Anti Woke ETFs: Do they practice what they preach and have they outperformed since Trump’s return to power?

Have you ever heard of so-called ‘Anti Woke ETFs’? If you’re sick of companies that are big on ESG, this could be something for you to consider. But do Anti Woke ETFs really practice what they preach, should you consider investing in them and what does the Trump administration’s second term mean for them?

What are Anti Woke ETFs?

Firstly, let’s recap what ETFs are. In simple terms, ETFs are investment funds that track an underlying index, asset, or basket of securities. Think of them as like holding a portfolio of stocks but in the same way as if you owned just one share.

Now onto anti-woke ETFs specifically. These funds are designed to cater to investors who want their investments to align with their political and social beliefs, specifically those that oppose the so-called “woke” ideology.

Anti-woke ETFs invest in companies that are perceived to be opposing “woke” values or supporting conservative ideals. This can include companies that have publicly opposed progressive social causes or criticized cancel culture…among other things. To give an example, let’s just say Anti-Woke ETFs would not invest in Ben & Jerrys with its advocacy on social causes – most recently after the 4th of July holiday in 2023 where it called for the return of lands to Indigenous people.

Are these ETFs good or bad?

Overall, anti-woke ETFs are still a relatively new concept and their long-term performance has yet to be determined. This said, there are individual traits about them that are good and bad.

One of the main benefits of anti-woke ETFs is that they allow investors to support causes and ideologies they believe in while still diversifying their portfolio. These funds may also appeal to those who are looking for ways to express their political views through their investments.

The Bad

However, there are also criticisms surrounding anti-woke ETFs. Some argue that these funds can be seen as divisive and polarising, as they may exclude companies that promote diversity and inclusion. Additionally, there is a concern that investing in these funds could lead to financial underperformance, as the sole focus is on aligning with specific beliefs rather than maximising returns.

As with any investment, thorough research and consideration should be taken before making a decision. Whether or not these funds will have a lasting impact on the financial market remains to be seen, but they do offer investors another way to align their investments with their personal beliefs.

Also, whether you agree or disagree with Trump, his term will end in January 2029. What will happen then is anyone’s guess and it will be influential on these funds – whether another MAGA Republican, a ‘moderate’ Republican or perhaps a Democrat.

Case Study

There are only a handful of anti-woke ETFs and just about all of them are in the USA. Let’s take a look at one, the MAGA ETF – the Point Bridge America First ETF. By taking a look, we mean take a look at stocks it is invested in. It has a wide variety of stocks, including discount retailers (Dollar Tree, Dollar General), airlines (like Delta and American Airlines), industrial conglomerates (FedEx and Parker-Hannifin), Dominos Pizza and United Health Services. In the last 5 years, it is up over 100% whilst the S&P 500 is up over 80%. Not bad.

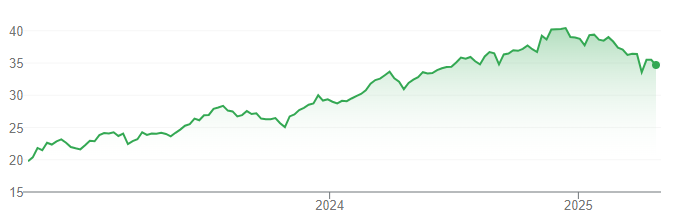

Point Bridge America First ETF (NYSE:MAGA), share price chart, log scale (Source: TradingView)

The next most famous anti-woke ETF, the God Bless America ETF (NYSE:YALL) has underperformed the S&P 500 with a 75% gain in 5 years.

But what about since Trump’s return to the White House? The S&P 500 has cratered 15% as of April 22, 2025. MAGA and YALL are down 12%, so they are ‘sharing the pain’ but are ahead of the S&P500.

The reality is, these ETFs are investing in the S&P 500 predominantly and picking or choosing stocks within them on the basis of whether or not companies adhere or avoid ‘woke values’. It’s not like they’re gambling on penny stocks, thinking they can overtake ‘woke competitors’. And of course, these stocks do want to make money just like ESG ETFs do too.

Should you invest in them?

Ultimately, the decision to invest in anti-woke ETFs is a personal one that depends on an individual’s values and financial goals. So, it is important to carefully consider one’s motivations and the potential risks before investing in these funds. As with any investment, diversification remains key in mitigating risk. It may be beneficial to consult a financial advisor to determine if anti-woke ETFs are a suitable addition to one’s portfolio.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Objective Corporation (ASX:OCL) is a superb ASX 200 tech stock

Objective Corporation (ASX:OCL) is one of a kind. There are few companies with a 2-decade listed life without raising a cent…

AI-Media Technologies (ASX:AIM): Investors are panicking that it’ll be a victim of AI

AI-Media Technologies (ASX:AIM) is not the only ASX stock with investors panicking that AI will make it go the way…

Geopolitics, AI, and Energy, The Three Pillars of Investment Growth in 2026

Investing right now feels riskier than ever – messy geopolitics, the AI boom, and power shortages are all piling on.…