APA Group (ASX:APA): Does it deserve to have declined like its peers in 2023?

![]() Nick Sundich, January 7, 2024

Nick Sundich, January 7, 2024

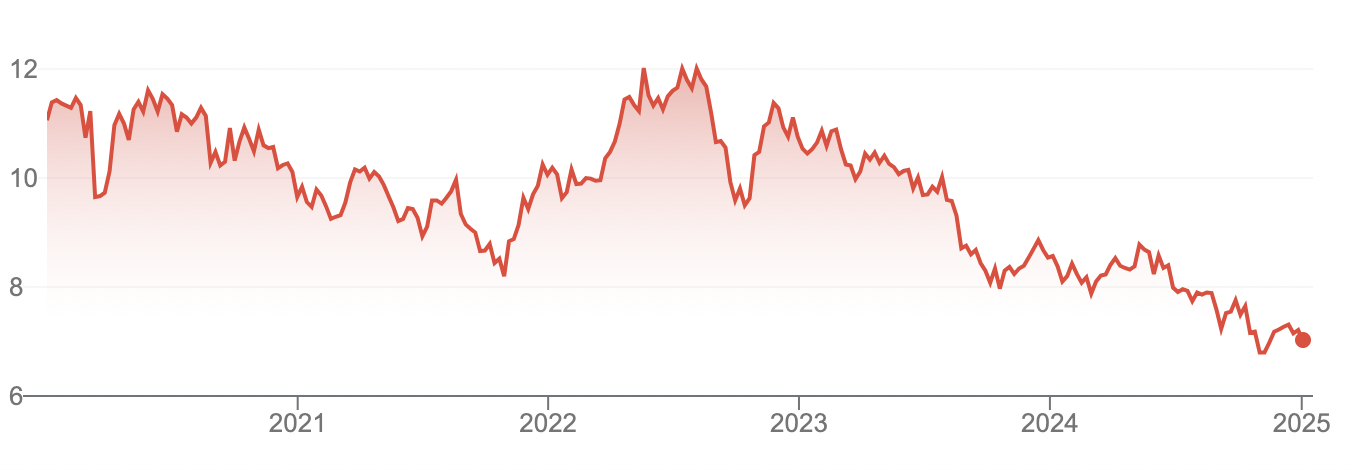

APA Group (ASX:APA) investors hoped that after it declined by over 20% in CY23, a better year would happen in CY24. But it fell another 17% and is down by over 40% since August 2022.

APA Group (ASX:APA) share price chart, logs scale (Source: Google)

On one hand, it is understandable. As a gas pipeline operator, it is in a heavily capital intensive business, has significant capex requirements, not to mention it is in headlines all the time as it is in the ‘worst of both worlds’ needing to reduce its carbon footprint, but faces scrutiny from regulators and from local residents anywhere anytime it tries to domsrhing.

On the other hand, it could be part of the solution. It is pivoting into being a power line and renewable energy power generation manager, without entirely walking away from its roots. Gas has been locked in beyond 2050 to support renewable energy, manufacturing and energy exports.

All about APA Group

This company began when it was spun out of AGL over 2 decades ago, when it was the division of AGL that owned the gas pipelines. APA’s network spans 15,000km across Australia and claims to deliver half of the nation’s natural gas usage.

The company also operates gas storage and processing facilities, other power stations and even renewable energy facilities. APA also has investments in other private energy companies. It also has more than 600km of high voltage power transmission lines, storage for 12,000 tonnes of LNG and 18 petajoules of gas, as well as 29,500 gas mains and pipelines for more than 1.4 million customers. On the generation side, it is one of Australia’s biggest renewable energy generators, with 342MW of wind power and 248MW of solar.

One project worth noting is a gas pipeline in the NT to transport gas from the huge Beetaloo Basin resource in the NT. It is one of the three most likely provinces to be developed for large-scale supply. The company has partnered with explorers Tamboran Resources and Daly Waters Energy to deliver it into the established Alice Springs-Darwin pipeline. It is expected to come online in the first half of 2026.

Another area where APA is active is in WA where it is building renewable operations in WA’s mining regions where it hopes to supply the region’s miners. Indeed, it just opened one project in Port Hedland that will supply energy to BHP. Finally, there’s the Basslink electricity cable which lies under the Bass Strait.

