Adobe (NDQ:ADBE): The 43-year old company behind PhotoShop and PDFs may have an even richer future ahead, driven by AI

Outside the so-called Magnificant Seven stocks, Adobe (NDQ:ADBE) is one of the most well-known by investors, as well as the most-used. After all, it is the company responsible for PhotoShop (which is just one of several products in its Creative Suite) and the Portable Document Format (PDF). But is it a good company, and is it a buy at this point in time? Maybe it is.

Yes its shares are down 35% in a year, and perhaps investors have right to fear it is falling behind in the AI race. But it is not a lot cause.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

The history of Adobe (NDQ:ADBE)

The company’s name comes from a Creek in Silicon Valley where co-founder John Warnock lived. Adobe means mud-brick in Spanish and there was mud-brick clay found there. Warnock and his partner Chuck Geschke were software engineers by trade and worked on a Interpress, which describes a printed page at a higher level than the actual output bitmap.

After failing to convince their then employer Xerox to market it, they started their own company to commercialise it, and the technology became PostScript. The first printer was one of Apple’s and Apple became a very large customer. Steve Jobs offered to buy the company – in the end Geschke and Warnock would only agree to sell 19%, only for Apple to sell it a few years down the track when it realised the companies were becoming rivals.

The Photoshop software was first released in 1989, having been developed by Thomas and John Knoll who sold distribution rights to Adobe for royalties, before Adobe bought it outright in 1995 for $34.5m. The PDF technology was launched in 1993, and the most prominent early customer was the Internal Revenue Service which started distributing tax forms in that format the very next year.

Warnock and Geschke both stood down in the early 2000s and have both passed away in the last 5 years. The company has been led by Shantanu Narayen since 2007.

So what is next?

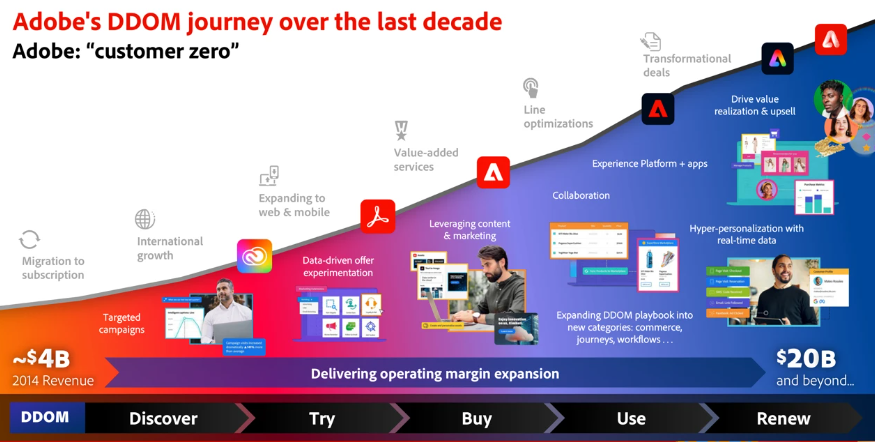

From a business model perspective, a focal point has been its decision to switch from perpetual licenses to a subscription model in the early 2010s. While there were some fears from Wall Street that it would permanently hit margins, and that subscriber numbers would be impacted – any short-term impacts were outdone by longer-term impacts. From there, other initiatives have driven increased adoption and margin expansion.

Source: Company Investor Day Presentation 2023

The company launched Adobe Firefly which creates AI-generated images. Over 70 million images were generated in the first month, and 8 billion to date. The legacy business has been going strong with 400 billion pdfs opened and 16 billion documents edited. The company claims that every 1 million documents signed through its software saves 105 million litres of water, 31,000 trees, and the equivalent of taking 2,300 cars off the road for a year—plus reducing costs by more than $7.2 million.

