Regis Healthcare (ASX:REG): Who said aged care isn’t a sexy industry

![]() Marc Kennis, February 4, 2022

Marc Kennis, February 4, 2022

Regis Healthcare’s share price is making a come back

Regis Healthcare Limited (ASX: REG) provides residential aged care services in Australia. The company offers government-funded and private home care services as well as aged care services. It also operates retirement villages that provide retirement services. In addition, the company operates Regis Day Therapy Centers which provide a range of professional allied health services in areas such as physiotherapy and occupational therapy as well as rehabilitation services to people living in the community, in retirement villages and in low care facilities. In addition, the company offers Day Respite Programs for carers. As of June 30, 2021, the company owned and operated 65 aged care facilities. Regis Healthcare is based in Armadale, Australia.

Regulatory changes and the Pandemic are the biggest risks to the share price

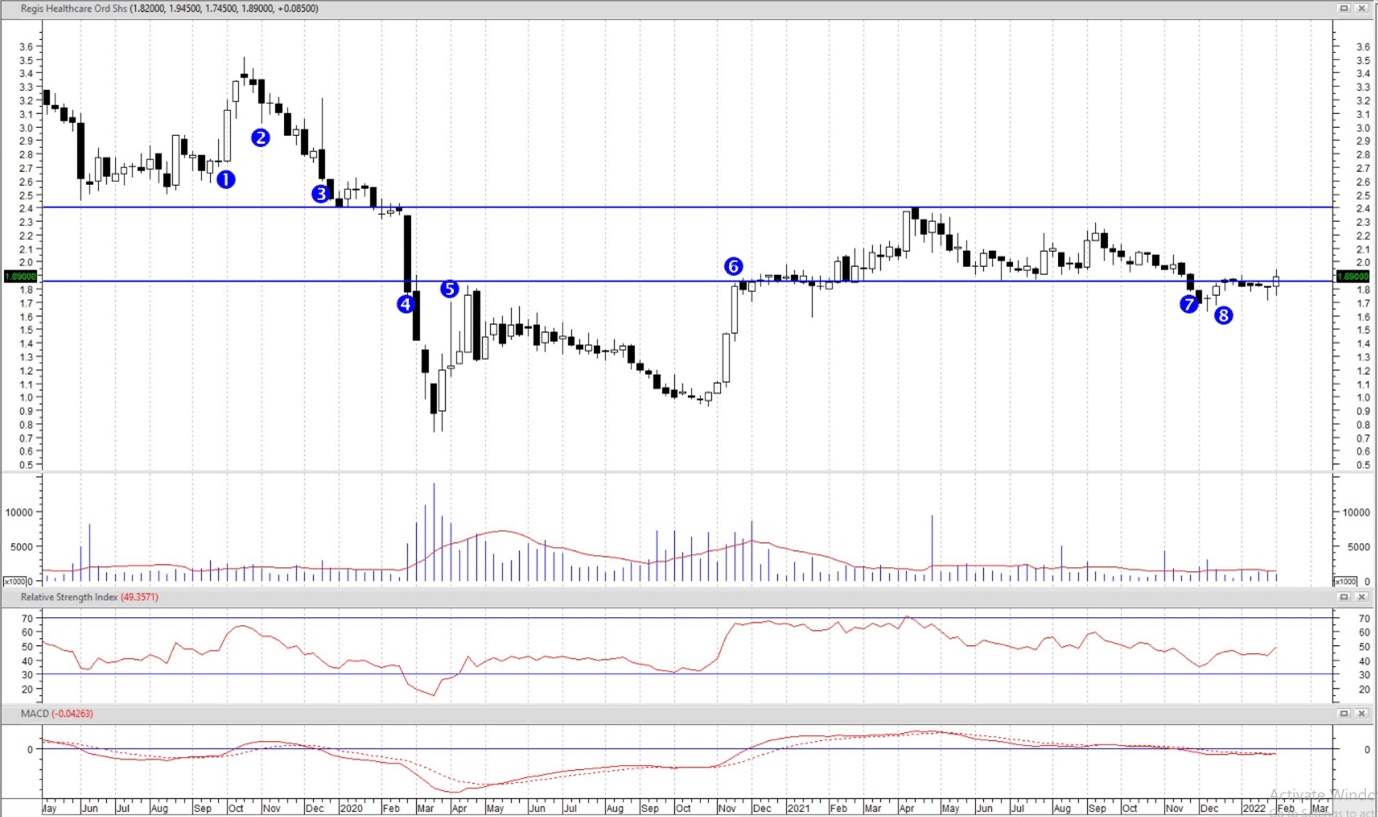

The following chart illustrates what has moved the share price since late 2019.

