, we expect material price action in gold by the end of March 2022 at the latest. We have been gold bulls for a while, so our money would be on an upward break out of this chart and, consequently, our money is on gold stocks. We expect to see gold to go above US$2,000 an ounce and will potentially see US$3,000 in the longer run.

Check out Resources Stocks Down Under for our favourite gold plays!

Subscribe to Stocks Down Under today!

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…