Here are 5 ASX data centre stocks other than NextDC

![]() Nick Sundich, October 10, 2024

Nick Sundich, October 10, 2024

If you thought the list of ASX data centre stocks only comprised of NextDC (ASX:NXT), you’d be wrong.

NextDC’s success shows how lucrative data centres can be and how exponentially demand has grown over the last 15 years. And of course, the journey is still underway. Morgan Stanley reckons Australia’s data centre market will grow by 1500 megawatts to nearly 2500mw by 2030.

But NextDC’s journey from a Bevan Slattery startup worth $80m to an ASX large cap worth over $10bn shows they are capital intensive and so are not an easy market to break into. At the same time, they show that once the money is spent and the centre is up and running, money can be made very quickly because it is easy to sign on customers and to start delivering for them.

A few companies have exposure to data centres, and we thought we’d share some of them with you

5 ASX data centre stocks other than NextDC

Global Data Centre Group (ASX:GDC)

Capped at $253.5m, GDC is an investor in data centre companies. It is indirectly invested in AirTrunk because it is a unitholder in a fund operated by Macquarie, so will reap $123m from the $20bn takeover deal. It is also facing the takeover of other assets – Etix Everywhere and Perth Data Centre, and the company itself has kept its lips sealed as to where the proceeds will be reinvested. GDC closed FY24 with $27.9m in cash, and it made a $40.2m profit.

Infratil (ASX:IFT)

Infratil is an investor in infrastructure and one of its assets is a minority stake in Canberra data centre business CDC. CDC is the largest private operator in Australia with 268Mq in capacity operational and another 265mw under construction across Australia and New Zealand. It has big contracts with government departments and cloud companies such as Microsoft. Infratil is not alone as a CDC investor – the Future Fund and Commonwealth Superannuation Corporation own 24% each.

Back in June, the NZ-based company listed just over NZ$1bn to fund expansion at the CDC business, all because of the expected rise in demand for data, and with it, data centres. Infratil’s other investments include New Zealand’s largest wireless carrier One NZ, and renewables development company Longroad Energy.

Telstra (ASX:TLS)

In some respects this is an obvious company to put on the list because Telstra needs data centres as Australia’s largest telco. And maybe it would make sense to own their own outright, rather than rely on an external provider like NextDC or Amazon Web Services.

But what you may not know is that it operates data storage services with two of its own – one at St Leonard’s in Sydney and the other at Clayton in Melbourne.

Goodman (ASX:GMG)

This $66bn company has for years been in the industrial space. This was a great space to be in – think warehouse storage for companies like Amazon, Coles, Australia Post, FedEx, JD, DHL and Global Express. Yes, this was in hot demand during the pandemic, although it has moderated from all time highs.

