AMP (ASX:AMP): It is up 50% since November 2023! Is a better future ahead?

![]() Nick Sundich, October 16, 2024

Nick Sundich, October 16, 2024

One time wealth management giant AMP (ASX: AMP) has endured a massive fall from grace over the years. There is an argument to be made that now is turnaround time, since it now has a banking brand and wealth management platform, which are both performing well. And shares are up over 50% since November last year.

AMP (ASX:AMP) share price chart, log scale (Source: TradingView)

But on the flip side, remember how much money investors have lost over the years betting that the turnaround was on when it really wasn’t. Right now, here are a few good signs, but we still find it hard to get excited about this company. Not just because of past letdowns, but because the new industries AMP is attempting to penetrate are fiercely competitive – before you even consider its reputational baggage.

History of AMP

AMP was founded in 1849 as the Australian Mutual Provident Society with an aim to provide life insurance for widow or widowers – in a colonial era where people died young. It only listed in 1998 after being demutualised and giving policy holders shares in the company. Over the next 20 years, AMP entered new businesses, including financial advice, banking, superannuation and investment management. While AMP’s fate mostly followed the broader equity markets, it managed to peak at a market capitalisation of $20bn in early 2015.

Now, it is just $3.5bn. In 2018 AMP’s reputation was trashed by the Royal Commission through stories of fees for no service, inappropriate advice, charging fees to dead people, policy churning and employing incompetent financial advisers. Fast forward to 2022 and things have barely improved. There has been a significant turnover in staff, several backflips on strategic direction and a significant outflow of funds from the company. At the end of FY17, it boasted over $250bn in Funds under Management across the group, but this fell to $121.4bn by the end of FY22. As new financial advisor regulations (mandatory education and ethics reforms) were introduced, advisors left the industry en-masse. Over 60% of advisors on AMP’s books in early 2019 have since departed. And it has copped big penalties from regulators for its misdemeanors in the past.

A new era or more of the same?

The company’s current CEO is Alexis George, who used to be an executive at ANZ at the time it sold its wealth arm to IOOF and has sold off AMP Capital.

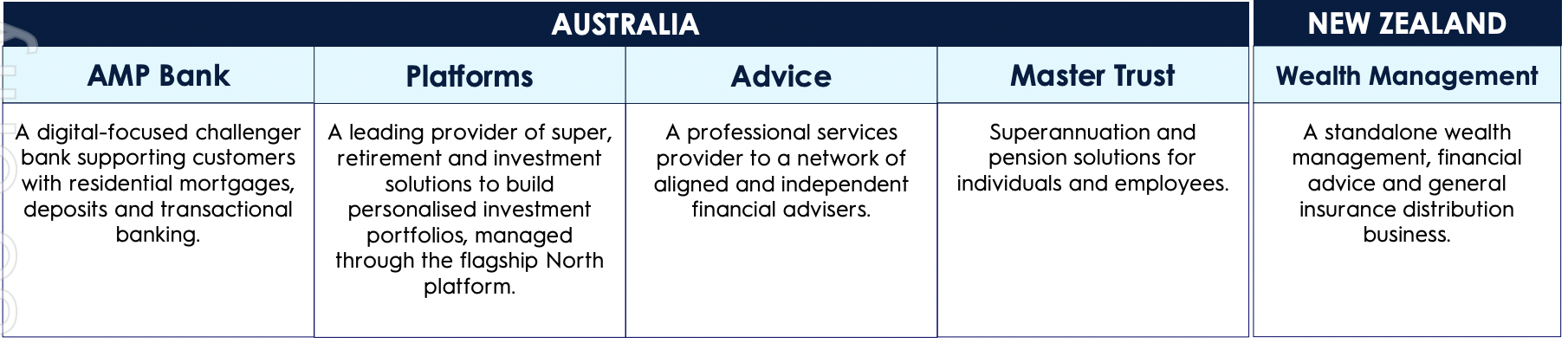

These days AMP has three key divisions:

- A small bank focused on low loan-to-value ratios

- A platforms business

- A financial advice business

There is also a Master Trust and Wealth Management business in New Zealand but these are immaterial relative to the other 3.

Source: Company

At best all of these are little fish in giant ponds – in other words, small playrs in big markets. The bank is the 12th largest lender to Australian households. And the advice business is struggling to be profitable with a net loss of $47m in 2023.

As a smaller business, you would imagine it would have less costs. But you’d be wrong. The company has a challenge to cut costs to reflect a smaller business.

AMP wants to launch an SME-focused digital-only bank in 2025 to diversify its revenue and funding mix. And it hopes that its platforms business, the best performing part of the business, can continue to perform well as people turn to investments in equities again as interest rates fall.

Other catalysts that could aid the company include the gradual rise in the superannuation guarantee rate – to 12% by July 2025 – as well as the growing retirement age population. There is some recognition by regulators that some of the changes to financial advice regulations has gone too far. And the company is managing to grow its AUM, with $133.8bn at the end of CY24.

Consensus estimates expect a retreat in FY23

However, costs remain high and the company’s financial advice division faces a difficult few years ahead. While the case study of Macquarie depicts that it is not impossible for challenger retail banks to come out of nowhere and capture a major market share, this is easier said than done in an era of rising interest rates and cutthroat competition in the mortgage market. And there is also major competition in the annuities space. Perhaps AMP could grow through M&A, but there is competition here too – AMP tried to buy Westpac’s Panorama platform but was knocked out of the auction.

Looking at consensus estimates, revenues are expected to stagnate for the next 5 years and its bottom line until at least CY26. The mean target price is $1.32 per share, compared to a current share price of…$1.32. Its multiples may look appealing at 12.5x P/E, 1x PEG and 0.9x P/B. Nonetheless…

…those who don’t learn from history…

…are doomed to repeat it. We have heard plenty of times before that AMP is entering a new era, but it has continued to decline.

But the new market segments it is trying to penetrate are fiercely competitive. And we doubt its ability to stand out considering its reputational damage. On top of all this, we doubt it can ever get back to its former self so far as financial advice is concerned because there is so much more red tape and costs in a post-Hayne Royal Commission World.

There are better opportunities on the ASX available to investors.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…