Regis Healthcare, Weekly Chart in Semi-log Scale (Source: Metastock)

❶ REG reports profits for FY19 within management’s guidance range. It also announces a 7.11 cent fully franked final dividend for a total of 15.3 cents for the year.

❷ The Royal Commission inquiry into the aged care industry released a report, strongly criticising care of the elderly and vulnerable, raising expectations of a far-reaching regulatory overhaul.

❸ REG downgrades its FY20 guidance due to continued challenging industry conditions.

❹ Results for 1HY20 show significantly lower profits on the year-over-year basis. This was mainly due to increased costs and stagnant government funding.

❺ REG withdraws its earnings guidance and defers the interim dividend due to the uncertainty caused by the COVID-19 pandemic.

❻ REG rejects an acquisition proposal at $1.85 per share.

❼ Omicron outbreak deals another blow to the share price.

❽ REG’s announcement shows that new regulations and the government’s 2021-22 budget present opportunities to the company.

This techno-fundamental analysis shows us that major risks to REG’s share price are regulatory changes and the ongoing pandemic. We also learned that the underlying business is well-established and attractive at the right price, as shown by the acquisition offer.

The acquisition offer has defined a strong bottom for the share price

The acquisition offer by Washington H. Soul Pattinson Limited and Ashburn Pty Limited to purchase all shares of REG at $1.85 per share in an all-cash offer (point 6 on the chart) put a strong support under the share price (the lower blue line on the chart). This support level was able to hold until the outbreak of the Omicron variant, which hit REG’s business (point 7).

The announcement regarding the impacts of government funding changes on 13 January 2022 (point 8 on the chart) made clear what the latest impact of the regulatory changes and government funding to REG’s business is. According to REG’s announcement, these changes will have no cash impact on the business and present new opportunities for REG to further expand its business in geographic areas not open previously.

We believe this announcement to a wide extent removed the regulatory risks to REG’s business and helped the share price move back above its support level at $1.85.

The stock looks cheap on consensus EBITDA estimates

The sources of revenue and costs in REG’s financial statements are normally well-defined and therefore easy to estimate with reliable accuracy. This makes consensus analyst EBITDA estimates quite reliable. The shares are currently trading at EV/EBITDA multiples of 4.8x and 4.5x for FY23 and FY24 respectively, implying the market is expecting EBITDA growth of 5.5% and 5.9% for those years. This is solid for a well-established company that normally pays fully franked dividends with dividend yields around 4%.

The risks

We believe the main risk to REG’s profitability is the ongoing pandemic. The impact of COVID-19 has already been reflected in the share price. But any further disappointing news regarding the spread of the virus or potential new variants could hit the share price, in our view.

The Royal Commission inquiry and the government funding for the aged care sector have been finalised and no longer pose any significant risk to the share price, in our view, at least in the foreseeable future.

Our suggested action plan

With government risks settled and the easing COVID situation, Regis Healthcare stock seems to be attractive at prices near the support level at $1.85. We think the share price can go back to the pre-pandemic levels around $2.40 (the upper blue line on the chart), which implies approximately 30% upside….pretty sexy in our opinion!

The polls so far are favouring the Labor party in the oncoming Federal election. Labor is likely to assign better funding to the aged care sector and a victory in the election would be good news for REG.

The latest low at $1.63 can be used as a stop loss level. This price was recorded during the peak of the Omicron outbreak. Any drop in the share price lower than this level indicates significant issues with the underlying business.

Stay up-to-date on ASX-listed stocks!

Make sure you subscribe to Stocks Down Under today

No credit card needed and the trial expires automatically.

Frequently Asked Questions about Regis Healthcare

- Does pay Regis Healthcare pay a dividend?

Yes, the company pays a 7 cent fully franked dividend for FY22.

- Where is REG headquartered?

Regis Healthcare is based in Armadale, Australia.

- How many beds does Regis Healthcare have?

REG has 7,000 operational beds across its facilities.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…