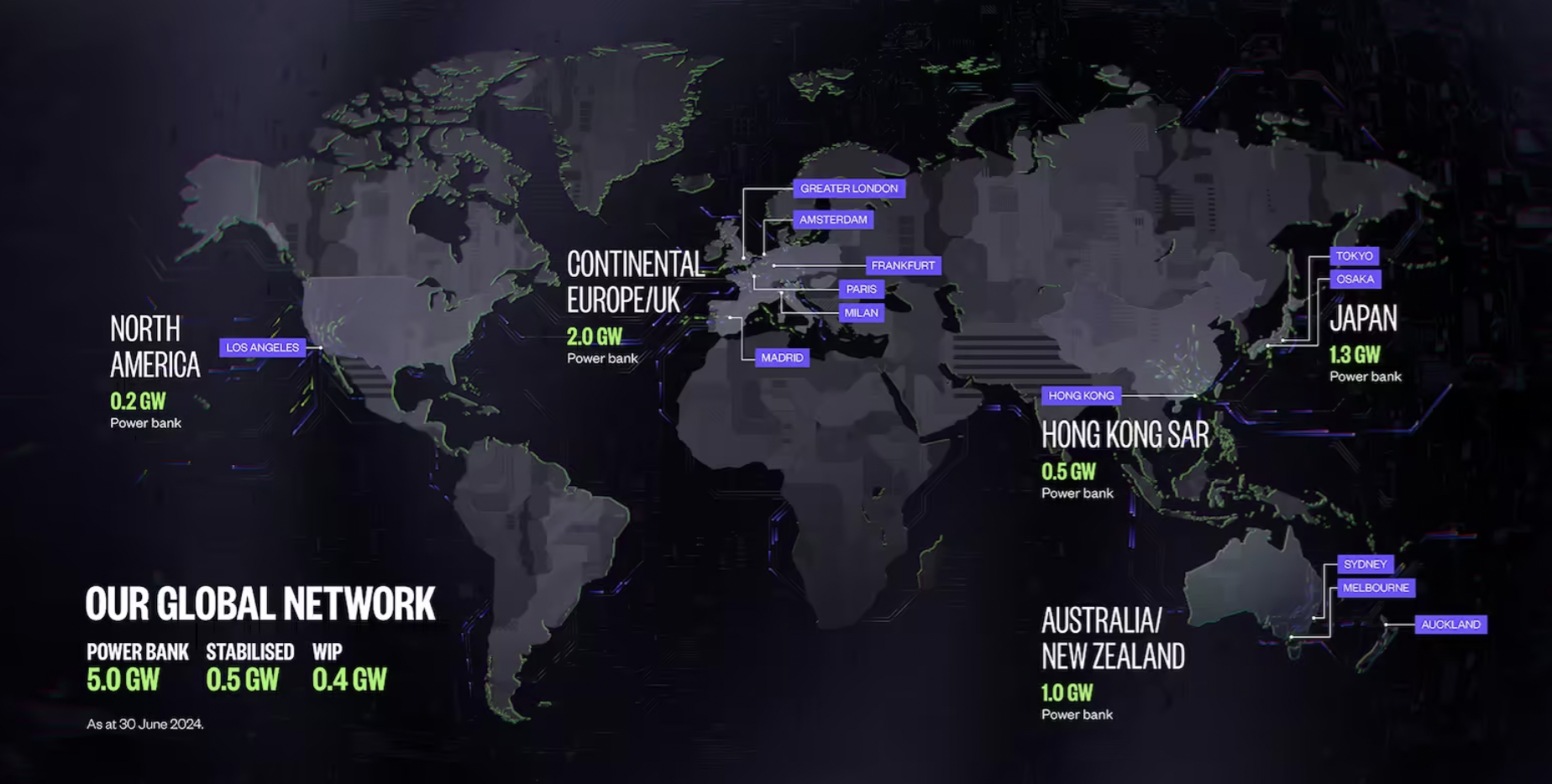

But it has pivoted into data centres and these now account for over 40% of its $13bn in development projects. Investors have been told that this is the future of the company going forward. Goodman’s global power bank is 5.0Gw which includes completed facilities, secured power and potential data centre projects across 13 major international cities.

Source: Company

5G Networks (ASX:5GN)

Saving our smallest company until last, capped at just over $40m, this IT services provider has its own data centres. It has 5 owned and operated centres and is connected to a further 60+, with a collective cloud capacity of 1700TB.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Adairs (ASX: ADH): After copping a massive beating in 2022-23, shares are on their way back up

After shedding 75% between mid-2021 and mid-2023, Adairs (ASX: ADH) shares have been on a slow and steady recovery, more…

The MySuper Performance Test: Here’s why it is good for your personal super, but potentially bad for your ASX stock investments

In 2021, the MySuper Performance Test was introduced as part of the ‘Your Future, Your Super’ reforms. This was introduced…

Here are 5 ASX stocks vulnerable to AI: Should you sell them?

Let’s take a look at some ASX stocks vulnerable to AI. Because right now, investors are focused on stocks that…