Red Mountain Mining (ASX:RMX) and a critical silvery metal called antimony

Here’s something to try out at this weekend’s BBQ with the other guests: How much do you know about a metal called antimony? The answer is likely to be next to nothing.

Indeed, you might have to explain that the word is pronounced with an emphasis on the first syllable, as in ‘AN-ti-muh-nee’, and not pronounced so that it sounds like the platform of a left wing politician who is ‘anti money’.

Antimony, atomic no. 51, is a silver-coloured metal that has been known about since antiquity. It’s commonly used in flame retardants, in lead-acid batteries, and as hardening and strengthening agent in lead and tin-based alloys. Usually, there’s plenty of it available to industrial users, so no one really paid attention…until recently.

Investors are paying attention to antimony

‘Recently’ was August 2024 when China, the world’s largest producer of antimony, decided to restrict its export. No surprises there since they’re doing that to a whole bunch of critical minerals. Significantly, antimony is an important input for a lot of defence material. Without it you can’t make bullets, armour-piercing ammunition or night vision goggles. It’s also important in semiconductors as a dopant.

With Chinese antimony off the global market, and Russia not exporting either because it needs it for its current war effort, the price of antimony has gone, to use the vernacular, nuts. At the end of 2023 antimony was changing hands at something like US$10,000 per tonne. It’s now over US$50,000 per tonne.

Red Mountain Mining is looking in Larvotto’s backyard

Antimony is the reason why Larvotto Resources (ASX: LRV) has been riding high since the middle of 2024. Its flagship is the Hillgrove Gold-Antimony Project in northern NSW. That project covers an old mine 23 km east of the university town of Armidale that began producing antimony way back in 1877.

Gold only followed at Hillgrove four years later, and tungsten from the scheelite in the mine was first worked in the late 1930s. Hillgrove has been on care and maintenance since 2009 but if, under Larvotto’s aegis, it gets up and running again, which could be as early as next year, the mine will be box seat to produce something like 7% of the world’s requirements.

LRV’s Base Case DFS delivered A$280m NOV and an IRR of 48%, which would see a payback in 2.2 years. The Spot case delivered an NPV of $1,269m and a 153% IRR. Impressive.

There are other ASX-listed companies that have started looking for antimony. The one that caught our attention recently was a little known mineral explorer named Red Mountain Mining (ASX:RMX).

