Adobe (NDQ:ADBE): The 42-year old company behind PhotoShop and PDFs may have an even richer future ahead, driven by AI

![]() Nick Sundich, September 12, 2024

Nick Sundich, September 12, 2024

Outside the so-called Magnificant Seven stocks, Adobe (NDQ:ADBE) is one of the most well-known by investors, as well as the most-used. After all, it is the company responsible for PhotoShop (which is just one of several products in its Creative Suite) and the Portable Document Format (PDF). But is it a good company, and is it a buy at this point in time?

The history of Adobe (NDQ:ADBE)

The company’s name comes from a Creek in Silicon Valley where co-founder John Warnock lived. Adobe means mud-brick in Spanish and there was mud-brick clay found there. Warnock and his partner Chuck Geschke were software engineers by trade and worked on a Interpress, which describes a printed page at a higher level than the actual output bitmap. After failing to convince their then employer Xerox to market it, they started their own company to commercialise it, and the technology became PostScript. The first printer was one of Apple’s and Apple became a very large customer. Steve Jobs offered to buy the company – in the end Geschke and Warnock would only agree to sell 19%, only for Apple to sell it a few years down the track when it realised the companies were becoming rivals.

The Photoshop software was first released in 1989, having been developed by Thomas and John Knoll who sold distribution rights to Adobe for royalties, before Adobe bought it outright in 1995 for $34.5m. The PDF technology was launched in 1993, and the most prominent early customer was the Internal Revenue Service which started distributing tax forms in that format the very next year.

Warnock and Geschke both stood down in the early 2000s and have both passed away in the last 5 years. The company has been led by Shantanu Narayen since 2007.

So what is next?

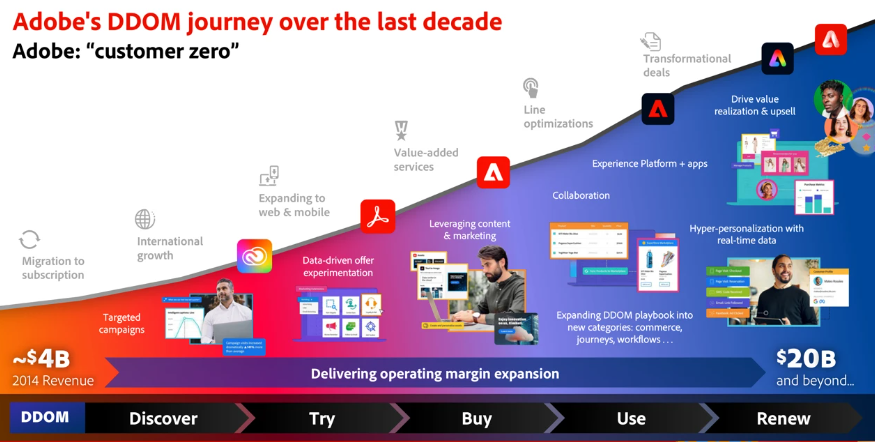

From a business model perspective, a focal point has been its decision to switch from perpetual licenses to a subscription model in the early 2010s. While there were some fears from Wall Street that it would permanently hit margins, and that subscriber numbers would be impacted – any short-term impacts were outdone by longer-term impacts. From there, other initiatives have driven increased adoption and margin expansion.

Source: Company Investor Day Presentation 2023

Recently, the company launched Adobe Firefly which creates AI-generated images. Over 70 million images were generated in the first month, and 8 billion to date. The legacy business has been going strong with 400 billion pdfs opened and 16 billion documents edited. The company claims that every 1 million documents signed through its software saves 105 million litres of water, 31,000 trees, and the equivalent of taking 2,300 cars off the road for a year—plus reducing costs by more than $7.2 million.

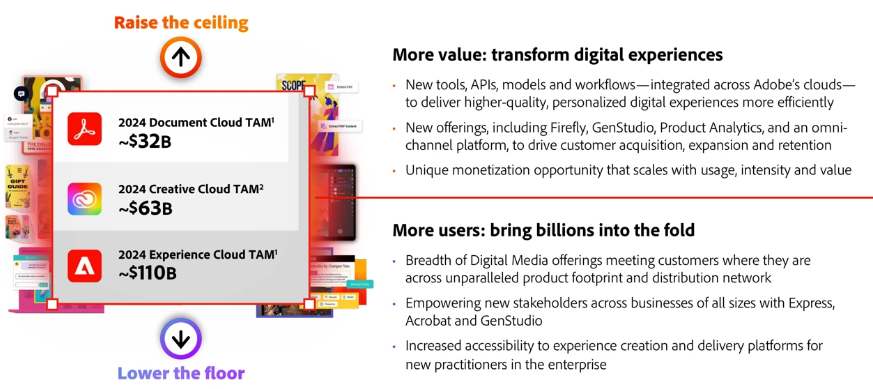

The company purports to have an overall TAM (Total Addressable Market) of over $200bn for its segments.

Source: Company

In the most recent quarter, Adobe grew revenues by 10% year on year. For CY24, it expects $21.4-21.5bn revenue and $11.80-12 per share Earnings Per Share which would be a $5.3bn profit. The revenue result would be $2bn higher while revenue would be flat.

Analysts covering the company have a mean target price of US$608.25, which is 7% above the current share price. It is 26.7x P/E and 1.6x PEG for FY25. Their estimates for the CY24 result are in line with the company’s guidance, but they expect growth for the next few years. For CY25, $23.9bn in revenue and a $7.2bn profit, followed by $26.7bn revenue and an $8.5bn profit in CY26.

Hinged to AI, but it comes with pros and cons

Adobe may well be one of the best ways to gain exposure to AI on global stock exchanges. The risk with this one is that momentum around this stock and rise and fall substantially with the broader market and AI stocks generally – and this could be from anything that Adobe has no control over. It could be slower earnings growth from Nvidia, or it could be a major central bank not cutting interest rates when consensus suggested it would.

But in the longer-term, we expect good times for Adobe and its shareholders.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…