Here is why AGL Energy is buying Kaluza, spending $150m for a chunky 20% stake

![]() Nick Sundich, June 13, 2024

Nick Sundich, June 13, 2024

‘AGL Energy is buying Kaluza’, read the headlines across the media earlier this week.

It is not the first time AGL has been in the headlines, although it has mostly been for the wrong reasons since the pandemic. The company’s entire board was forced to resign after shareholders (led by Mike Cannon-Brookes) rejected its plan to transition to renewables. Although there is a clear plan now, it is not clear how this will be funded. Even looking at its core operations, it took a while to receive the margin boost many long-suffering electricity bill payers would have imagined given how much prices have spiked. Write-downs and a lack of reliability at its remaining coal stations did not help things.

Why AGL Energy is buying Kaluza

The news that AGL was buying Kaluza was a different kind of news – certainly not bad for the company. Although many investors may have questions about the deal: Is it worth the price, will it deliver a return on investment and why is the company doing this deal?

Kaluza is a technology platform that manages electricity supply and billing. It automates many functions required from energy companies including streamlined billing and the co-ordinaiton of electricity supply. From the perspective of consumers, it helps them as well, enabling them to see their energy usage, emissions and potentially even when they need to recharge their EVs.

Kaluza is owned by UK energy retailer Ovo Energy, and will continue to be. It serves over 6 million meters back over in the Old Dart. AGL will only own 20%, a minority stake, but one large enough to have a seat on the board. Ovo Energy had an Australian retailing business, but sold a majority stake to AGL in 2021. AGL is not the first company to have an investment in a ‘smart energy’ platform – Origin Energy invested in Octopus Energy in 2020, which is similar to Kraken.

AGL will spend $150m to accumulate the 20% stake. This money will be used to fund the growth and operations of Kaluza, including internationally. It is inevitable that AGL will provide a further boost to Kaluza, by transferring its customers onto the platform. AGL has told investors it will be able to fund the investment through cash on the balance sheet.

So what now?

AGL has told investors it will deploy its customer base onto Kaluza over the next 3 years. With over 4 million customers, this will take 4 years, although $70-90m in annual pre-tax cash savings are invested. For now, Large Business customers won’t be transferred across, although AGL has said it would ‘continue to consider transformation options for those customers’.

What will be in it for customers? If you listen to AGL’s PR team, it will enable customer satisfaction, streamline the company’s operating model and aid the push of customers to decarbonise and electrify. Only time will tell if this comes to fruition, although there is no doubt the company has thought this deal through and would not have proceeded had it clearly seen benefits would not flow through to the company.

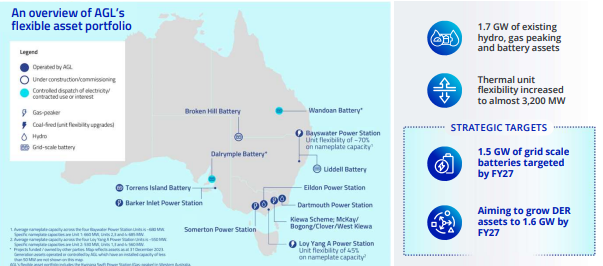

Ultimately, the bigger elephant in AGL’s board room is how to fund the renewable energy projects that will play a far greater role in reducing emissions than any platform ever will. The company has made some progress, commencing construction on its 500 MW Liddell Battery in NSW and its 50 MW Broken Hill Battery, as well as growing its border pipeline of renewable projects. The ‘Battery’ projects are the development of grid-scale energy storage systems. The Liddell battery is on the plant of the former coal site and is scheduled to open in 2026

Source: Company

Conclusion

AGL most recently issued FY24 guidance at the Macquarie Conference. It is expecting an underlying post-tax profit of $760-810m, well ahead of the $281m it recorded last year. This expectation, along with the Kaluza transaction may lead investors to believe the company is a good buy in the short-term. It is tough to argue with this thesis. But ultimately, the company still needs to outline how it will fund its decarbonisation plans over the next decade.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Goodman Group (ASX:GMG): It looks expensive at A$65bn, but can its expansion into Data Centers make it worth its high price?

Goodman Group (ASX:GMG), the ASX’s biggest industrial property player, is making a shift into the world of data centres. On…

Here are 5 ASX resources stocks with a DFS unveiled in the last 12 months!

ASX resources stocks with a DFS (Definitive Feasibility Study) have the best possible chance for investors to profit. Companies in…

Cettire shares are down over 90% from their all time high as investors follow the leader in selling shares

It hasn’t been a good 14 months for Cettire shares. For a long time after the pandemic, eCommerce was one…