APA Group (ASX:APA) network (Source: Company)

Trying to reach Renewable Energy targets

You would think APA Group would have a major role to play in decarbonisation as a gas pipeline operator and renewable energy player. Gas has less carbon intensity and can back up renewable energy when necessary. After all, Australia has a goal of 82% renewable energy by 2030, which means emissions will need to decline by 43% from 2005 levels.

Despite this goal, there’s doubts it can be achieved. Looking to the industry generally, multiple factors are delaying the transition, including slow planning approvals, NIMBYs community opposition and rising costs (not least of which is interest rates but also skilled labour).

As we noted above, the company is both trying to maintain a connection to its roots, while pivoting into renewables. Of course, this is not a cheap exercise, not just in relation to money but also time. Regulation has slowed things down. The Australian Energy Regulator’s review of gas price regulation for the South West Queensland pipeline, announced in February, forced APA to pause $200m of investment planned for the expansion of its east coast gas grid. Ultimately, the AER approved it belatedly in October 2024.

So far this has not had an impact on APA’s share price. In fact, ex-major shareholder UniSuper sold a 5.3% stake for $500m in a block trade last October, representing roughly half of its stake. UniSuper went out of its way to clarify this was not specifically because it was anti-gas, but to rebalance its portfolio. But it sold the other half only a few weeks afterward. Not exactly a sign of confidence in a company, when its top shareholder sells out – regardless of the reason.

Dividends not really growing much

Looking to APA, it has spent a lot of money recently on new acquisitions and will continue to face high capex. It bought $1.7bn for Alinta Energy’s off-grid power generation assets in WA and is bidding to build renewable energy zones.

Although APA has not cut dividends, it has not grown them substantially and this has disappointed investors who expect constant dividend growth from top 50 companies. And when you consider the new shares being issued to pay for new acquisitions, this will further dilute investors. Of course if it has too much outflow, it’ll lose its investment-grade credit rating.

APA managed to achieve 7.9% revenue growth (excluding ‘pass through’ revenue) with a $2.6bn topline result. Underlying EBITDA was up 10% to $1.9bn, its statutory NPAT was up 250% to $998m, but this included fair value re-measurements of a number of its assets.

The company’s underlying NPAT was just $119m and this was 58% lower than the year before. Interest costs were up 26% and depreciation & amortisation expenses were up 23%.

Is there upside?

Analysts covering the company think so, but not much. The mean target price is $8.30, a premium from the $7.02 it is trading at now, but well off its all time highs.

Consensus estimates for FY25 expect 7% revenue growth, but flat bottom line growth. Things are expected to improve from FY26 with 5% revenue growth but 30% bottom line (profit) growth as Beetaloo comes online. It is just 10.x EV/EBITDA but 32.9x P/E – multiples which may appear reasonable at first glance, but keep in mind that this is no high-growth tech stock.

The bottom line

One of the key risk with this company is the prospect of industrial accidents. This is not just in the mining operations – one example is driving which accounts for 33% of the company’s potential serious harm events. Nonetheless, the company’s vehicles drove 15m kilometres in FY23 for 4.3m hours with zero fatalities or serious injuries. The company recently launched a new Driver Awareness Campaign, aimed at promoting safe driving practices. Finally, we note that interest rates remaining higher for longer will inevitably continue to impact the company.

Ultimately, we wouldn’t invest in the company at the moment, at least not until there’s somewhat more certainty of its capex and debt requirements, not to mention regulations.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

What is a REIT’s Funds From Operations (FFO) and how can investors use this metric to their advantage

ASX REITs often use the metric Funds From Operations (FFO). Investors new to investing in REITs may wonder what it…

Microsoft (NDQ:MSFT): There’s still a lot more growth left in this one

Microsoft (NDQ:MSFT) is our International Stock of the Week, but it really needs no introduction. We all use its products…

ASX Dividend Shares or Term Deposits? Here’s Why These 5 ASX Shares Make More Sense Right Now

ASX Dividend Shares or Term Deposits – what is the better way for investors to grow their wealth? Historically, term…