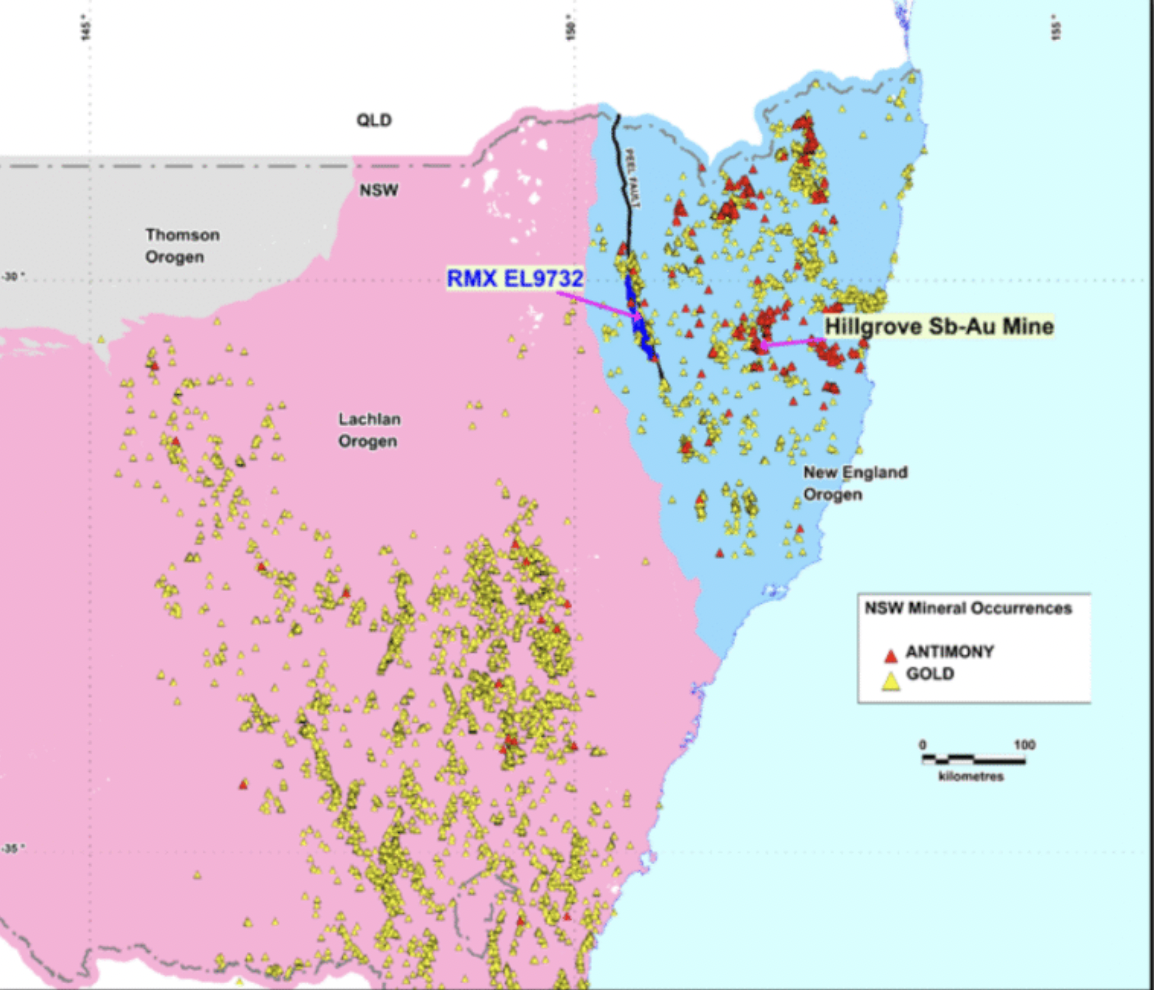

Red Mountain’s instinct is that there’s more antimony where Hillgrove came from. In the southern New England Orogen, there’s a lot of metasediments and granitoids where the vein and breccia systems look not dissimilar to Hillgrove, and Red Mountain has pegged a 391 sq km Exploration Licence around 80 km west of Armidale where, back in the day, there were some old stibnite workings, stibnite being an important ore of antimony.

Source: Company

The attraction for Red Mountain is the lack of serious prior exploration. There’s a fault out here called the Peel Fault where gold and base metals are hinted at in early stage exploration but where most drill holes haven’t gone down that far.

On a clear day, you can see the stibnite

Red Mountain’s early stage work has zeroed in on two of the century-old stibnite workings, called Oaky Creek North and Oaky Creek South, where the silvery coloured mineral is visible at multiple locations and shows up in multiple quartz veins.

Potentially, there’s a lot of it because the Oaky Creek North system has a strike length of over a kilometre. Red Mountain’s geologists have collected around 1,000 soil and rock chip samples and those samples are off at the laboratory now.

The results from this programme will give Red Mountain some idea as to how big their antimony prospects are and guide some initial magnetic work that can in turn guide the first drill holes. We expect all this can happen over the next year or so.

Meanwhile Red Mountain has another important iron in the fire

Over in Western Australia it’s in the early stages of checking out a Greenstone Belt called Kiabye – pronounced ‘kye-ah-bee’ – in the part of the Yilgarn that sits in the Murchison region. Red Mountain’s Kiabye Gold Project covers 111 sq km southeast of the town of Mount Magnet.

Historically, this area was of interest for base metals, and not long ago a nickel-cobalt rich gossan showed up, but the gold values in the historic soil sampling are interesting. Indeed, there’s been one historic high-grade hit in a RAB hole, and in recent years prospectors have been quietly finding alluvial gold.

Red Mountain has picked out two magnetic anomalies to drill at Kiabye North and it also wants to drill the area where the RAB drill gold and the soil samples have looked good. That maiden drill programme kicked off in mid-May 2025.

Can Patricia be golden again?

Red Mountain also has an interesting gold project in Canada, the Fry Lake Project in the province of Ontario. This project sits in a region of northern Ontario commonly called ‘Uchi’ on the Meen-Dempster Greenstone Belt.

That belt’s greatest mine success, Golden Patricia, is not far away. It produced 620,000 ounces of gold at an average grade of 15.2 g/t Au – you read that right – from 1988 to 1997. About 70 km away is the town of Pickle Lake, population only 400, but long known as the centre of a gold ‘camp’ at the northernmost point of Ontario’s provincial highway system.

Ardiden (ASX:ADV) is a big player in the Pickle Lake area today. At Fry Lake Red Mountain has picked out a prospect called Flicka where the soil and rock chip samples yielded some very rich gold grades, and the geologists will go back for more samples when funds permit.

A telling sign of confidence

Red Mountain Mining’s Executive Director since June 2024 has been Lincoln Liu, a former broker who is now trying his hand at running a junior explorer. One thing we like about Lincoln is his confidence. On 29 May 2025 he bought some more Red Mountain stock on-market, and that’s not the first time he’s done this.

With his company now positioned in commodities that the market likes, ahead of the first drill work at Kiabye and maiden sampling results from Armidale, this is one where there could be some excitement ahead.

What are the Best ASX Resources Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…