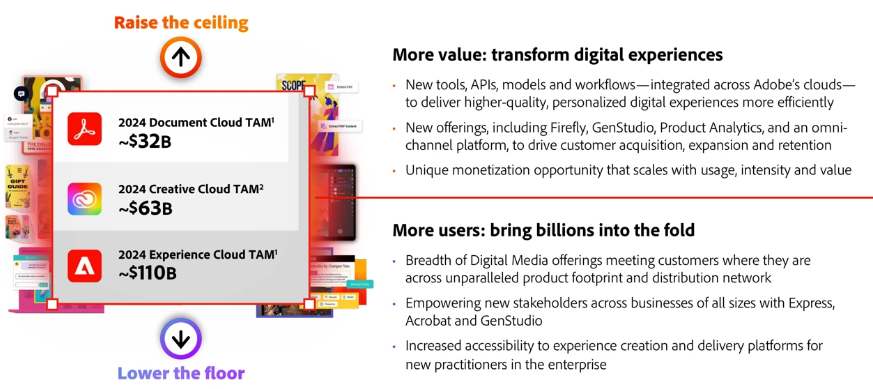

The company purports to have an overall TAM (Total Addressable Market) of over $200bn for its segments.

Source: Company

A difficult 2025

For CY24, the company delivered expects $21.5bn revenue and $12.36 Earnings Per Share which was a $5.3bn profit. Despite reporting guidance of $23.3-23.55bn, this was below analyst expectations. That raised worries that Adobe’s AI-related investments weren’t yet producing strong monetization or that investors weren’t being given enough clarity on how new AI products would drive revenue.

The AI boom means that Adobe is not just competing against traditional software rivals, but now against very well-capitalised GenAI players like Microsoft, Google, Meta, and smaller but fast-moving startups like Midjourney, Runway, and Canva. Of course, we cannot forget Figma, the rival to Canva that IPO’d earlier this year to great hype. The irony is that it has declined since and thus recorded a worse performance than Adobe.

Some analysts argue that “AI is eating software” — meaning infrastructure and platform players might capture more of the value than a traditional SaaS business like Adobe. Even if this is not the case, it is clear that there is far more competition around. While Adobe is making large AI investments, some investors are concerned about margin pressure or the time lag for return on those investments.

There is hope

Despite this, Adobe has kept delivering good results, with 11% revenue growth in the most recent fiscal quarter (the 3 months to the end of August 2025). And its operating cash flow was a company record for a Q3 – US$2.2bn. Its Remaining Performance Obligations (RPO) — a forward-looking contractual number (basically revenue it is contracted to receive for services it has not yet performed) — was strong: US$20.4bn. The results led the company to raise its guidance to US$23.65-23.7bn revenue and US$16.53-16.58 per share on a GAAP basis.

Moreover, the company has been spruiking its AI potential. It told investors its ‘AI-first’ product ARR has already hit a US$250m target that was not meant to be reached until the end of this year. This includes Firefly but also GenStudio and Acrobat AI assistant. These products can expand both its creative user base (designers, creators) and more enterprise usage (marketing, document workflows).

Some analysts may wonder if it should be looking at M&A rather than developing in-house. The company is clearly focused on the latter, although it did fork out US$1.9bn to buy Semrush which has tools for SEO but also GEO (think SEO but for ‘generative engines’).

Analysts covering the company have a mean target price of US$450.32, which is 30% above the current share price. They expect US$23.7bn revenue and US$16.54 EPS for FY25. Then for FY26, US$25.9bn EPS and $18.37 EPS, followed by US$28.2bn revenue and US$20.74 EPS for FY27. Shares are thus trading at multiples of is 13.9x P/E and 1x PEG for FY26.

Hinged to AI, but it comes with pros and cons

Adobe may well be one of the best ways to gain exposure to AI on global stock exchanges. The risk with this one is that momentum around this stock and rise and fall substantially with the broader market and AI stocks generally – and this could be from anything that Adobe has no control over. It could be slower earnings growth from Nvidia, or it could be a major central bank not cutting interest rates when consensus suggested it would.

But in the longer-term, we expect good times for Adobe and its shareholders.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Amazon (NASDAQ:AMZN) Down 9%, Is Capex Becoming the Story?

14% Sales Growth, 128B Spend, Now What? Amazon has fallen about 9%. While we are holders of the stock, when…

The proposed Rio Tinto Glencore merger failed, here’s why and what it means for the companies!

The proposed Rio Tinto Glencore merger is off. The deal would have created the world’s biggest mining company, capped at…

Tech and AI Stocks Sell Off, This Reckoning Was Always Coming

The Tech and AI Valuation Reality Check When it comes to stock prices, they usually rise when fundamentals and earnings…