Here are 4 ASX electric vehicle stocks that you may have missed

![]() Nick Sundich, January 23, 2024

Nick Sundich, January 23, 2024

In the absence of any car manufacturers in Australia, many investors would be forgiven for assuming the only ASX electric vehicle stocks are lithium miners or explorers. If you thought that, you would be wrong. Here are 4 ASX stocks you probably didn’t think about!

4 ASX electric vehicle stocks that you may be missing out on

Jupiter Mines (ASX:JMS)

Manganese is not the first element that would come to many investors’ minds when thinking of electric vehicle metals, but it is an important one nonetheless. And Jupiter Mines is one of the few pure play manganese stocks, owning 49.9% a major manganese mine in South Africa.

Manganese is used in the production of lithium-ion batteries which are essential for powering electric vehicles. These batteries require high amounts of manganese to ensure long-lasting and efficient performance. Furthermore, manganese is also used in the production of other components for electric vehicles such as magnetic materials and motor windings. It is a vital element in the manufacturing process of electric vehicles and plays a crucial role in their overall performance and sustainability. Manganese also has various other industrial applications. It is used in the production of steel, fertilizers, animal feed supplements, and ceramics. Manganese compounds are also used as pigments in paints, dyes, and glass.

Turning to Jupiter Mines, it is a company that is capitalised at $343m, made a $77m profit, has no debt and paid a dividend yielding 13% last year. Its project, the Tshipi Mine, is a top 5 producer, with stable production, low costs, a long life remaining (over 100 years) and outstanding ESG performance. Similar to lithium, there will be a shortfall in the years ahead, particularly as long standing incumbent mines come to the end of their lives. This bodes well for companies with long-life projects like Jupiter Mines.

IPG Group (ASX:IPG)

IPG Group is a provider of electrical services and distributor of electrical equipment including distribution boards, switchboard systems and power metres. Its clientele include electric vehicle charger providers, where IPD provides installation, testing, commissioning and ongoing maintenance services for chargers and any associated infrastructure.

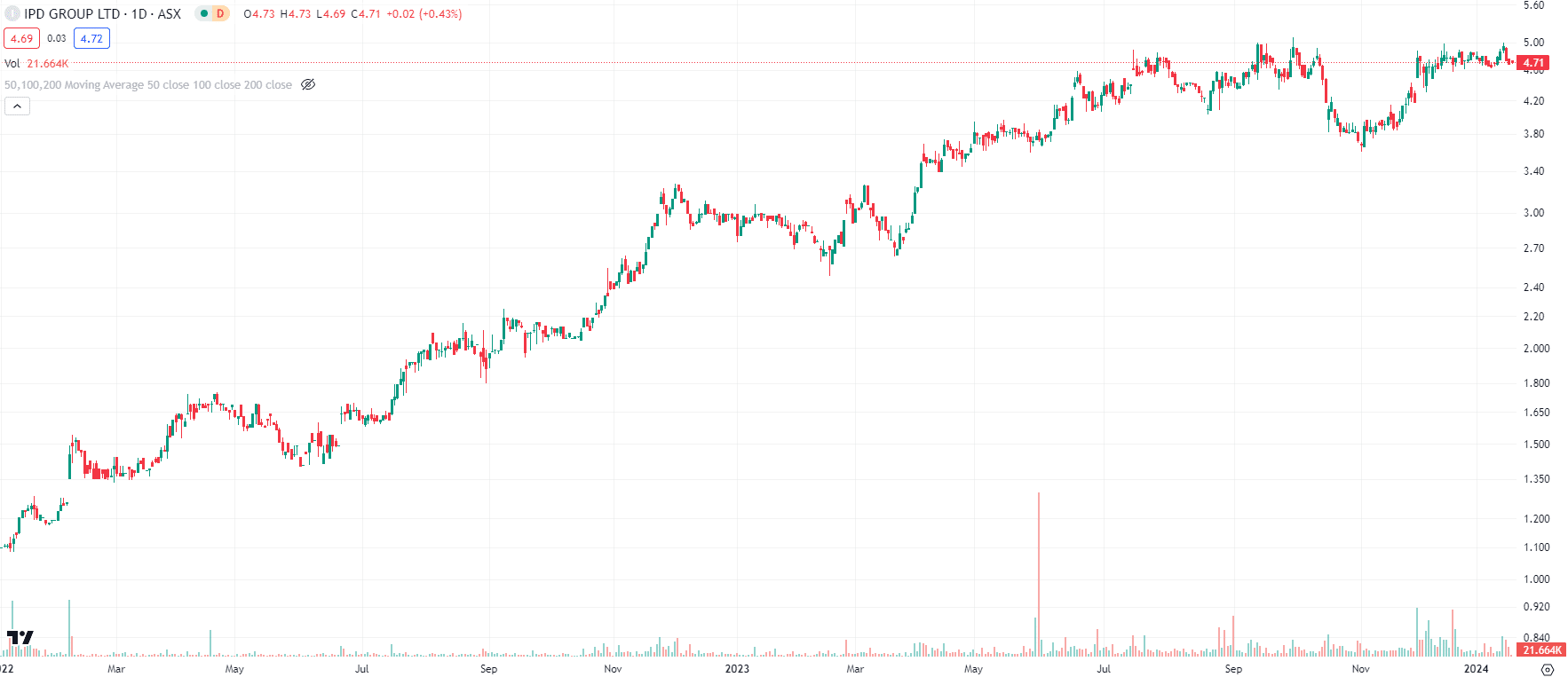

Since listing in late 2021, the company has never looked back, growing from $1 a share to nearly $5 and is capped at nearly $500m. In FY23, it increased its revenues by 28% to $226.9m and its profit by 45% to $16.1m, representing a 7.1% margin. Unaudited trading figures for the first four months of FY24 suggest another 21% earning growth for the first half of the year (1HY24).

IPD Group (ASX:IPG) share price chart, log scale (Source: TradingView)

Carly (ASX:CL8)

For nearly 5 years now, this company has operated a flexible car subscription service. For one simply monthly subscription fee, users get exclusive car use, all ‘red tape’ including insurance, the ability to switch the vehicle to suit changing needs and no debt.

Just in time for Christmas this year, this company ordered 78 electric vehicles to add to its fleet, for nearly $3m. And it is growing fast, with 106% subscription revenue during the September quarter of CY23.

Electric Vehicles and Future Mobility ETF (ASX:DRIV)

We round out our list with one of the few pureplay EV ETFs on the ASX.

An ETF is a type of investment fund that holds a basket of assets such as stocks, bonds, or commodities. It can be bought and sold on an exchange, similar to a stock, making it a more accessible option for investors compared to traditional mutual funds.

The DRIV ETF invests in predominantly electric vehicle manufacturers, including newcomers like BYD and Tesla, as well as traditional manufacturers including Volvo and Volkswagen.

It also invests in tech companies like Infineon Technologies and Analog Devices that have a heavy focus on electric vehicle customers.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Trump vs. Jerome Powell: What Happens to the Market If Powell Is Fired?

The relationship between President Donald Trump and Federal Reserve Chair Jerome Powell has often been tumultuous, particularly around decisions regarding…

Telix Pharmaceuticals (ASX:TLX): It’s made ~A$1.7bn in revenue from Illucix, but here’s why the best is yet to come!

What would you have thought if you were told 5 years ago you would see Telix Pharmaceuticals as a successful…

Anti Woke ETFs: Do they practice what they preach and have they outperformed since Trump’s return to power?

Have you ever heard of so-called ‘Anti Woke ETFs’? If you’re sick of companies that are big on ESG, this…